M1 Finance Adds Early Deposit Feature And Easier Pie Making Process!

Table of Contents

What is M1 Finance?

M1 Finance is an investment brokerage that offers investment and banking services. The unique thing about M1 Finance is that they were one of the first brokerages to offer both commission-free and fractional shares on any stock listed in the US stock market. They did have predecessors like the investment brokerages Stash and Robinhood that really started and popularized the investment trend of commission-free trades, started by Robinhood, and fractional shares, started by Stash. Technically, Stash also had commission-free trades, but they also charge a monthly fee for their accounts, so I’m not counting it as entirely free.

M1 Finance adds new early deposit feature!

Recently M1 Finance decided to join the bandwagon for allowing people to receive their paychecks earlier than normal with an early deposit feature. This is similar to what some banks like Chime or Sofi offer. The way early deposit works is often your employer or benefits provider will notify your bank of your incoming deposit in advance of your actual payday. If they do, ASAP Direct Deposit can credit these funds to your debit account when they give us that advance notice.

It’s quite a convenient perk. I as the owner of this blog use Sofi myself. I always get paid earlier than normal which feels quite nice when compared to waiting for the usual time frame getting paid. When you get paid early you have access to money as quickly as possible to pay for things that you want or need, like your regular bills.

M1 Finance make making pies easier!

In my original post about M1 Finance, I went into detail about how their pie-making process was. It was a very convoluted and overly complex process just to choose what you want to invest into. Technically, there was always the choice of using one of their pre-made “expert pies”, but in my opinion, those aren’t very good. Most people would be better off just investing in one big ETF, like the S&P 500.

However, recently M1 Finance changed its pie-making process for the better. Instead of their original convoluted way, where you had to go to the “Research” section just to find the option to make a pie, you can now do the entire pie-making process from the Investing tab. Now, when you open an account or want to edit one of the pies you’ve made, you can just go to the “Invest” tab, and if you’ve just opened the account, the option to make a pie should appear right away.

If you want to edit a pie you’ve already made you can just:

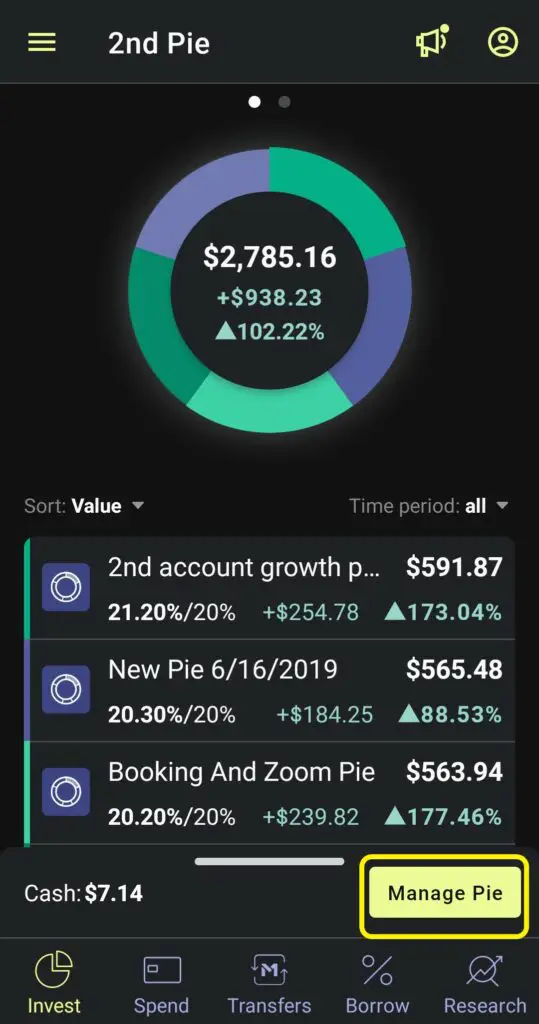

Step 1: click on the manage pie button

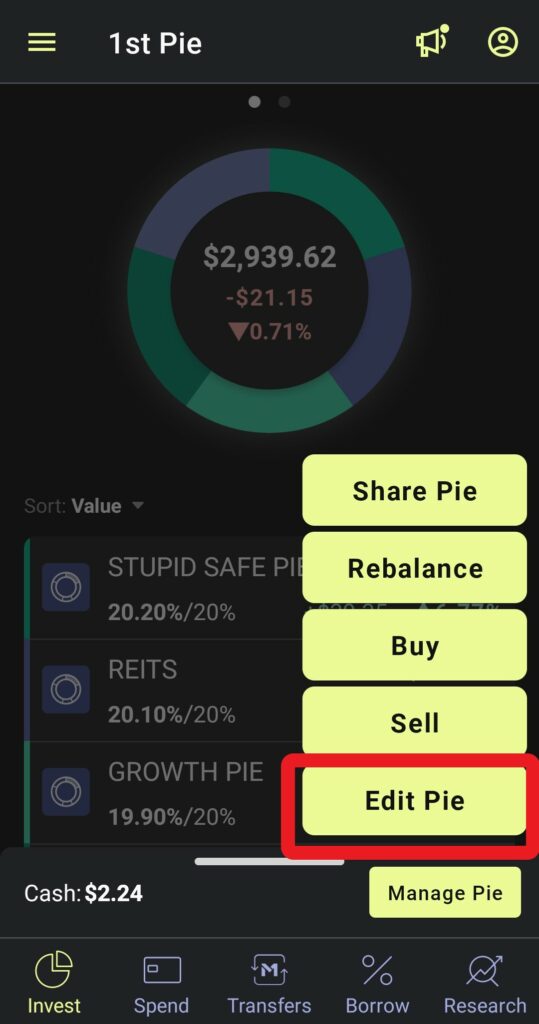

Step 2: Click on the edit pie button

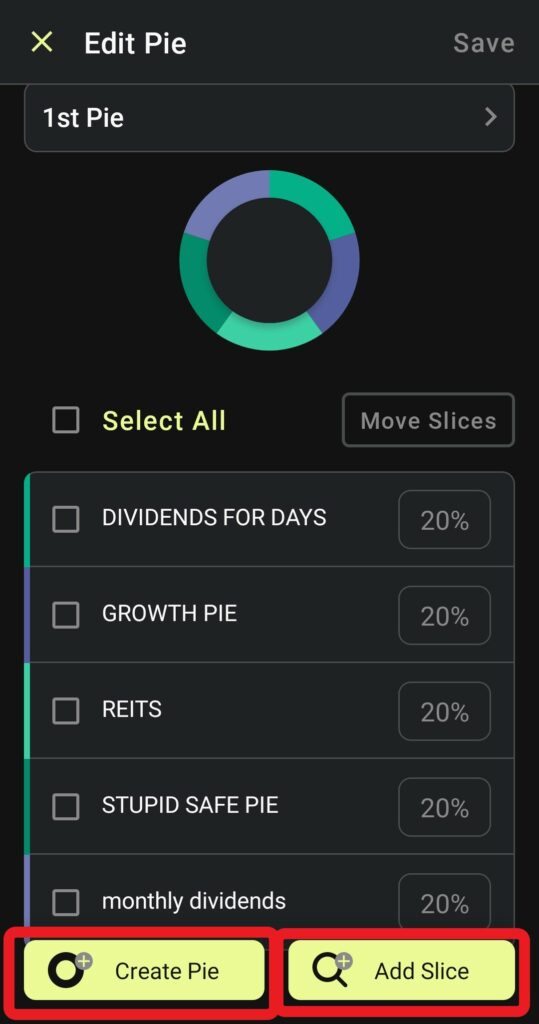

Step 3: Click on either the “Create Pie” or “Add Slice” buttons in order to create an M1 Pie

Using the “Create Pie” option allows you to create an entirely new pie which you can just invest in by itself or you can in fact stick into another pie in order to invest in a greater number of companies. M1 pies are like ETFs that you can make all on your own without the need to rely on financial advisors who might use ETFs they manage to invest in companies you don’t want to and/or dislike.

Whenever you’re done making you’re own M1 pie, you can also use the “Add Slice” option to edit in or out any of the slices of companies or ETFs you already have in your pie. This new way of creating and managing M1 pies is way, way easier for people to understand and do themselves as opposed to the original way of doing things which was honestly needlessly complicated.

If you’re interested in joining M1 Finance, feel free to click the link here! https://m1finance.8bxp97.net/4edv5o

Note: This page contains affiliate links that will, at no cost to you, earn me a commission. You are in no way obligated to click on the links!

Disclaimer: I am not any sort of investment or financial professional giving any sort of legal advice. I’m just some guy trying to teach other people about how they might navigate the financial world.