How To Invest with Robinhood – The Brokerage That Started Free Trade Commissions!

Table of Contents

What is Robinhood?

Robinhood is an investment brokerage that’s named after the famed fairy tale character of Robinhood, who stole from the rich and gave to the poor. Robinhood named itself in such a manner because they were one of, if not the first investment brokerage that allowed people to invest commission-free.

Before Robinhood, most brokerages had stricter limits on things like how much money people needed to get started to invest. More notably, brokerages charged a fair amount of money for trade commissions. Trade commissions are whenever you buy or sell stocks inside of a brokerage. Before Robinhood, depending on which brokerage you used you could end up getting charged as low as $5 to hundreds of dollars every time you bought or sold stocks, which sucked.

Thanks to Robinhood, many brokerages decided to get rid of most or all of their charges on trade commissions making it easier for anyone to invest their money in the stock market.

Although they weren’t the first brokerage to start allowing people to invest in this way, they also eventually adopt the ability for people to invest in fractional shares like the brokerages M1 Finance or Stash.

How to invest with Robinhood!

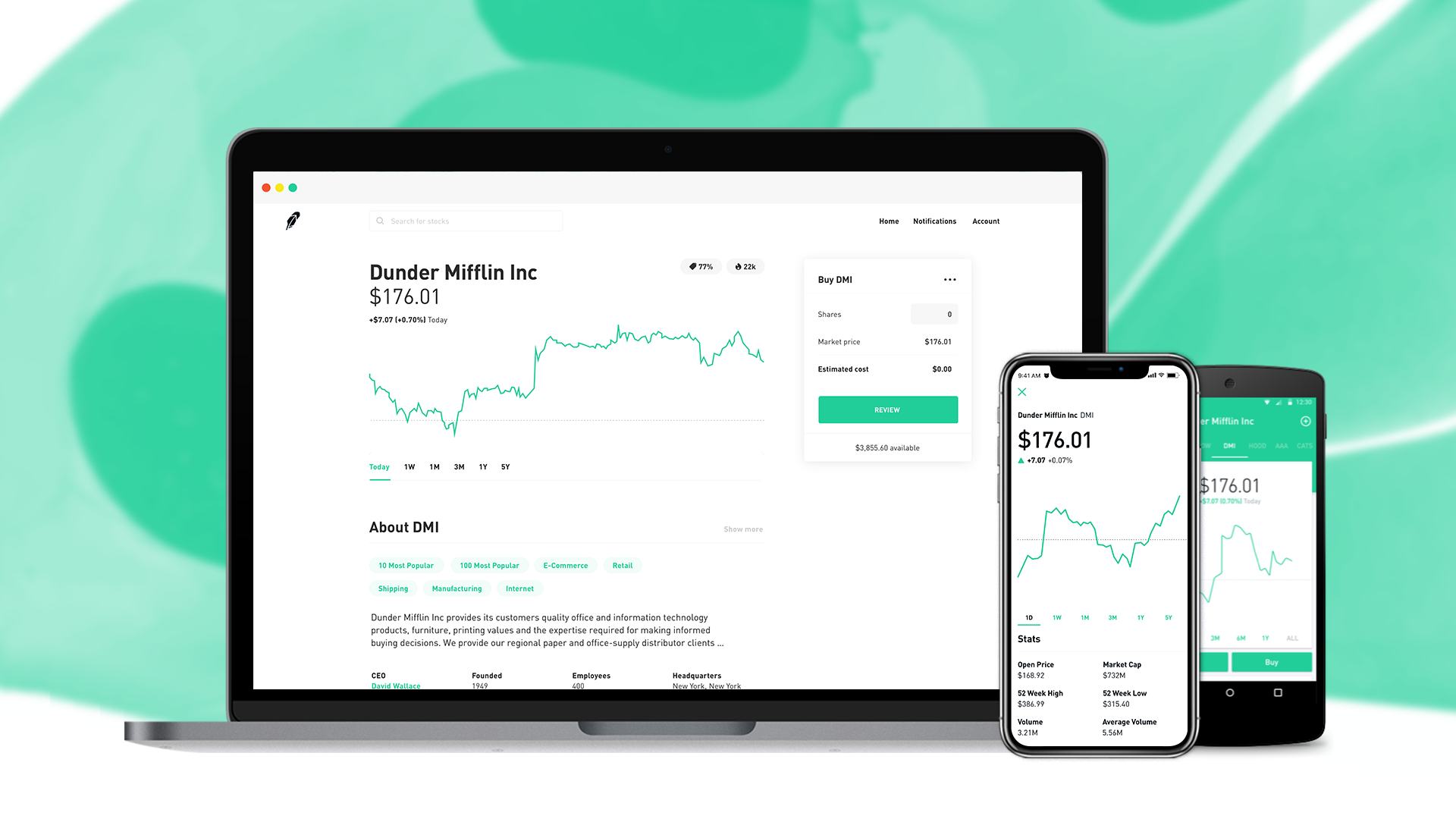

If you are familiar with how to invest in the stock market, Robinhood might be a bit confusing at first because there are a few different ways that you can use to invest your money.

The ways that you can invest your money include:

- Market Orders

- Limit Orders

- Stop Orders

- Stop Limit Orders

- Trailing Stop Orders

- Options Trading

- Fractional Shares

- Recurring Investments

- Cryptocurrencies

Market orders allow investors to buy stocks right at the moment in time that you put in the buy order. This means that you will buy or sell a stock for whatever price the stock or other asset is worth the moment you press the buy button.

Limit orders allow investors more control over how much money they make or lose from a stock. When investors use limit orders they can set a specific “limit for how much they will buy a stock for. Once you make a limit order, from that point onwards your investment account will monitor the price of said stock, and once it reaches the price you set your brokerage will automatically buy or sell the stock at the price that you set.

So, if you set a limit order to buy a $100 dollar stock if it hits $80 per share and said stock actually dips to or below $80 then, provided you have cash in your account, your brokerage will buy it for you without you having to do anything else, and it works the same way vice versa for selling stocks. Limit orders might allow investors to save some money on buying or selling stocks, but they also rely on the fluctuations of the market to bring the price of whatever they want to buy or sell to the price they want which might never actually happen.

Stop orders are just a type limit order that focuses on buying or selling a stock when it reaches or goes above or below the price point that an investor sets.

Stop limit orders are the same as stop orders except that an investor has even more control over the price at which they will buy or sell a stock by setting a specific price range at which they will buy or sell a stock.

For example, if you wanted to buy a stock using a stop-limit order that cost $100 and set the stop price to $150 and the limit(maximum price you are willing to buy or sell at) price to $200 so you wouldn’t buy the stock if it ended being lower than $150 or higher than $200. If you wanted to sell the same stock using a stop-limit order you could set the stop price at $80 and the limit price to $50. This means that if the stock price fell from $100 to somewhere in the range of $50-80, then that is then your brokerage would sell said stock when it fell into that price range.

Trailing stop orders are a more advanced type of stop order that allows investors to protect their profits or limit their losses as long as the stock price moves favorably for how an investor trades based on if you invest normally or “short”(place an order that bets a stock price will go down) a stock.

Options trading is probably one of the most advanced types of trading in the stock market that someone can do. An option is actually a type of contract that gives a buyer the right, but not the obligation, to buy or sell a stock at a specific price on or before a certain date.

Although Robinhood wasn’t the first brokerage to allow for fractional trading, they did eventually allow it after brokerages like Stash, M1 Finance, others started and popularized this way of investing. Investing in fractional shares means that you can Invest however much money into a stock regardless of how much it costs. This means that you could invest a few hundred dollars in stocks like Amazon that, as of the time this post was written, costs over three thousand dollars. If you buy fractional shares of stocks that pay dividends you also still receive the fractional proportion of the stock’s dividend.

Like most other brokerages nowadays, Robinhood offers recurring investments. Recurring investments are investments that happen automatically based on a schedule set by the investor that can happen daily, weekly, bi-weekly, or monthly. Recurring investments are a great way to automate your investments since you can just set them up once and just leave them alone while your invested money piles up.

For those of you who are unfamiliar with what cryptocurrency is and how it works, a cryptocurrency is basically a form of digital currency. Many cryptocurrencies are backed by something called a blockchain. A blockchain is a detailed ledger of all of the different transactions of the cryptocurrency that are typically accessible to the public.

The blockchain is distributed and duplicated throughout an entire network. This means that there is not one central bank or government entity that controls any of the numerous types of cryptocurrencies. Similar to Sofi Invest, Robinhood currently offers several cryptocurrencies that include: Dogecoin, Litecoin, Bitcoin SV, Bitcoin Cash, Bitcoin, Ethereum Classic, and Ethereum.

Banking with Robinhood!

Along with the investment services they offer, Robinhood also offers the ability for people to bank with them using a checking account that they call their “Cash Management account” that is provided by them. Their checking accounts come with a bunch of nice features that include:

- No account opening fees

- No account maintenance fees

- No inactive account fees

- No foreign transaction fees

- No minimum balance fees

- You’ll earn 0.30 APY with any cash held in your checking account (Note: This interest is subject to change at any time)

- They use multiple banks so that your cash is FDIC insured up to $1.25 million dollars

- Direct deposit

- You can pay your bills with Robinhood’s checking account

- 75,000 fee free ATMs – In order to find a fee free ATM, go the “Cash Management” tab, scroll to the bottom of the screen, and then click the “See Nearby ATMs” button

- Access to Apple Pay, Google Pay, and Samsung Pay

Robinhood Gold

Similar to M1 Finance’s M1 Plus program, Robinhood offers a special service as part of a subscription that users have to pay for. Robinhood Gold currently costs only $5 per month and the benefits that you get with Robinhood Gold include:

- Bigger Instant Deposits – With Robinhood Gold you can get instant access to $5k – $50k when you make such a deposit instantly

- Professional Research – Gain access to Morningstar which provides unlimited access to in-depth stock research reports on around 1700 stocks

- Level 2 Market Data – See multiple bids and asks for any given stock to help you better determine the availability or desire for a stock at a certain price

- Access To Margin On Investing – Investing on margin gives you more flexibility, extra buying power, and less time waiting to access your deposited funds

Click on the link here to join Robinhood! https://robinhood.c3me6x.net/qny0Bg

Note: This page contains affiliate links that will, at no cost to you, earn me a commission. You are in no way obligated to click on the links!

Disclaimer: I am not any sort of investment or financial professional giving any sort of legal advice. I’m just some guy trying to teach other people about how they might navigate the financial world.

.