Traditional and Roth 401ks – What Are They and What Are Their Benefits?

Table of Contents

What are traditional 401ks?

There are two different types of 401ks. There is the traditional and the Roth 401k. They are both classified as tax-deferred accounts. The money you invest in traditional 401ks is typically money that comes out of your regular paycheck before you pay the usual federal, state, and FICA taxes. This means that the money that you put into traditional 401ks is capable of being deducted from your overall taxable income for the year.

What are Roth 401ks?

Roth 401k investment contributions are made with post-tax money meaning they’re made with money you get after you pay the usual federal, state, and FICA taxes. This means that the money that you put into traditional 401ks is NOT capable of being deducted from your overall taxable income for the year. However, after your reach the age of 59 1/2 and retire, all of the money you invested is yours 100% tax-free!

The different tax benefits of traditional and Roth 401ks!

That means that traditional contributions are deductible from your entire taxable income for the year, while Roth contributions are not. So, come tax time, if you can itemize your tax deductions you can deduct however much you contributed to any or all of your traditional 401ks, which would be $19,500 for the year 2021 that this was posted. While you do get to deduct your traditional 401k contributions while working after you reach the official retirement age of 59 1/2 or whenever you decide to withdraw your money you will have to pay regular federal and state income taxes.

With Roth 401ks, while you can’t deduct the contributions from your taxes the year you made them, you do get the benefit of not having to pay any taxes at all whenever you reach the official retirement age of 59 1/2 and start making withdrawals.

Contribution Limits

Unfortunately, when it comes to contributing to both traditional and Roth 401ks, the contribution limit counts towards both types of accounts. There are no rules about the number of such accounts that you can have, but if you have one of each that means that you can only contribute $9,750 to each, or $2000 for one and $17,500 for the other, or vice versa for any contribution combination. This rule counts against all of such accounts you have so the $19,500 or whatever the current contribution limit might be has to be spread out through all of the accounts and not exceed the limit.

Withdrawals and Penalties

Technically speaking, one is supposed to wait until the official retirement age of 59 1/2 before you take any money out of either type of account. In the event that you do take money out of one of these accounts before then, then you make incur penalties which are currently set to 10%, and regular income taxes that you have to pay for the year you made the withdrawal.

That said there are some circumstances that you can withdraw money out of these accounts without incurring these fees.

- Qualified public safety employees can begin taking penalty-free withdrawals if they leave service in the year they turn 50 or older.

- Some 401k plans will allow what is called a hardship withdrawal with education expenses sometimes falling under this clause. It is important to note here that expenses eligible for a hardship withdrawal will vary depending on your 401k plan administrator.

- First-time home purchases or new builds may also be considered eligible for a hardship withdrawal from your 401k.

- 401k without penalty at any age before 59 ½ by taking a 72T early distribution. It is named for the tax code which describes it and allows you to take a series of specified payments every year. The amount of these payments is based on a calculation involving your current age and the size of your retirement account. Unfortunately, once you start, you have to continue taking the periodic payments for five years, or until you reach age 59 ½, whichever is longer. Also, you will not be allowed to take more or less than the calculated distribution, even if you no longer need the money.

It’s also important to note that 401(k) withdrawals are required after age 72 unless you are still working for a company you don’t have an ownership stake in. The penalty for missing a required minimum distribution is 50% of the amount that should have been withdrawn in addition to the regular income tax you owe on the distribution.

Employer Control over Investments!

With 401ks, they are employer-sponsored plans, so to gain access to an account, it needs to be offered by your employer as an option to invest in. Also unlike IRAs or individual retirement accounts, 401ks come with a few other downsides, since they are employer-sponsored accounts they don’t follow you wherever you go like IRAs and in order to keep that money, you will need to contact the company’s HR department or the brokerage the 401k is in order to get it transfers to a 401k account you might have with your current employer, and you need to do this every time you change companies or else the money you invested will just go to waste!

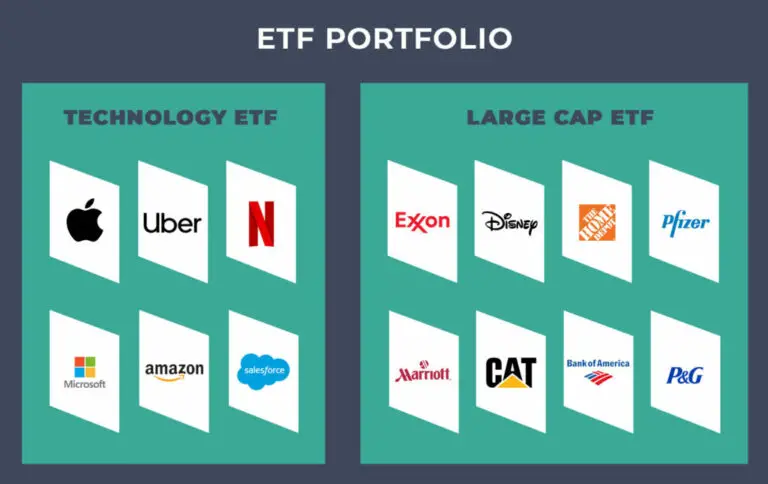

Another thing is that while IRAs have lower contribution limits, they still allow you to invest in anything in the stock market which includes stock, ETFs, REITs, BDCs, and etc., while 401k of both types only allows you to invest in portfolios chosen by the employer. You will typically find simple options like an S&P 500 fund, a bond type fund, and maybe even a fund that invests internationally, and these will be the only few options that the company will allow you to invest in with your 401k.

Disclaimer: I am not any sort of investment or financial professional giving any sort of legal advice. I’m just some guy trying to teach other people about how they might navigate the financial world.