How To Save And Invest Your Money With Digit!

Table of Contents

What is Digit?

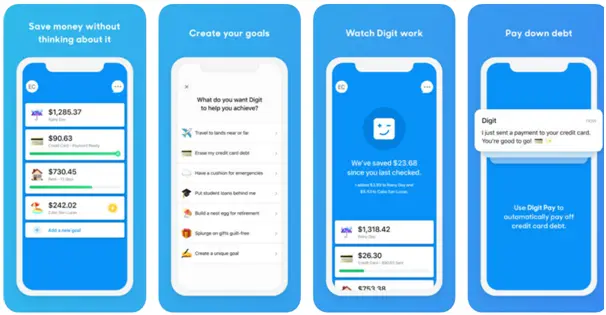

Digit is a new budgeting and investment app available on both the App and Google Play stores. It allows you to create unlimited savings goals that are like Sofi’s “vaults”. It can help prevent you from getting hit by overdraft fees from your bank by instantly transferring savings over to your bank when needed.

You can invest in the stock market with Digit. They are a robo-advisor brokerage, meaning they provide you with a few portfolios that they manage based on your risk preferences and investment timetable. You can invest in a conservative, moderate, or aggressive pie of stocks. You can also open an IRA-type account to start saving for your retirement. Digit automatically keeps track of the legal minimum contribution limits so you don’t overinvest in your IRA and get in trouble with the IRS and pay extra unnecessary taxes.

How does Digit work?

In order to save and invest with Digit, you have to first link your bank account with your Digit account. When setting up your account you can set up a regular taxable investment account, a traditional or Roth IRA account, and a regular account to save cash in.

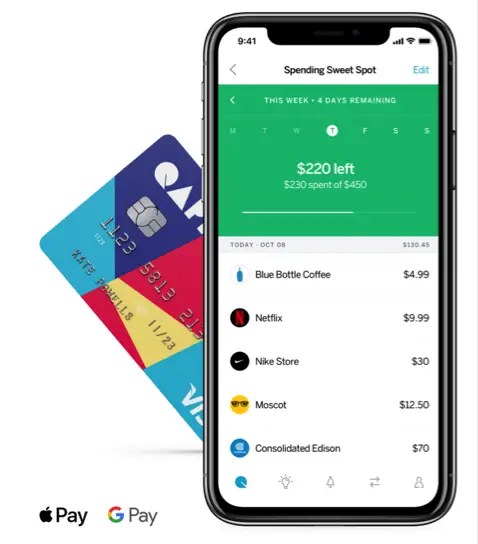

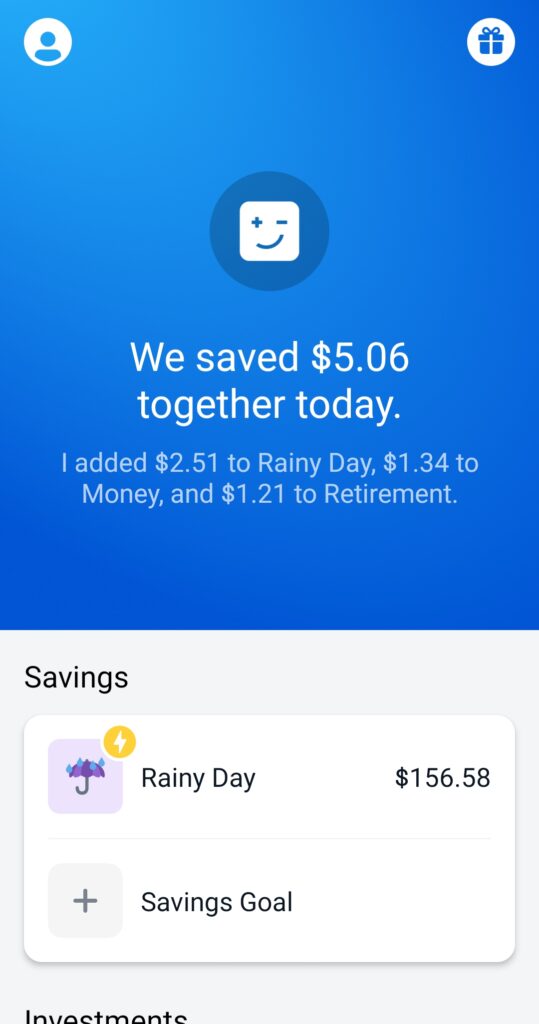

Digit takes a little bit of money out of your account every day and puts that money towards all of the different accounts that you set up. In order to make sure that you don’t put any money away that you don’t want or particularly need to they allow you set up “overdraft protection” on your account. This way, if you need a certain amount of money to pay for bills or even other miscellaneous expenses, Digit will only withdraw and invest/save money until it reaches that threshold. They also allow you to transfer funds instantly to your bank account if you need some money in order to avoid minimum account or overdraft fees.

The cash held for your savings goals are FDIC insured up to $250,000 and earns an annual interest rate of 0.1%. You can add or withdraw money manually on their app at any time. They also allow you to withdraw money from your investment accounts for a while after it’s transferred because it is not invested immediately so you won’t have to pay any taxes or penalty fees on that money just yet. The app only invests your money once a month so you have roughly one month after money is transferred from your bank account to the app before it invests it for you.

How much does Digit cost?

Similar to the famous robo-investment app, Acorns, Digit charges you a monthly fee. They offer the first 30 days free after you first sign up, but after that, you have to pay a fee of $5 to use their service.

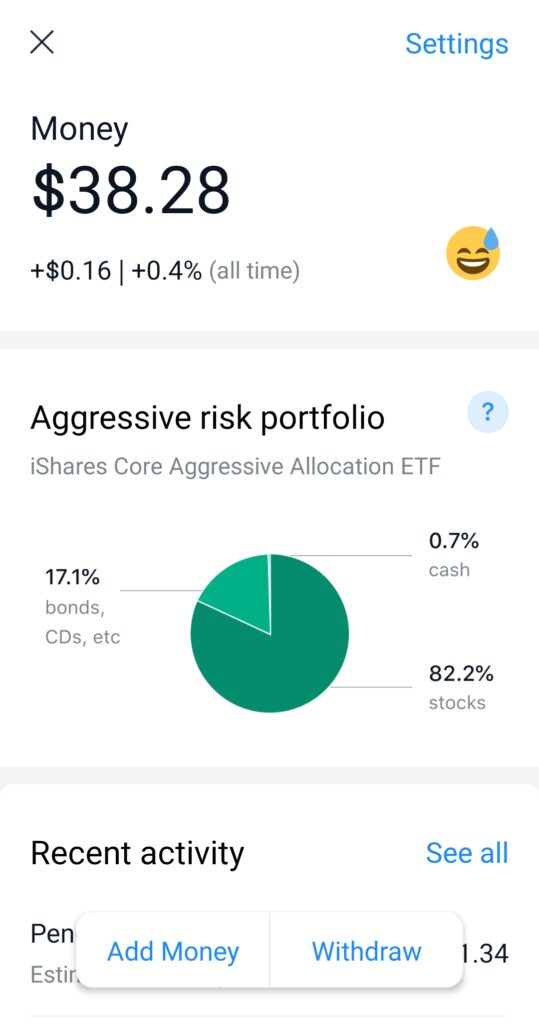

Picture of the app showing how much was saved and put towards a “rainy day” savings account, a “Money” table investment account, and a “retirement” IRA account

Picture of the “money” table investment account with the money being automatically invested in an aggressive pie with mostly stocks, some bonds, and a little bit of cash.

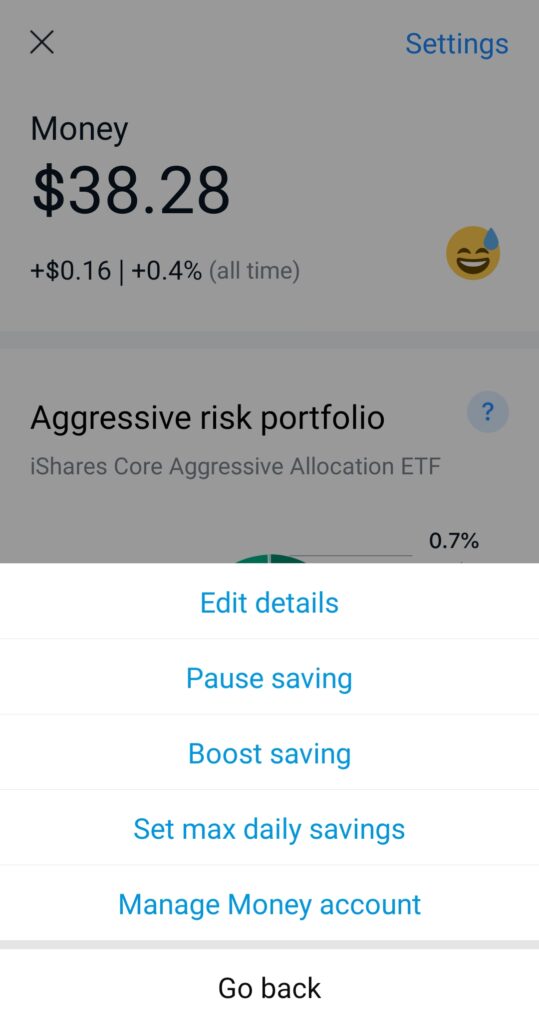

Picture of the “money” taxable investment account with the options to edit the details of the account, pause savings, boost savings, set max daily savings, and managing the investments in the account

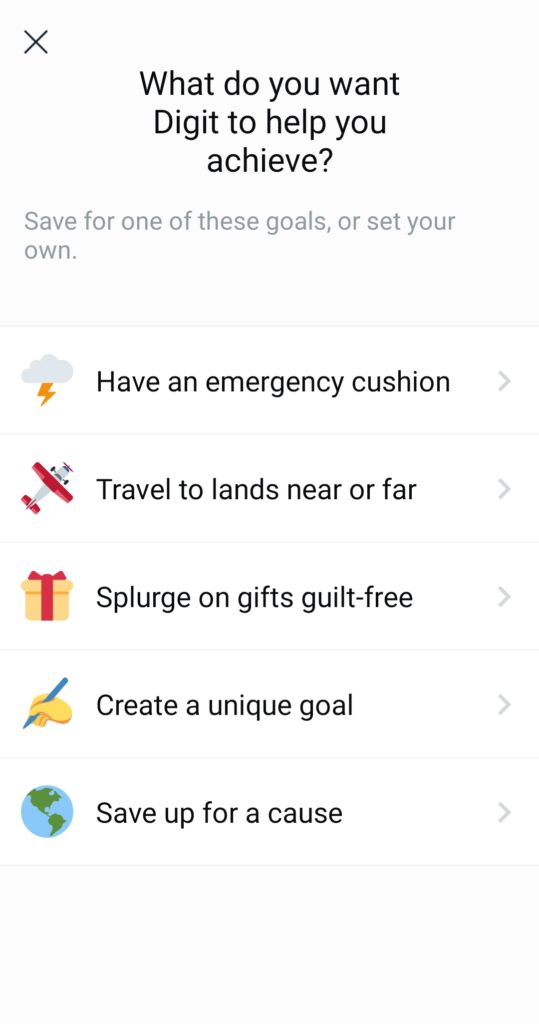

Picture of some of the goals that you save your money towards in the Digit app. You are allowed to create an unlimited amount of savings goals.

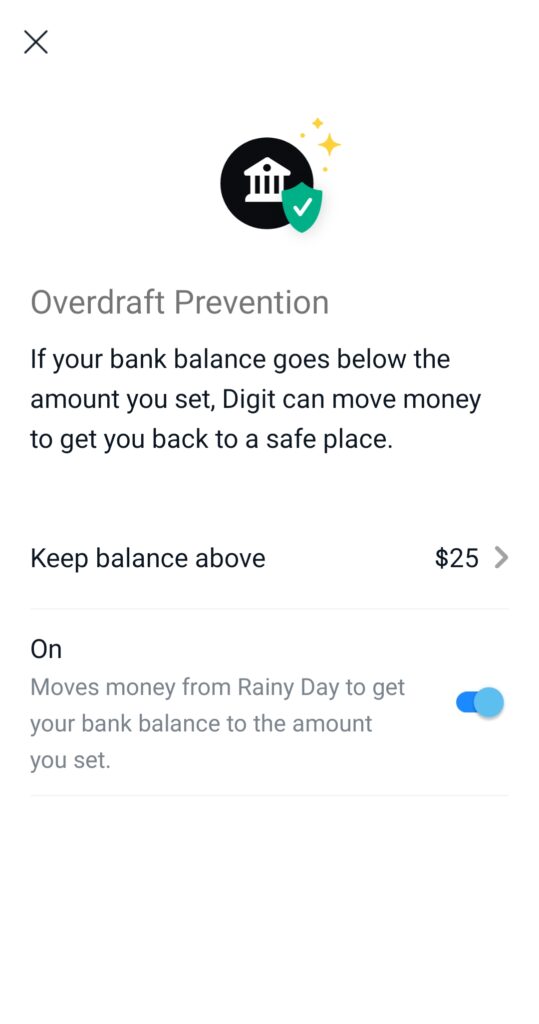

Picture of the Digit app’s overdraft protection settings.

Digit will automatically try to keep your bank account balance at the threshold you set. You can turn the feature on the bottom of the picture if you want to automatically move money from your Digit account to your bank account in order to keep it at the balance that you set in the app.

Disclaimer: I am not any sort of investment or financial professional giving any sort of legal advice. I’m just some guy trying to teach other people about how they might navigate the financial world.