Traditional IRAs and Roth IRAs – What Are They and What Are Their Benefits?

Table of Contents

What are traditional IRAs?

Traditional IRAs are individual retirement accounts offered by investment brokerages in the US. The money you invest in traditional IRAs is typically money that you contribute with after-tax money, and then you have the option to deduct these contributions from your total taxes for the year if your itemized deductions are higher than your standard deduction.

What are Roth IRAs?

Roth IRA investment contributions are made with post-tax money meaning they’re made with money you get after you pay the usual federal, state, and FICA taxes. This means that, unlike traditional IRAs, Roth IRA contributions are not capable of being deducted from your taxes for the year.

The different tax benefits of traditional and Roth IRAs!

That means that traditional IRAs contributions are deductible from your entire taxable income for the year, while Roth IRA contributions are not. So, come tax time, if you can itemize your tax deductions you can deduct however much you contributed to any or all of your traditional IRAs, which would be $6000 for the year 2021 that this was posted. While you do get to deduct your traditional IRA contributions while working after you reach the official retirement age of 59 1/2 or whenever you decide to withdraw your money you will have to pay regular federal and state income taxes.

With Roth IRAs, while you can’t deduct the contributions from your taxes the year you made them, you do get the benefit of not having to pay any taxes at all whenever you reach the official retirement age of 59 1/2 and start making withdrawals.

Contribution Limits of traditional and Roth IRAs!

Unfortunately, when it comes to contributing to both traditional and Roth IRAs, the contribution limit counts towards both types of accounts. There are no rules about the number of such accounts that you can have, but if you have one of each that means that you can only contribute $3000 to each, or $2000 for one and $4000 for the other, or vice versa. This rule counts against all of such accounts you have so the $6000 or whatever the current contribution limit might be has to be spread out through all of the accounts and not exceed the limit.

Withdrawals and Penalties

Technically speaking, one is supposed to wait until the official retirement age of 59 1/2 before you take any money out of either type of account. In the event that you do take money out of one of these accounts before then, then you make incur penalties which are currently set to 10%, and regular income taxes that you have to pay for the year you made the withdrawal.

That said there are some circumstances that you can withdraw money out of these accounts without incurring these fees.

For traditional IRAs you can avoid the penalties and taxes if you do one of these things:

- IRA distributions used to pay for medical expenses that are not reimbursed by health insurance and exceed 7.5% of your adjusted gross income are not subject to the early withdrawal penalty

- If you are unemployed, you may be able to take early IRA withdrawals without penalty to cover the cost of health insurance premiums. If you lose your job and collect unemployment compensation for 12 consecutive weeks, you can take penalty-free IRA distributions if you use the money to pay for health insurance for you or your spouse or dependents. To qualify for this penalty exception, you must take the distribution in the year you received the unemployment compensation or the following year

- Penalty-free IRA distributions are allowed to pay for college expenses, which include tuition, fees, books, supplies, and equipment. Room and board also count if the individual attending college is at least a half-time student. The education must be for the account owner, his or her spouse, or their children or grandchildren. The withdrawal can be used for colleges, universities and vocational schools eligible to participate in federal student aid programs. Unfortunately, IRA withdrawals are count as taxable income and could reduce the student’s eligibility for financial aid.

- An early IRA withdrawal can be used to help fund a first home purchase. You can withdraw up to $10,000 ($20,000 for couples) from an IRA to buy or build a first home without incurring the early withdrawal penalty. If the purchase or construction of your home is canceled or delayed, put the money back in your IRA within 120 days of the distribution to avoid the penalty. This type of early IRA withdrawal can also be used to help purchase a first home for a child, grandchild, or parent.

- Beginning in 2020, IRA owners could withdraw up to $5,000 without penalty following the birth or adoption of a child. The distribution must be taken within one year of a child’s birth or adoption.

- People with severe physical and mental disabilities who are no longer able to work can take IRA withdrawals without penalty. You may need to provide documentation that you are unable to participate in significant activities due to your condition. A physician will need to determine the severity of the disability.

- Members of the military reserves who take an IRA distribution during active duty do not have to pay a 10% penalty on the amount withdrawn. The exception is only available to those ordered or called to duty after Sept. 11, 2001, for a period of more than 179 days. The distribution must also be taken during the active duty period to avoid the penalty.

- If you inherit a traditional IRA before age 59 1/2, you may take penalty-free withdrawals but you will need to pay income taxes on each distribution. If the original account owner passed away after Jan. 1, 2020, you will be required to withdrawal all assets from the inherited IRA within 10 years of the IRA owner’s death, unless you are a surviving spouse, minor child, disabled, chronically ill, or up to 10 years younger than the original account owner. However, if you inherit an IRA from your spouse and elect to treat it as your own, distributions before age 59 1/2 will be subject to the early withdrawal penalties.

It’s also important to note that traditional IRA withdrawals are required after age 72 unless you are still working for a company you don’t have an ownership stake in. The penalty for missing a required minimum distribution is 50% of the amount that should have been withdrawn in addition to the regular income tax you owe on the distribution. However, this RMD or required minimum distribution rule doesn’t apply to Roth IRAs at all.

For Roth IRAs, you can withdraw money out of these accounts if they meet two specific criteria.

- 1. The account must five years or older

- 2. You can only withdraw the principal money that you invested and not any of the gains. That means if you invested $10,000 and you made 5,000 in gains to have a total of 15,000, you are only allowed to withdraw 10,000 without incurring penalties and taxes.

Individual Control over Investments

The good thing about these types of accounts is that you can set one up for yourself without needing an employer to do it like with 401ks. It’s honestly not much harder than opening a social media account and this particular type of retirement account follows you wherever you go, whereas, with 401ks or similar employer-sponsored plans you have, it remains with the employer, you have to make sure you don’t forget it with them, and they typically have a slightly complicated process to make sure it’s transferred to your own IRA or another account.

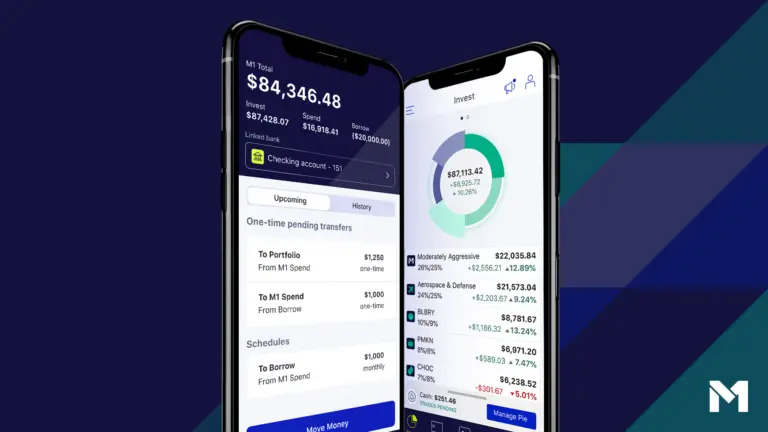

With IRAs, you also have the option of investing based on your own tastes. If you want someone else to do the work many brokerages offer portfolios, that they manage, for you to invest with them. You can also choose to invest how you want, whether that be in single stocks, ETFs, or if you want to invest for specific goals like fixed income or in green companies.

Click here to open an IRA with M1 Finance! https://m1finance.8bxp97.net/4edv5o

Note: This page contains affiliate links that will, at no cost to you, earn me a commission. You are in no way obligated to click on the links!

Disclaimer: I am not any sort of investment or financial professional giving any sort of legal advice. I’m just some guy trying to teach other people about how they might navigate the financial world.