529 College Savings Plans – What Are They and What Are Their Benefits?

Table of Contents

What are 529 College Savings Plans?

There are two types of 529 plans. There are 529 college savings plans and 529 prepaid plans. Typically, 529 plans are sponsored by individual states. You can, but do not even need to use your own state’s 529 plans. These plans also do not have set contribution limits by the IRS unlike most other types of investment accounts. Another nice little benefit to using your own state’s plan is that quite a few, but not all of them act similar to 401ks or IRAs in that contributions can be deducted from your state income taxes but not federal income tax.

529 College Savings Plans:

529 college savings plans are the more common type where your investments grow and can be withdrawn tax-free. However, this is only if the money is withdrawn for eligible expenses like tuition, room and board, required textbooks, and anything to do with the most basic of school-based expenses. This means you can’t use it to fund anything else like summer vacations or even student loan debt repayment, at least not without paying a 10% penalty and federal income tax on non-qualified distributions.

529 Prepaid Plans:

529 Prepaid plans are plans that allow you to lock in a certain amount for college tuition by prepaying part or all of an in-state college’s tuition costs. Prepaid tuition plans let a saver or account holder purchase units or credits at participating colleges and universities (usually public and in-state) for future tuition and mandatory fees at current prices for the beneficiary.

Prepaid tuition plans usually cannot be used to pay for future room and board at colleges and universities and do not allow you to prepay for tuition for elementary and secondary schools. They may also be converted for use at private and out-of-state colleges, but most prepaid tuition plans are designed to save for an in-state public college, with the exception of Private College 529, which is a prepaid plan sponsored by more than 250 private colleges. Educational institutions can offer a prepaid tuition plan but not a 529 college savings plan.

Video from SavingForCollege.com – How much can you contribute to a 529 plan in 2021?

What are the benefits of a College 529 Savings Plan?

One of the primary benefits of using a 529 savings plan is that you can use account withdrawals at eligible schools nationwide. You can use a 529 plan to pay for college, K-12 tuition, apprenticeship programs, and student loan repayments. Unlike a UGMA/UTMA, a 529 plan will have a minimal impact on your child’s financial aid eligibility.

A 529 plan covers almost all expenses related to college, including tuition, fees, reasonable room and board, books, equipment including computers, software, and supplies. Reasonable room and board are considered qualified expenses if the student is enrolled at least half the time. If a child decides not to attend college or doesn’t use all of the funds, you can change the beneficiary to another member of the family.

You can also use a 529 College Savings Plan to avoid gift taxes. For 2020-2021, you can give up to $15,000 to another person and avoid paying the gift tax. But a 529 lets you pack five years into one contribution. You can give up to $75,000 as a lump sum and avoid the gift tax for that year. However, you have to wait until year six if you want to contribute again without incurring gift taxes. These numbers are doubled for married couples so you, could give up to $30,000 to another person for one year and up to $150,000 if you want to make a lump-sum contribution to the College 529 savings plan.

While they don’t offer savings of federal income taxes, if you invest in the 529 College savings plan in the state of your primary residency, quite a few of them offer you the ability to deduct your contributions from state income taxes.

What are the cons of investing in a College 529 Savings Plan?

If withdrawn money isn’t used for 529 plan qualified expenses, it’s subject to a 10% penalty and applicable taxes. Your investment choices are limited to those selected by the plan’s administrator. You might have fewer choices than with a brokerage account or self-directed Coverdell Education Savings Account. In addition to limited investment choices, your 529 plan only allows you to make changes for existing dollars twice in a calendar year.

How to open a College 529 Savings Plan!

For the rules on how your state’s College 529 savings plan works a good idea would be to refer to their official site and for some of the more general rules, a good site to refer to would be Savingforcollege.com.

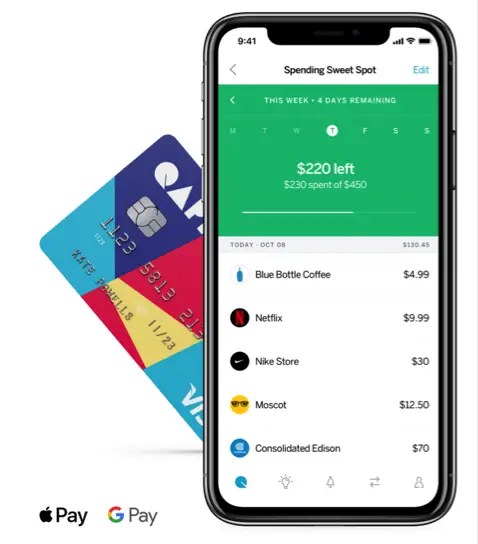

When you’re ready to open a College 529 savings plan one service you could use to make it as easy as possible is Collegebacker. The Backer Foundation is a non-profit organization that helps families with modest means get started with their college savings. Low-income families that qualify for a Backer Scholarship can start using Backer for free and will receive a $25 monthly bonus for up to 6 months.

Opening a 529 college savings plan with Collegebacker is quick and easy on their website or app. It should only take around five minutes. If you choose to invest with a 529 plan, your money is held with a 529 plan provider. If you choose to start with a “Backer Safe”, your money is held in an FDIC-insured account. You can choose to either start your own new 529 college savings plan or link an existing one.

Similar to the UTMA account service from Unest, Collegebacker allows you to use a link provided by them so family and friends can make one-time or recurring contributions. There is no minimum requirement for contributions. They can make these contributions by credit card, debit card, or bank transfer. It’s very easy to contribute!

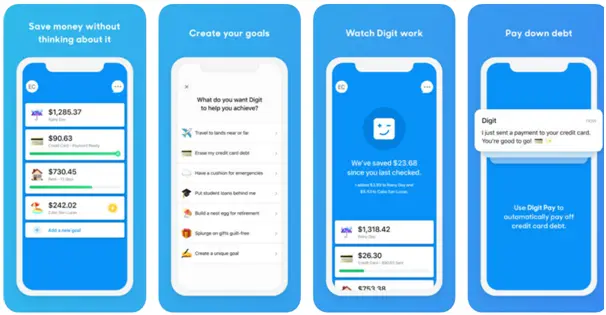

Collegebacker has a handy and convenient app available on both the App and Google Play stores that you can download and link to your bank accounts in order to invest in your 529 college savings plan and keep track of how well the investments are doing overtime. Collegebacker also allows you to earn cashback rewards on some items that you purchase that can be used to invest more money into the 529 savings plan.

Disclaimer: I am not any sort of investment or financial professional giving any sort of legal advice. I’m just some guy trying to teach other people about how they might navigate the financial world.