Unest – The Best Way To Invest For Your Child’s Future!

Table of Contents

What is Unest?

Unest is a new brokerage account that lets you invest in a particular type of account called a UTMA, which is a tax-advantaged custodial account for kids that allowed parents and other relatives the ability to invest so that the child can use the money for large expenses. It can be used for college like 529 savings plans, but unlike 529 plans, the custodial account in Unest can be used for any other goal like buying a car, paying a down-payment on a house, or a wedding.

What is a UTMA account?

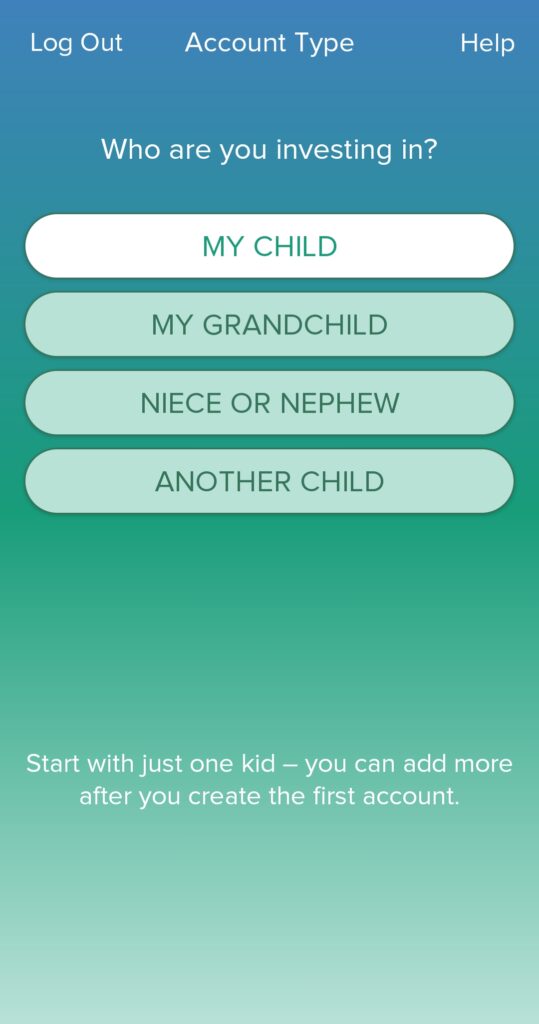

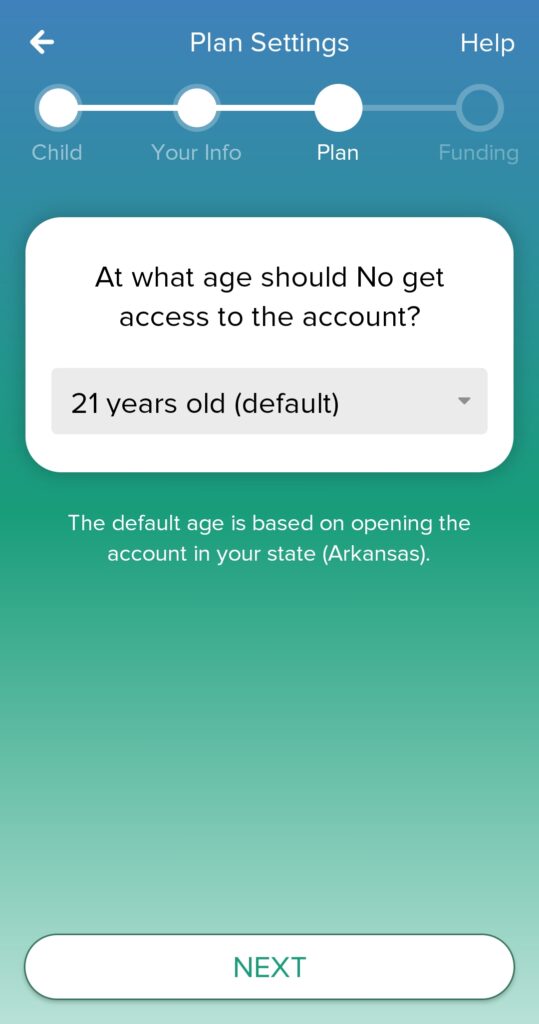

UTMA stands for “Uniform Transfer to Minors”. The UTMA accounts in Unest are set up and managed by the custodian of a child. The custodian can be a parent, grandparent, relative, or even a friend. The custodian manages the account until the child “comes of age”. The custodian can choose which age the beneficiary gets control of the account.

Up to $2,200 in annual earnings in a UTMA account grow tax-advantaged. The first $1,100 or growth is completely tax-free, the next $1,100 is taxed at the child’s tax rate, and anything exceeding $2,200 is taxed at the parent’s regular state and federal income tax rates. These tax rates only apply to the gains on your investments and not the contributions.

What is the difference between College 529 Savings Plans and an UTMA account?

College 529 savings plans are taxed advantaged accounts that allow people to save and invest money for their child’s education costs. They are offered by the states themselves or by some educational institutions.

Unfortunately, if you use the money that was invested in a 529 plan for anything other than education, you lose out on the tax benefits and any gains realized are subject to a 10% penalty fee.

Both 529 plans and UTMA accounts provide a tax-advantaged way to invest in your children’s future. However, UTMAs are more flexible about what the money can be used for once the beneficiary gains access to it. If you don’t want or need to pay for educational expenses then the money can be used for other big purchases like cars, houses, weddings, and more. There really isn’t much of a limit on what the money can be used for once the beneficiary gains access to it.

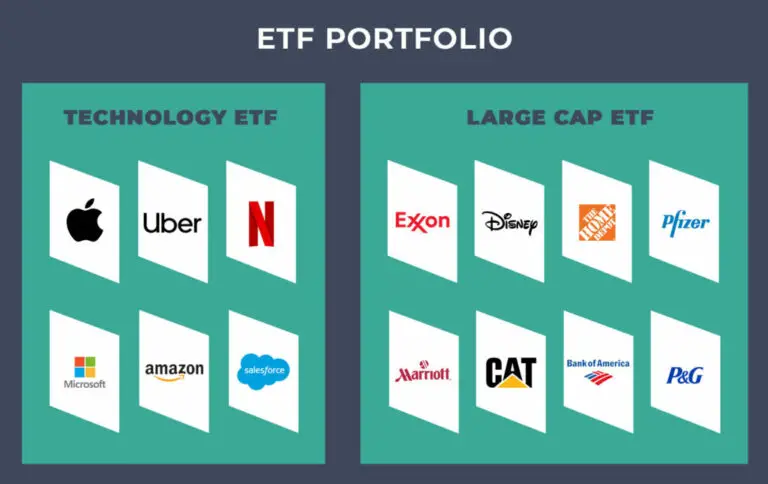

529 savings plans are also more limited in what options you are allowed to invest in when you use them. 529 savings plans are typically limited to a few mutual funds and ETFs. You are also limited in how often you can change what you invest in.

How to invest in Unest!

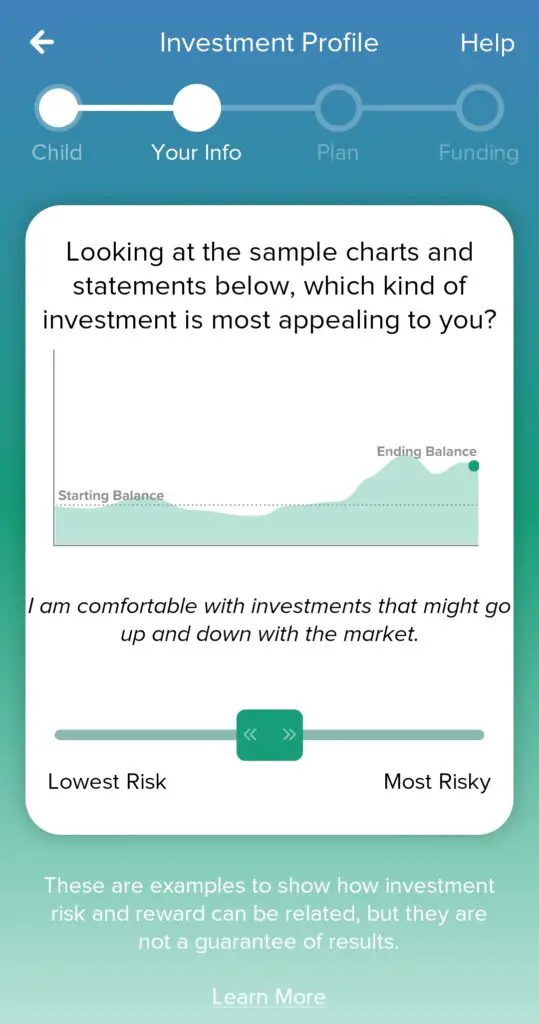

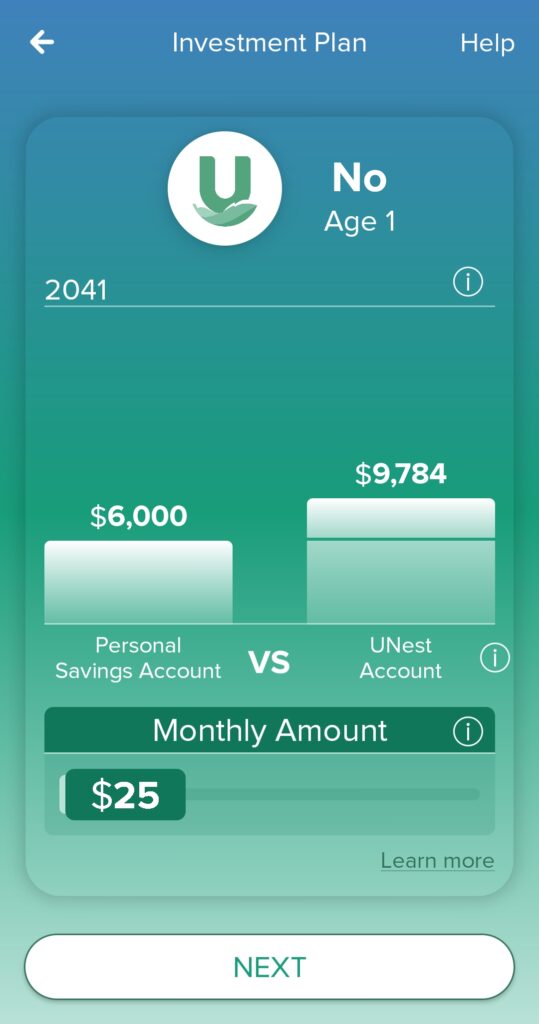

Unest offers five investment options based on your needs. They offer 5 different options based on your child’s age. Unest also allows you direct control of the account through their app. It also allows you to do auto deposits into the account.

Unest also offers people other than the custodian the ability to invest in the account. Simply send a link from the app to anyone who wants to invest to invite them and they can contribute on things like birthdays, holidays, and any other special occasion.

Unest also offers rewards for buying certain goods and services that are invested into your account.

How much does Unest cost?

Unest has a few different plans that charge you monthly to use their service

- Regular – $3/month

- Unest’s “Regular” plan allows you to easily set up your account

- It gives you a choice of five investment options based on age

- It allows unlimited gifts from friends and family

- It allows you to earn extra cash via Unest Rewards

- It allows you to use an easy to use savings calculator to estimate how much you need to invest in order to reach a certain savings goal

- Family – $6/month

- The “Family” plan offers everything in the “Regular” plan

- It also allows you to add up to 5 children to a single account

How to open a Unest account!

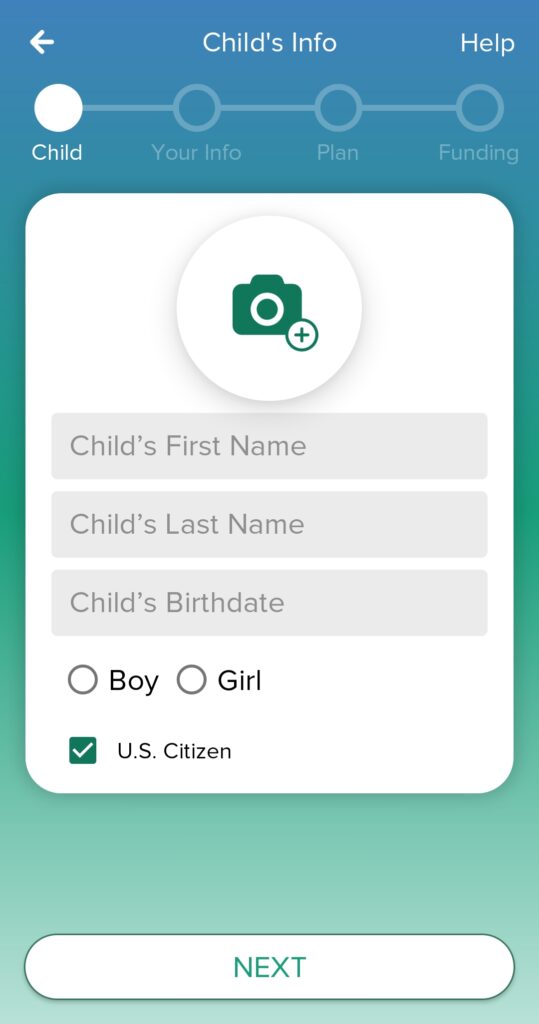

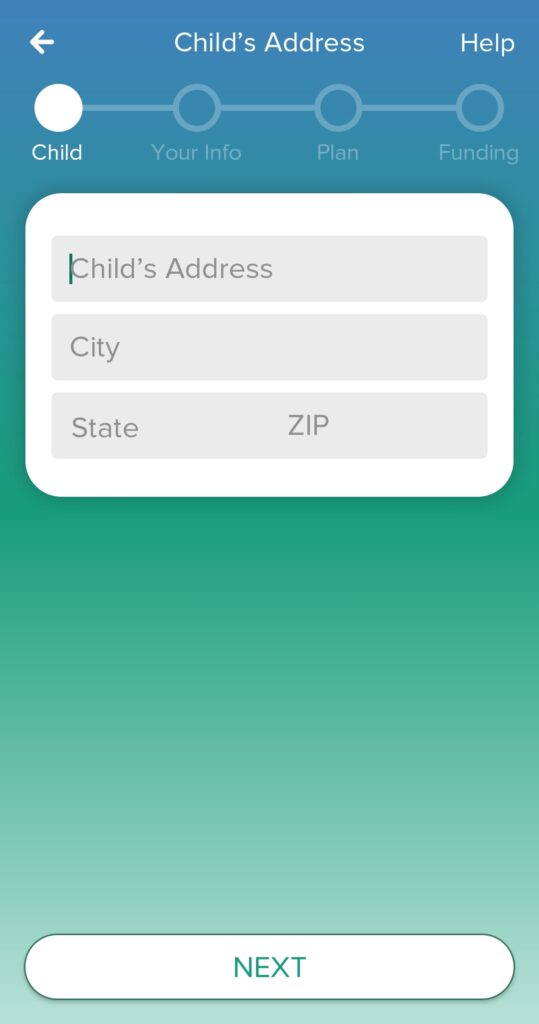

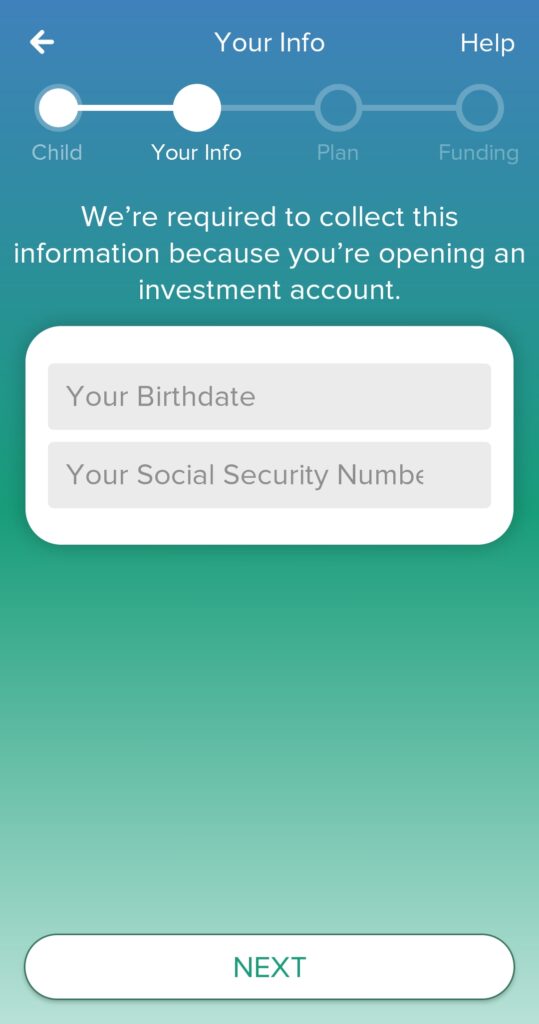

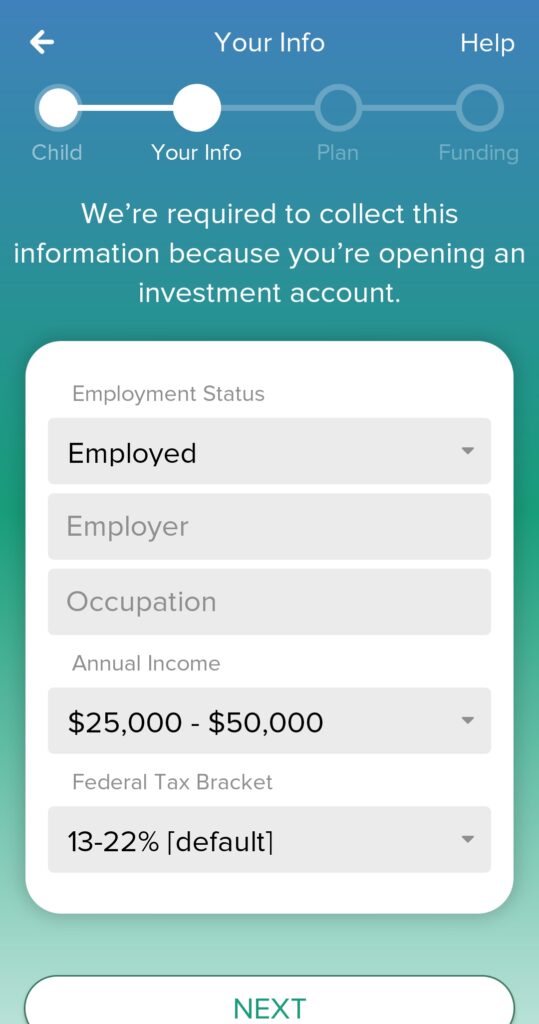

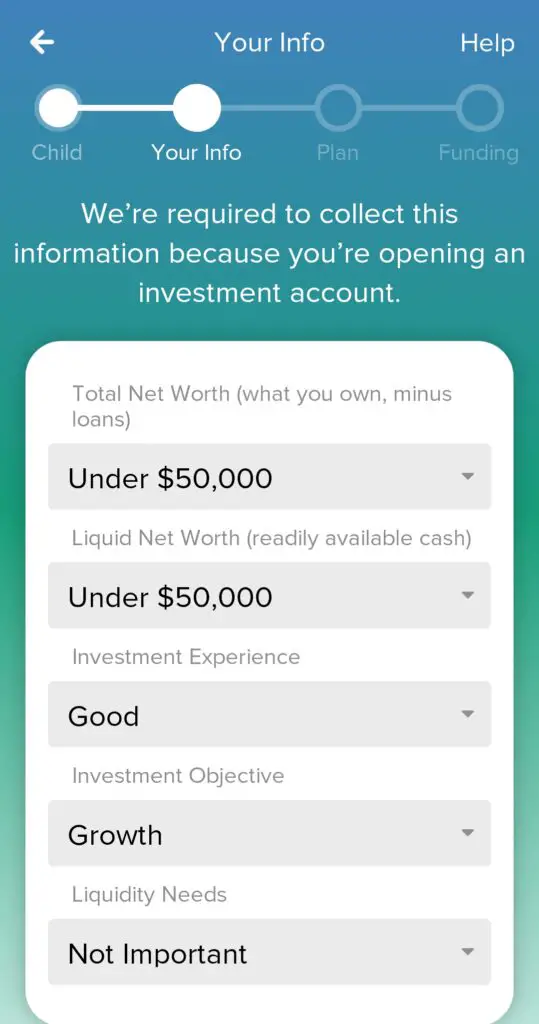

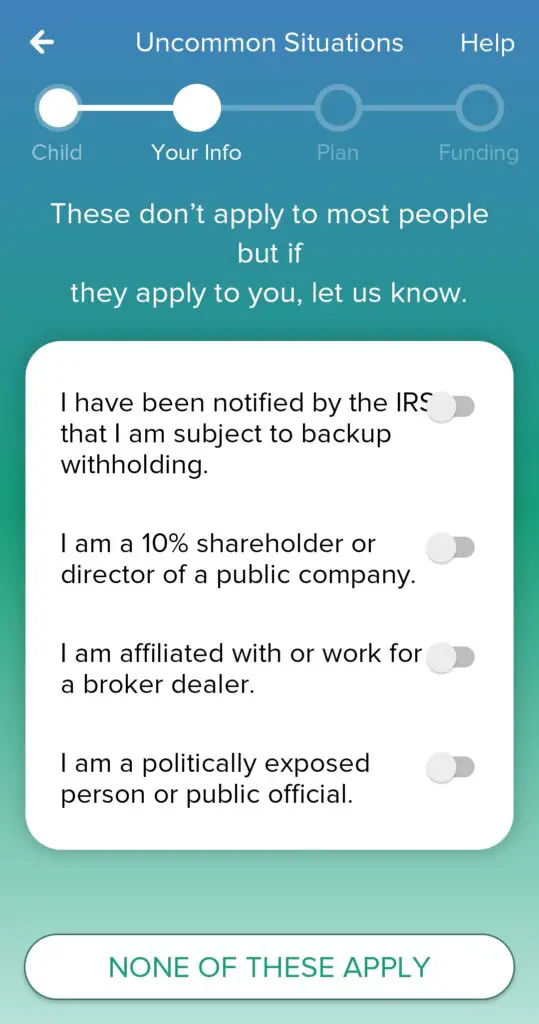

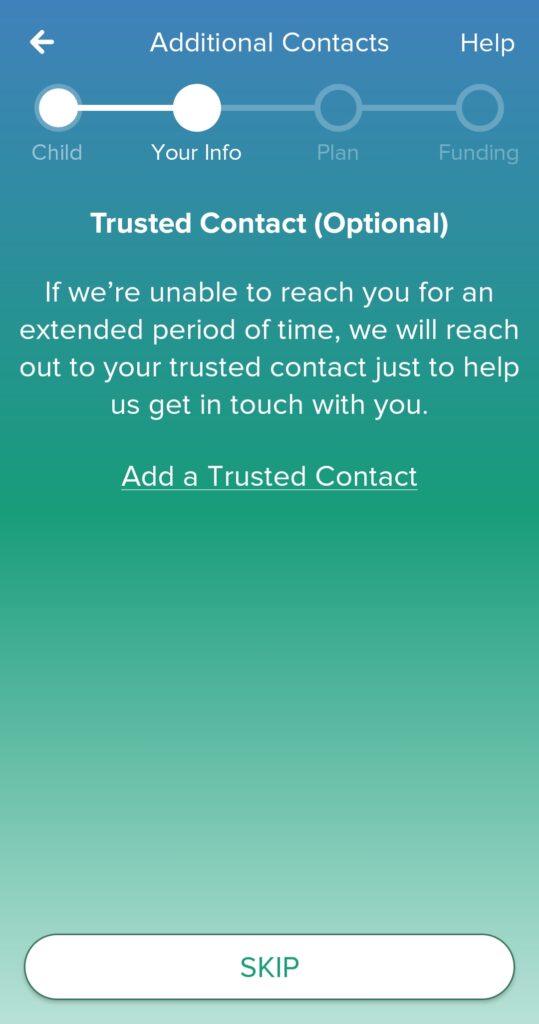

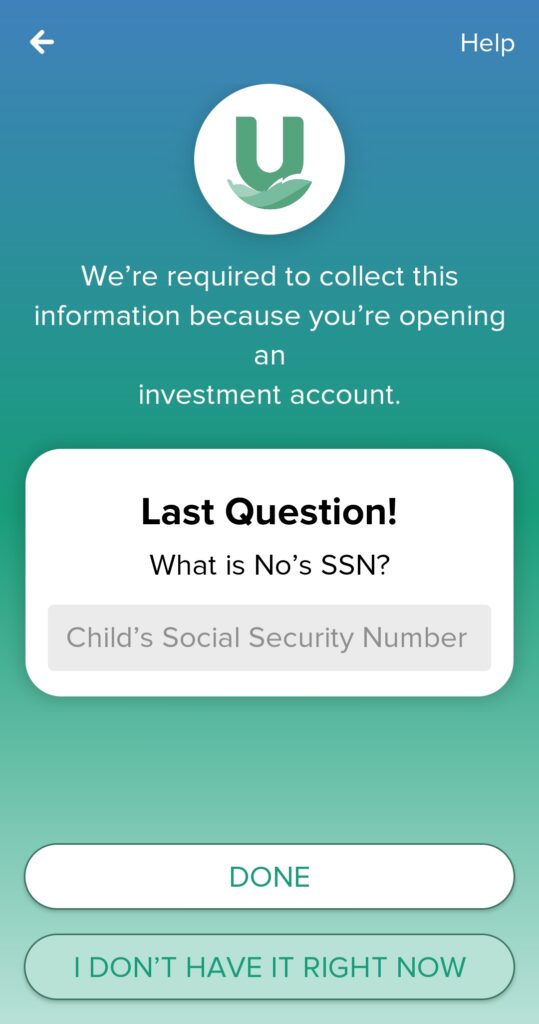

In order to open a UTMA account with Unest you will need to provide some information about both yourself as the custodian and the child you want to be the beneficiary of the account. You will need to enter the social security numbers of both the custodian and the child. You will also need to enter how much and how often you want to invest money into the account.

Disclaimer: I am not any sort of investment or financial professional giving any sort of legal advice. I am just some guy trying to teach other people about how they might navigate the financial world.