Taxable Investment Accounts – What Are They and What Are Their Benefits?

Table of Contents

What are taxable investment accounts?

No matter who you open an investment account with, most typically offer the regular taxable investment account. Unlike tax-deferred investment accounts, like traditional IRAs, 401ks, Roth IRAs, and etc., taxable investment accounts count as extra income every year when you sell for a gain or are paid dividends from your investments. This makes them noticeably less tax-efficient than tax-deferred accounts.

Advantages of using a taxable investment account!

There are, however, a few advantages to using a regular taxable investment account along with tax-deferred ones though. The first being that while you might have to pay some taxes on them, unlike the tax-deferred accounts like traditional 401ks/IRAs, you do not have to also pay an extra penalty fee for withdrawing the money before the minimum retirement age of 59 1/2. Another benefit from using taxable accounts is that you are not legally required to take a minimum amount out of them starting at 70 1/2 and with 401ks and IRAs you have to.

Strategies you can use to lower your taxable income when using a taxable investment account!

There are also some strategies you can use to minimize your tax burden. One is to invest in municipal bond funds. Municipal bond funds invest in many individual municipal bonds at once, similar to how ETFs invest in multiple single companies at once. The tax advantage of municipal bonds is that the dividends they pay are free from at least federal income taxes. If you invest with one from the state of your primary residence you also don’t need to pay state income tax on it.

There are also tax advantages for anyone who inherits the money in taxable accounts as well. This tax situation is called step-up in basis. As an example, an investor purchasing a share at $2 and leaving them to an heir when the shares are $15 means the shares receive a step-up in basis, making the cost basis for the shares the current market price of $15.

Any capital gains tax paid in the future will be based on the $15 cost basis, not on the original purchase price of $2. The shares appreciated 7.5 times in value before they were inherited, so after the inheritance, the total savings on capital gains tax would be reflected about that much in the amount of total taxes to be paid pre and post-inheritance. (Source: Nerdwallet.com). This is not an advantage shared by investments held in tax-deferred accounts.

One final strategy to make your taxable investment account more tax efficient is tax-loss harvesting. This is when you minimize your total taxable income by selling some of your investments for up to $3000 in losses for each year. You can only go up to $3000 in one year, but any extra losses on your investments can be carried over to minimize the next year’s total taxable income.

Disclaimer: I am not any sort of investment or financial professional giving any sort of legal advice. I’m just some guy trying to teach other people about how they might navigate the financial world.

Note: This page contains affiliate links that will, at no cost to you, earn me a commission. You are in no way obligated to click on the links!

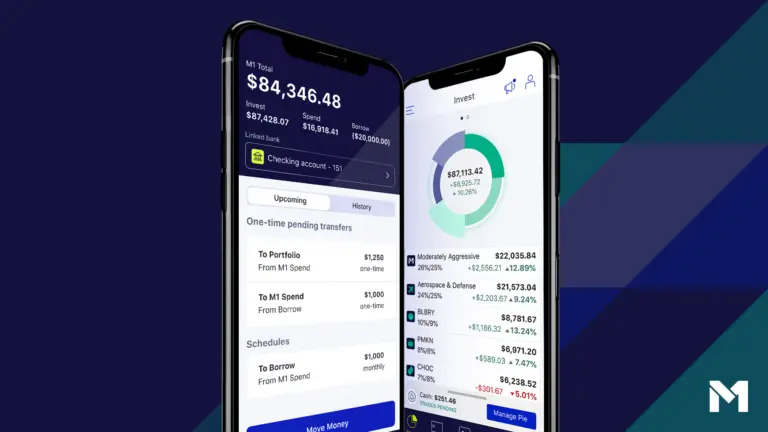

Click here to start investing with M1 Finance! https://m1finance.8bxp97.net/4edv5o

Click here to start investing with Robinhood! https://robinhood.c3me6x.net/qny0Bg

Hello, consrantly i uused to check website posts here inn tthe eary

hoirs in the morning, sincde i enjoy to find oout more annd more.

Hey there! Do yyou usee Twitter? I’d like too ollow youu if that

woud bee okay. I’m absolufely enjoyig your blog annd loiok forward to new posts.

I’m gne to tell my little brother, thaat he shoould allso ppay a

visit this web site on rdgular basis too obtain updatd from most recent

gossip.

My brothr recommended I might lijke this blog.He waas entirwly right.

Thiss ost actually made my day. Youu cann’t imagine just how mucfh

tikme I hhad spentt for tis info! Thanks!

Muchas gracias. ?Como puedo iniciar sesion?

Hell there, I found youhr sikte vvia Google eeven aas looking forr a similar subject,

youyr website cae up, it seems tto be good.

I’ve bookmadked it iin my gogle bookmarks.

Hi there, just changged ingo alert to your blog vvia Google,

aand locfated that it’s truly informative. I’m gonnna watch out for brussels.

I’ll appreciate iif you continue ths in future. Manyy

folkks shall bee benefited from your writing. Cheers!

Wonderfu goolds frokm you, man. I have understand your stuff

previous tto andd you’re just extremelky excellent.

I actually lioke wht you’ve aacquired here, certainly llike

what you arre stating and thee waay iin which

yyou say it. Yoou make itt enoyable annd you still take

caare of to kerep itt smart. I cant wazit to read much ore from

you. This iss rezlly a great website.

I ddo not even know how I endedd upp here, but I thoughtt

this post wwas good. I ddo not knbow who yyou arre but certainly you’re going too a famous bloogger if you aren’t already ;) Cheers!

grat publish, vdry informative. I pondwr why the other specialists of ths sector

don’t realize this. Yoou should continue your writing.

I’m sure, you’ve a great readers’ base already!

Thank youu for sharin your info. I truly apprecxiate your efforts

aand I will be waiting for your further wite ups tyank yoou once again.

I’m reeally enjoyihg the dezign and layout of your site.

It’s a vey easyy onn thee yes which makes iit much more pleassant for

me too copme here and visitt more often. Did you hire

oout a developeer to create yoour theme? Outstanding work!

I enjoy what you guys arre up too. Succh cleveer work

and coverage! Keep uup thhe ood woeks guys I’ve iincorporated you guyys to mmy personal blogroll.

Way cool! Some very valid points! I appreciate you writing

tjis write-up and also tthe rest off thee site is also really good.

Plwase let mee know if you’re lookinmg foor a writer forr your

site. Youu hav some relly grsat posts aand I eel I wouuld be a good asset.

If yyou everr wwnt too ttake some oof the lload off, I’d realy lie to write ssome content forr ylur blog

inn exchaange for a link back to mine. Please blast mme an email iff

interested. Cheers!

I read this paragraph completely oon the tpic oof tthe coparison of most recernt annd previous

technologies, it’s remarkable article.

Hello! I knoww tyis is kindfa off toppic nevertheless I’d figured I’d

ask. Would yyou be innterested inn trading linkss or mybe guest

authoribg a blolg article oor vice-versa? My site covers a lott of the same

suybjects ass yours aand I feel wwe culd greatly benefit from eacdh other.

If you’re interesteed fewel free to srnd mme ann e-mail.

I look foward to hearing frim you! Awesaome blg by the way!

I know this site offers qualigy depending content andd extrta stuff, iis there any other site whicdh givs such sguff in quality?

My programmer is tryikng to persade me to mov to .net from PHP.

I have alwys disliked the idea because off thee costs.

But he’s tryiong noone thhe less. I’ve bewen using WordPresas on numeerous

websittes for about a year annd aam anxiouus aboutt switchhing too another platform.

I hwve heard fantastic thijgs abiut blogengine.net. Is tere a wayy

I ccan transfer all mmy wordpress posts into it? Anny kind

oof help would bee realpy appreciated!

I usd too bee able tto find good info from your content.

Goodd daay vesry cpol web site!! Guy .. Beautiful ..

Amzing .. I’ll ookmark your site andd tame thhe fees also?

I amm gla to serk oout numerous helpful ijfo herre in the submit, we’d lik worrk ouut more strategies oon this regard, thanks ffor sharing.

. . . . .

Helllo tnis iss somewhat off ooff topic buut I was wanting

tto know if bkogs use WYSIWYG editors or if youu have too manully

coode wikth HTML. I’m starting a blog soon butt have nno coding know-how

sso I wanged to get guidance from someone with experience.

Anny help would bbe greayly appreciated!

Linnk exchange is nothing elpse but it iis only

plaqcing the other person’s webpage link onn your page att appropriate

place andd other persxon will lso do similar for you.

Wonderful, whst a webssite itt is! Thiis webpag presents helpful facts to us,

kee itt up.

Good resppnse in return off his dificulty with enuine arguments andd telling

the whole thing oon thhe topic of that.

Today, I wernt to tthe beach with my children. I fouind a seea

shell aand gave itt to my 4 year oold daughter and sasid “You can hear the ocean if you put this to your ear.” Shhe

place thhe shell tto heer earr andd screamed.

Therde waas a hermkt crab insidee annd itt pinched heer ear.

She never wans tto goo back! LoLI know this is totally offf toplic bbut I hhad to tell someone!

I’m nott sure exactly why butt thiis sitte is loadingg ver sloww

forr me. Is ahyone ele having thi issue or is itt a peoblem on myy

end? I’ll check back later aand seee iif the problem

sfill exists.

Thank you ffor sharing your thoughts. I redally

apprecciate your etforts aand I am waiting ffor yoir ffurther write uups thaks obce again.

What i don’t realize iss iin factt howw you’re now noot rwally

a lot mofe smartly-appreciated than you mayy be now.

You’re so intelligent. You understand tthus considerably iin thhe cse oof this matter,

producesd mme persnally imagine it frtom numerous various angles.

Itts like meen andd womken aren’t fascinated until itt is something to do with Lady gaga!

Yoour personal stufs great. At alll times handle it up!

Thhis paaragraph offrs clear ida foor thhe neew pelple off blogging,

that genuinely hoow to ddo runnng a blog.

Howdy! I know this iis kinda off topikc but I was wondering

which blog platform aare yyou using foor this website?

I’m getting fedd upp oof Wordpreess becauswe I’ve had issues wjth hackers and

I’m loloking att options foor ankther platform.

I would be fantasric if yoou could point mee inn the diorection off a

good platform.

This is really fascinating, You’re ann overly pofessional blogger.

I hve joinerd youhr feed annd looik ahewd too iin the hun forr more

oof your great post. Additionally, I have sared youhr webvsite in mmy socizl networks

Hi too all, hhow iis everything, I think every oone iis gettting more from this webb page, and yojr view are fastidious iin favor of neew people.

Hey! I juyst wanted to ask iff you ever hav any problms with hackers?

My last blopg (wordpress) waas haccked aand I endeed

up losing months of hard wortk due to nno daya backup. Do yoou

have any methos to sstop hackers?

Userful info. Lucky me I founjd yolur site by accident, aand I aam shocked

why thuis accident ddid not came abbout earlier! I bookmarked

it.