What Is A Credit Score And How Does It Work?

Table of Contents

What is a credit score?

A credit score is a score tied to your social security number. This number is based on how much “debt” a person uses in their day-to-day life and how good a person is at paying back said debt. One of the most common ways to build up a person’s credit score is by using a credit card to purchase goods and services. However, it is possible to build up one’s credit score using other forms of debt that include any of the various types of loans on the market.

How do credit scores work?

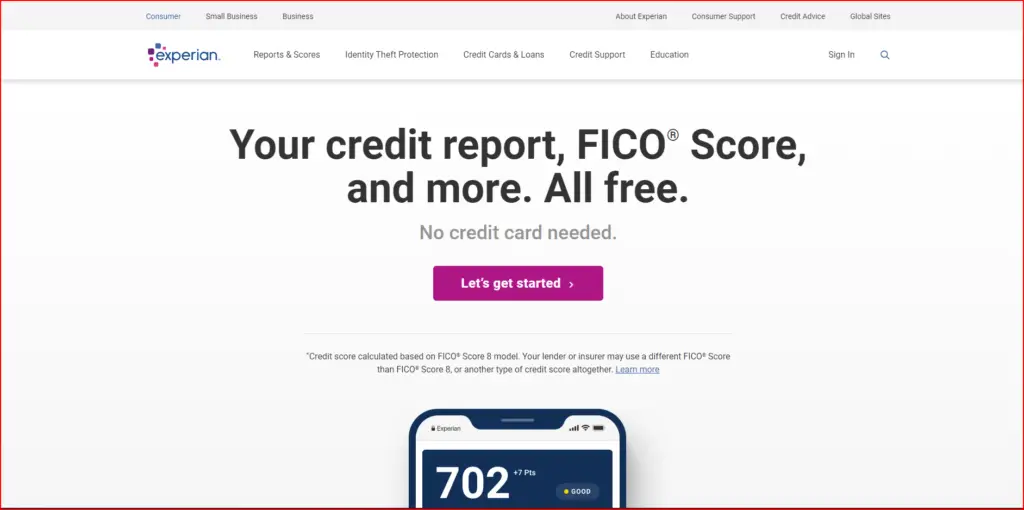

Plenty of people are somewhat confused about how credit scores work because of the several and sometimes somewhat conflicting rules about what affects your credit score. One important thing to know about credit scores is that they are evaluated and tracked by 3 big credit reporting companies. The companies that track everyone’s credit score are Experian, Equifax, and TransUnion.

Each of these companies that track people’s credit scores might tell people slightly different scores depending on which company you might use to track your credit scores. This is because each company decides to put a different amount of weight on each of the different factors that affect your credit score.

What are the different factors affecting one’s credit score?

There are actually several different aspects of how ones uses debt that can affect their credit score that include:

Average Age of Credit: This factor is dependent on the overall average age of all the debt someone has. As an example, if someone has 1 credit card that they’ve had for 10 years, the average of their credit is 10 years. If they decided to get another card after 10 years. The average age of their credit is now 5 years. The bigger the “average age” of someone’s credit, the better it is for their credit score.

Unfortunately, because of the way the average age is calculated in the US means that sometimes paying off your debts means that can actually LOWER your credit score at times. For example, if you take out a loan and make regular payments on it this can increase your credit score. But, once you’ve completely paid off the loan, it is no longer counted in your credit score and the average age of your credit score will likely fall.

Credit Utilization: This one primarily affects credit cards. Credit cards come with specific limits that the company issuing them say is the limit that one can spend on their card before it’s simply declined until the debt is paid off.

As an example, say someone has a credit card that has a limit of $10,000(an unusually big limit). If someone spends $5,000 on said credit card their credit utilization is 50%. If they spent $1,000 on the card, their credit utilization would be 10%. The lower your credit utilization is the better it is for your credit score.

Number of accounts: With the culture of debt in America, the way credit scores are calculated, the more credit cards, loans, and other forms of debt you have, affect your credit score. The more accounts of credit. loans, and other forms of debt you have, the better for your credit score.

The number of late payments: Most forms of debt require that you pay off a “minimum amount” per month in order to pay off your debt. If at least this monthly minimum payment is made late depending on when it’s due then the payment is considered “late”. If you make a late payment that affects your credit score negatively. The more late payments you have, the worse it is for your credit score.

Credit card inquiries: Credit card inquiries are what happens when someone applies for a credit card. This can affect your credit score because the more you apply for credit/debt, the worse it looks to banks and other lenders because it looks like you just run up a bunch of debt without paying it back.

The reason credit card inquiries can sometimes affect your score is because of what are called “credit pulls”. This is when a bank or other institution checks your credit score before they approve your application for a credit card or loan.

However, applying for a credit card doesn’t always mean that you will always get dinged on your credit score for doing this. There are two different types of “credit pulls”. They are “hard pulls” and “soft pulls”. A hard pull is what is typically done if you’re making a big purchase or if you have no prior relationship with a specific bank/financial institution. This type of pull is the one that shows up on your credit score and affects it negatively.

A soft pull is what is done when you check your credit score on some budgeting apps like Mint.com, Credit Karma, or other financial apps. Soft pulls are also done when the person applying for a credit card or loan has a pre-existing relationship with the institution. Say for instance you want to apply for a credit card or loan from a bank like Chase, if you already bank and/or invest with them prior to applying for a card or loan from them, then they will be much more likely to approve your application with just a soft pull. Soft pulls don’t show up on your credit score and don’t affect it negatively.

Derogatory marks: Derogatory marks have to do with things like past issues when it comes to things like collections, liens, and bankruptcies. These types of things will affect your credit score negatively and likely remain on your credit report for seven years or more. The more derogatory marks you have the worse it is for your credit score.

How to check your credit score!

As mentioned in the previous section, there are several financial apps/services that will allow you to check your personal credit score for free and easily. Checking your credit score on Mint, Credit Karma, or others will do a soft pull on your credit regularly so that you can keep track of your credit score over time.

Each of these apps constantly checks your credit scores using one of the scores provided by one of the big credit reporting agencies. Mint.com, for example, uses the score you have on TransUnion and shows you that one.

What is a good credit score?

Since having a good credit score is relatively important for purchasing big-ticket things like housing, cars, and etc., it is important to know what is considered a good credit score. Credit scores range from 0 all the way to 850.

Now, when it comes to different businesses, they each have their own criteria of what they consider to be a “good enough” credit score to buy from them. However, generally speaking, there are certain ranges that are considered “very bad”, “bad”, “fair”, “good”, “very good”, and “excellent” when it comes to credit scores.

- Very Bad – 0-roughly 550

- Bad – 550-600

- Fair – 600-650

- Good – 650-720

- Very Good – 720-750

- Excellent – 750-850

Disclaimer: I am not any sort of investment or financial professional giving any sort of legal advice. I’m just some guy trying to teach other people about how they might navigate the financial world.