Mainvest – How To Invest In Small Businesses!

Table of Contents

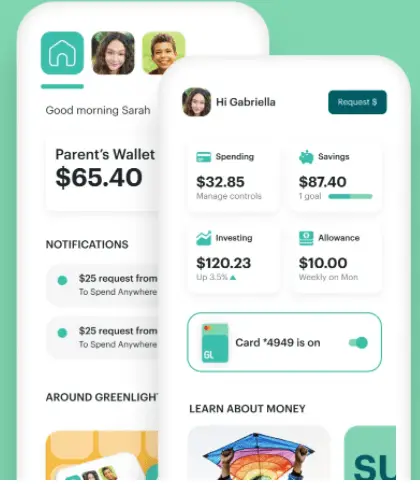

What is Mainvest!

Mainvest is an investment brokerage company that instead of focusing on the regular stock market or real estate like most brokerages nowadays, instead allows people to invest directly into small businesses and share in their profits. Their returns are supposed to be about 10-25% on average with returns as little as $100.

How does Mainvest work?

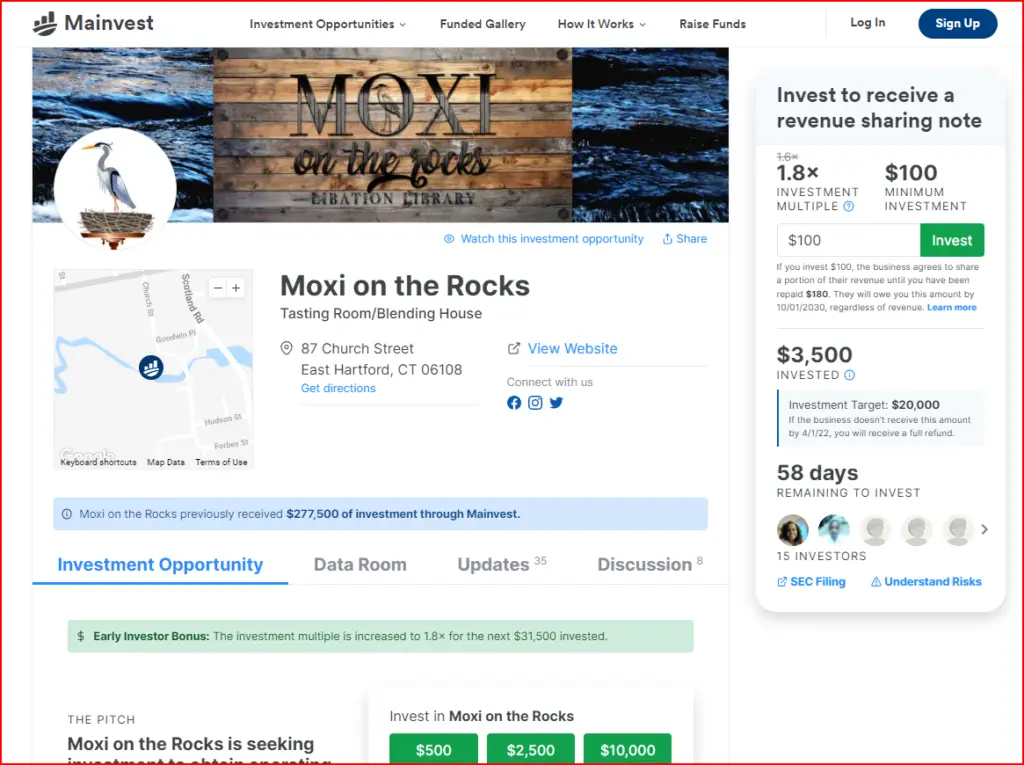

On Mainvest, investors can discover hundreds of small businesses that they can choose to invest in. You can get started investing with them with as little as $100. Once you invest in a business investors get access to “revenue sharing notes” as opposed to regular interest-based returns like with stocks, bonds, or real estate.

The faster businesses grow the stronger investor’s returns. Local economies become more resilient. Instead of an interest rate, the revenue sharing note has an investment multiple. This is the amount owed to investors, no later than the maturity date.

The rate of return is determined by the business’s gross revenue and the percentage of revenue they share each quarter. Investors receive a greater percentage of the business’s revenue by investing more.

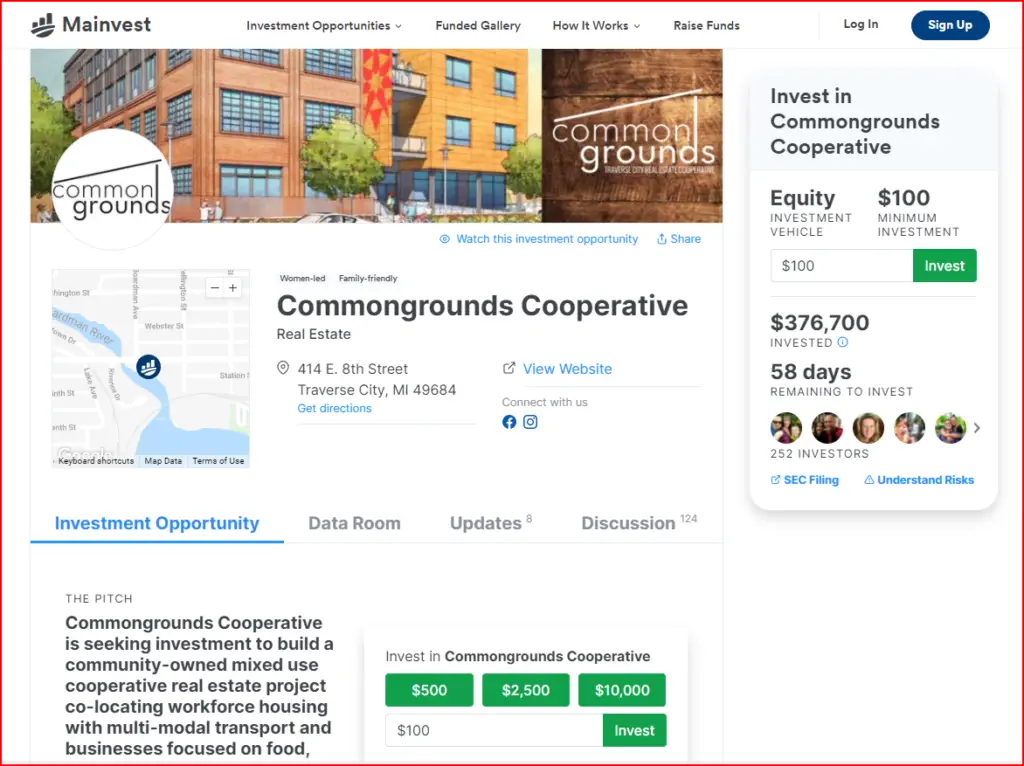

On their platform, you can see all of the individual companies available to invest in. You can see a significant amount of details about each individual company. You can see the amount invested, the company website, a summary of what the company is all about, some details about the staff working at said company, and most importantly the company’s financial info.

Interestingly enough, each company also has a “Discussion” section where current or potential investors are free to ask someone working there questions about the company.

Is Mainvest safe to invest in?

Considering that Mainvest is not like the typical investment options it would be entirely understandable if people were a little bit more wary of investing with them. After all, plenty of small businesses tend to fail before they ever become profitable.

However, in order to become public on Mainvest, companies have to follow a few rules. Before being listed publicly on Mainvest, a business must raise at least $10,000 from 10 people they know personally. To date, this thesis has led to a 96%+ repayment rate across the platform.

Mainvest also performs several checks on a business in order for them to be allowed on its platform. They perform anti-fraud vetting, responsibility checks, bad actor checks, yellow flag BACs, and they do continuous reviews on every company.

That said, “ALL TYPES OF INVESTMENTS COME WITH INHERENT RISK”.

How does Mainvest work for companies?

If someone knows of a small business that could use some extra funding Mainvest has a referral program where the one referring a company could receive up to $5,000 when a business starts a campaign on Mainvest.

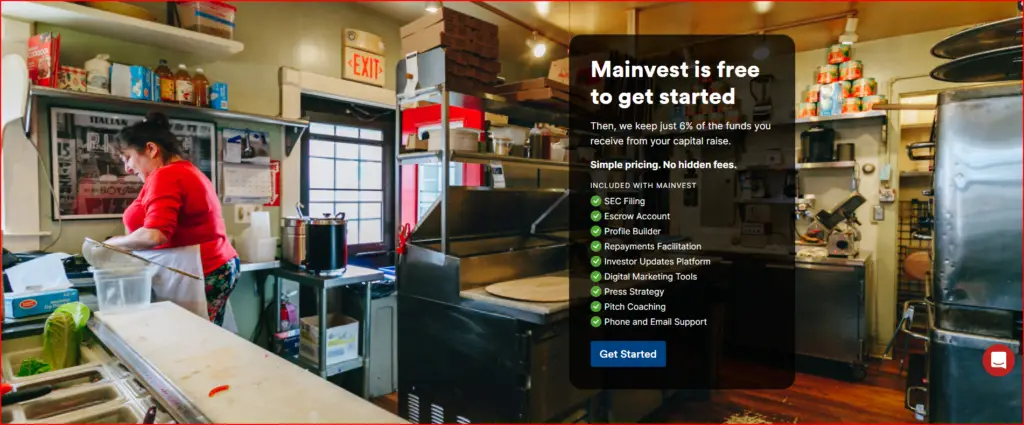

It is 100% free for any business to get started on their platform. Instead, they will keep 6% of the funds raised by any businesses’ campaign. When working with them, they will provide a myriad of legal services for you at no extra cost.

How are Mainvest investments taxed?

[slm_content_lock]

These investments are not taxed like regular stocks or bonds. They are taxed like interest earned from savings accounts. That means that they are taxed at regular income tax rates for federal taxes and the taxes for the state that is your primary residency.

[/slm_content_lock]

Note: This page contains affiliate links that will, at no cost to you, earn me a commission. You are in no way obligated to click on the links!

Disclaimer: I am not any sort of investment or financial professional giving any sort of legal advice. I’m just some guy trying to teach other people about how they might navigate the financial world.