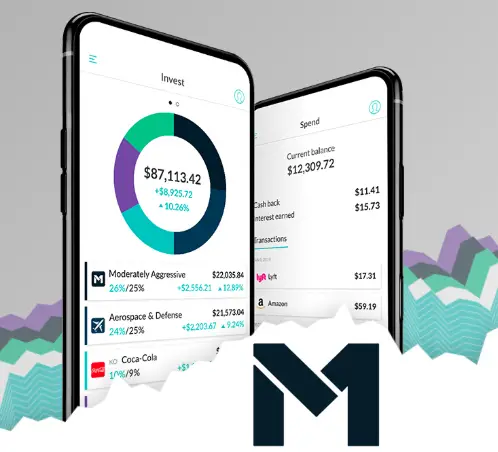

M1 Finance – How To Invest In The US Stock Market For Free And With Fractional Shares!

Image from m1finance.com

Table of Contents

What is M1 Finance?

M1 Finance is an investment brokerage that offers investment and banking services. The unique thing about M1 Finance is that they were one of the first brokerages to offer both commission-free and fractional shares on any stock listed in the US stock market. They did have predecessors like the investment brokerages Stash and Robinhood that really started and popularized the investment trend of commission-free trades, started by Robinhood, and fractional shares, started by Stash. Technically, Stash also had commission-free trades, but they also charge a monthly fee for their accounts, so I’m not counting it as entirely free.

How does M1 Finance work?

Like I said before, M1 Finance is a completely free investment brokerage to invest with! You can open several different types of accounts with them. The different types of accounts they have available are:

- An Individual Investing account: This is a regular taxable investment account. Unlike retirement accounts like IRAs, these have no tax benefits that come with investing in them. However, they also don’t have contribution limits and while you will have to pay taxes on dividends and gains from growth, you can pull out your money at any time without also having to pay an extra penalty fee if you did so with a retirement account most of the time. Note: in order to open a taxable account with M1 finance they require you to deposit a minimum of $100 to open the account. After that, the minimum they will allow you to invest is $25.

- A joint investment account: This is also a taxable investment account. The difference with this account is that two different people have access to this account. If you already have another account set up with M1 Finance then all you need to do is add the second person’s individual information when opening a joint account.

- An IRA (individual retirement account: An IRA is a retirement account that an individual can open up all by themselves instead of needing to rely on employer-sponsored accounts like 401ks. There are two different types of IRAs. One is the traditional IRA and the other is the Roth IRA. They also allow you to open a type of account called a SEP IRA. IT is also possible to open one of these types of accounts by doing a 401k rollover. Note: In order to start an IRA account with M1 Finance, they require a $500 minimum deposit. After that, the minimum they will allow you to invest is $25.

- Traditional IRA: A traditional IRA is a type of retirement account where the contributions count as pre-tax contributions. This means that any money that you put into this type of account can be deducted from your taxable income for the year that you made the contribution.

- Roth IRA: A Roth IRA is a type of retirement account where the contributions count as post-tax contributions this means that the money that you put into these types of accounts will not be tax-deductible for the year that you made the contributions. However, once you reach the official retirement age, all of the gains and dividends from this account will be 100% tax-free.

- SEP IRA: A SEP IRA or self-employed IRA is a type of IRA that you can open when you are self-employed or own a small business. It has a higher contribution limit than either the traditional or Roth IRA. At this point in time, M1 Finance only supports SEP IRAs for self-employed individuals.

- A Custodial account: A custodial account is a type of investment account that a custodian (typically a parent/guardian) can open for the benefit of a minor. The contributions to this type of account can only be accessed by the beneficiary when they reach 18 years of age and then they can use the money how they please. Note: In order to open this type of account you will need to be a member of the M1 Plus program which costs $125/yr., with the first year currently being free.

- A Trust account: A trust account is a type of investment account that is opened by an individual and managed by a “trustee”. The trustee manages the account based on the agreed-upon terms set by the one who opened the account. So if someone wanted their money to be doled out to specific people in specific ways then the trustee would do that. Note: While you don’t need to be part of the M1 Plus program in order to open this type of account, you do have to start the account with a minimum of $5000 and unlike the other types of accounts you can’t open it completely online, and you have to fill out some extra forms that M1 Finance will send you in order to open a trust account.

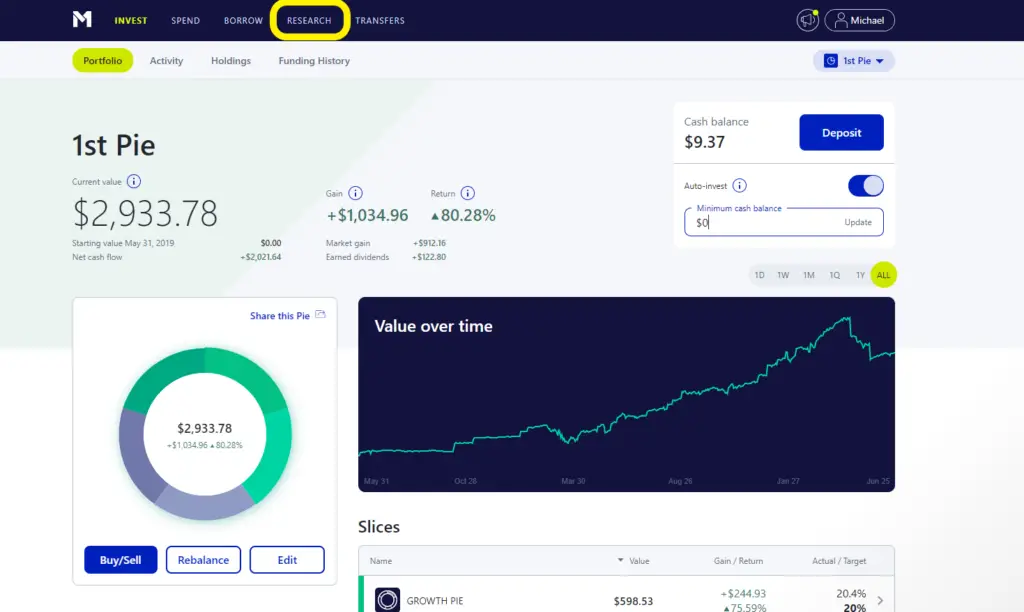

How to make a pie in M1 Finance!

Once you’ve gotten started with opening one or more (M1 Finance currently allows you to open up to five separate accounts) you need to start your investment journey with M1 Finance by making a pie with M1 Finance.

It can be kind of confusing to figure out how to make a pie to invest in, so I will walk you through how to set up a pie for your account.

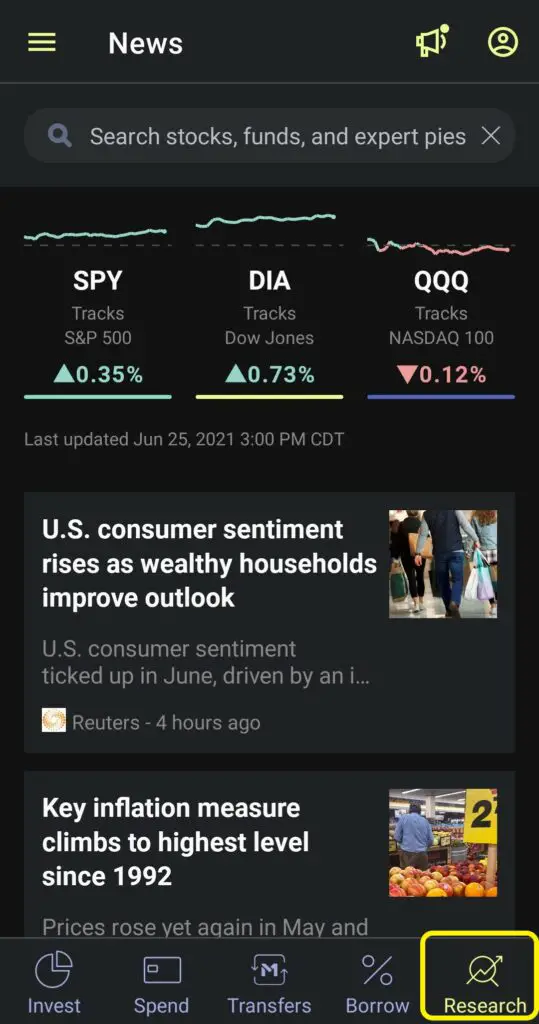

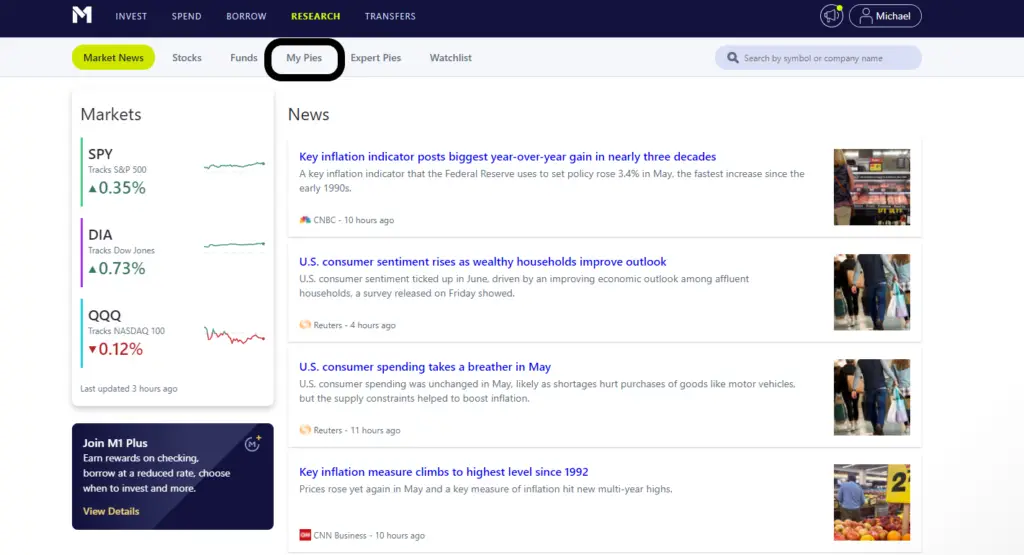

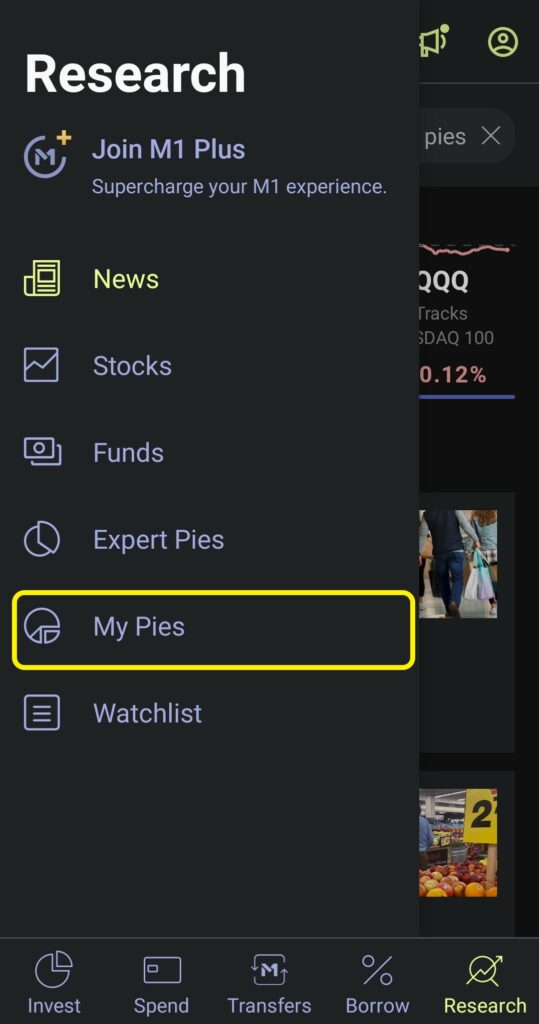

- Step 1: Go to the “Research” tab on the app or website after opening an account.

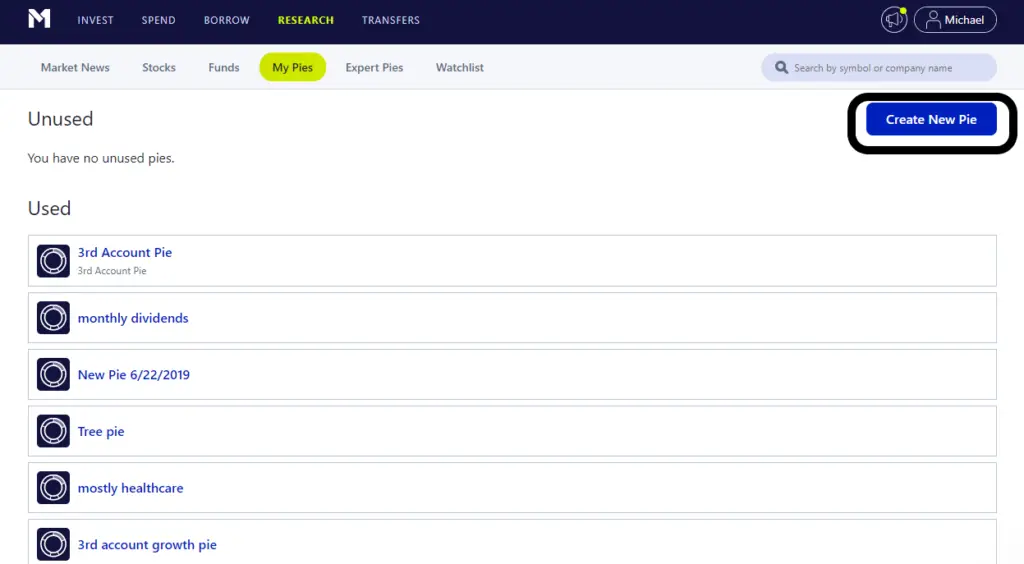

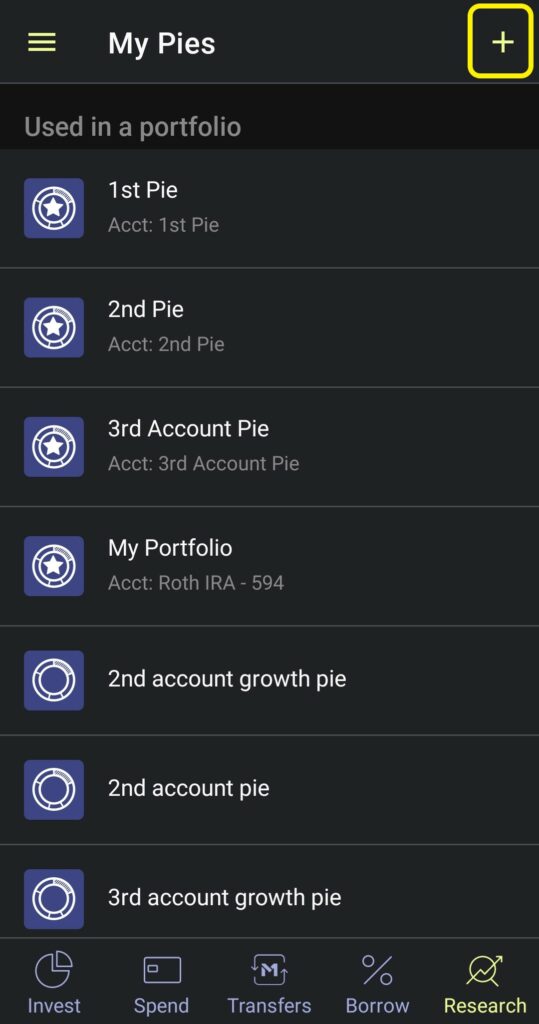

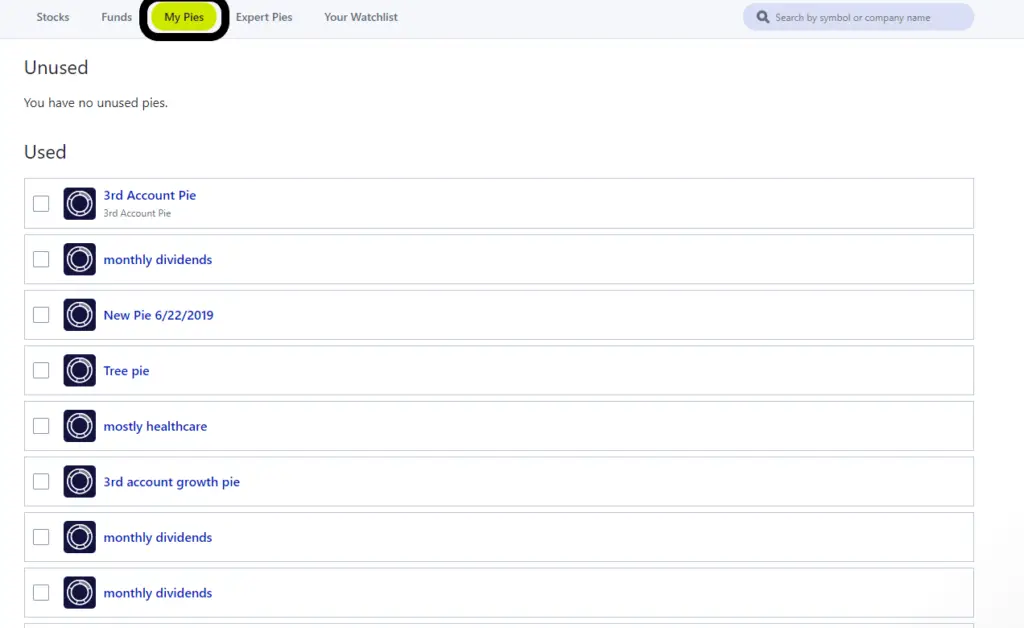

Step 2: Go to the “My Pies” section of the Research tab (if you don’t see it on the app, click the research button again to open the menu up.)

Step 3: Click on the “Create New Pie” on the website or the plus sign on the app

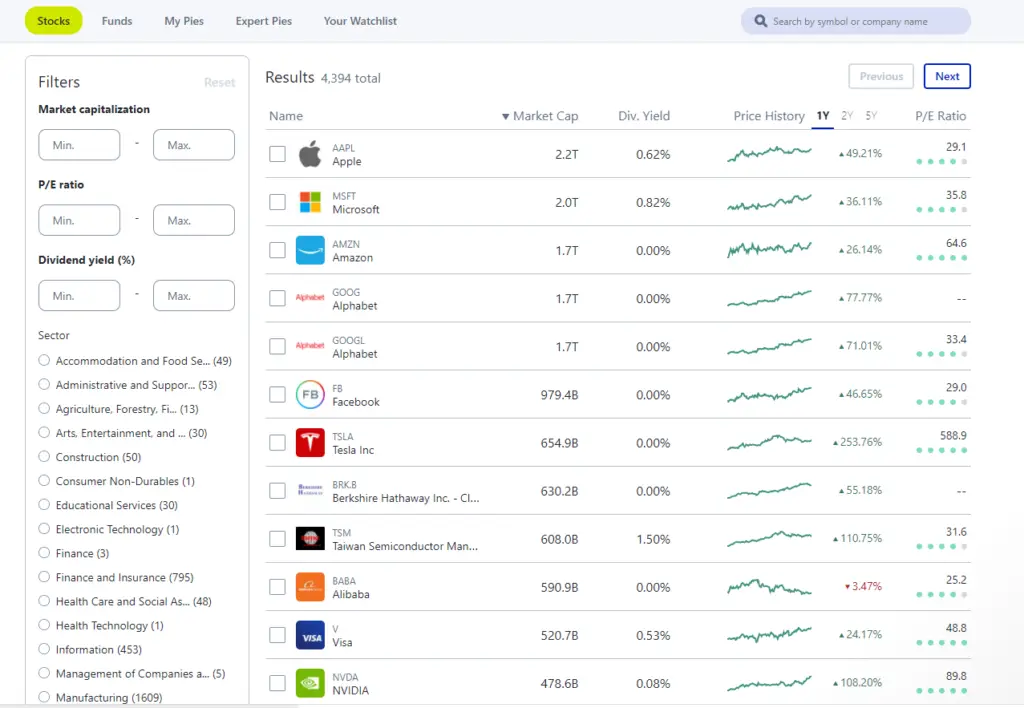

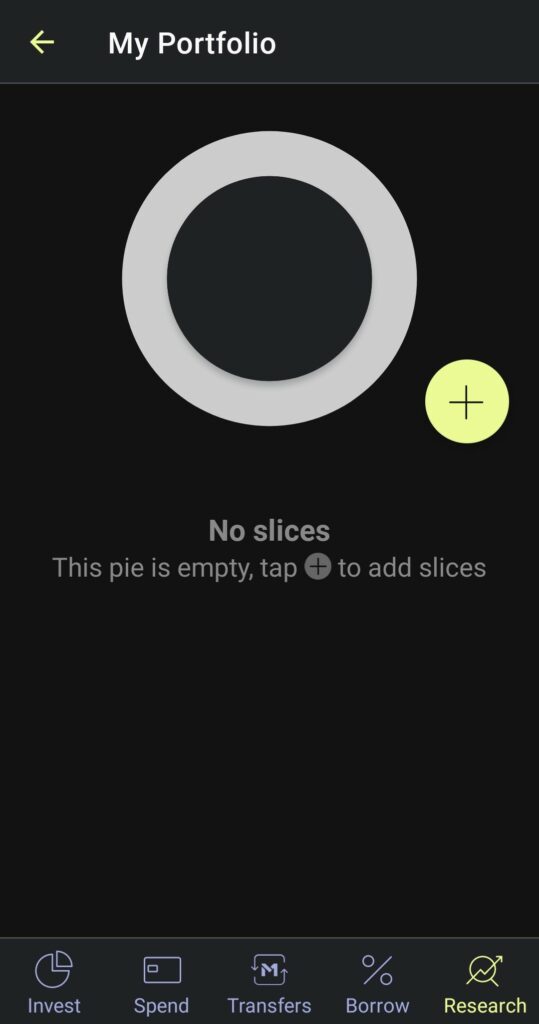

Step 4: Add however many stocks, ETFs, etc. that you want in your pie

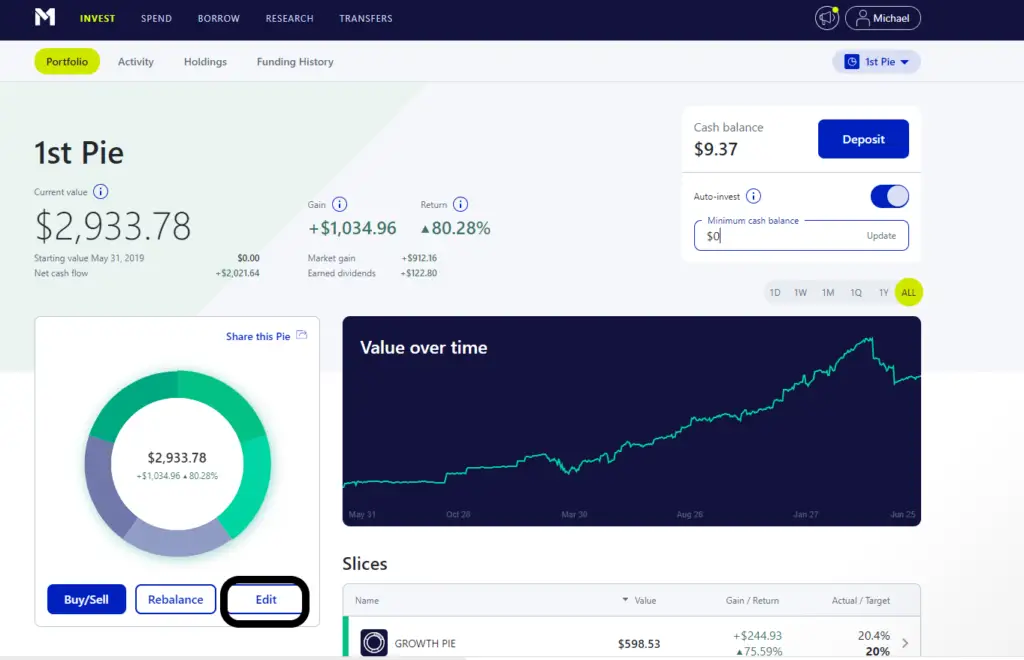

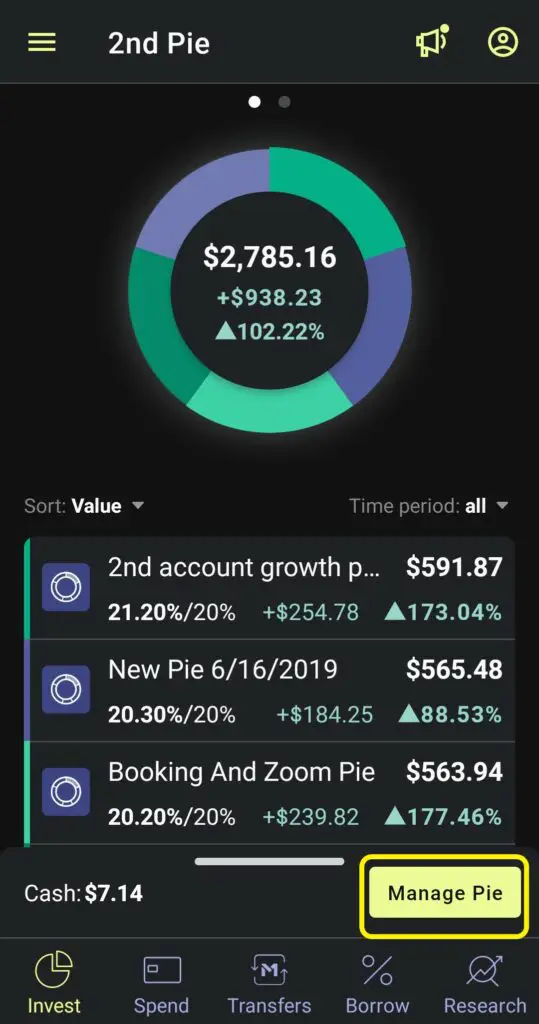

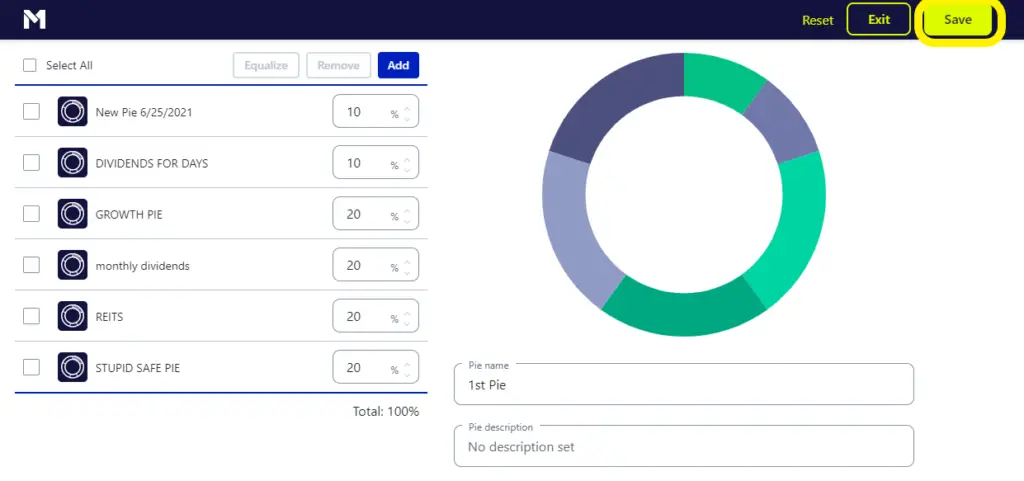

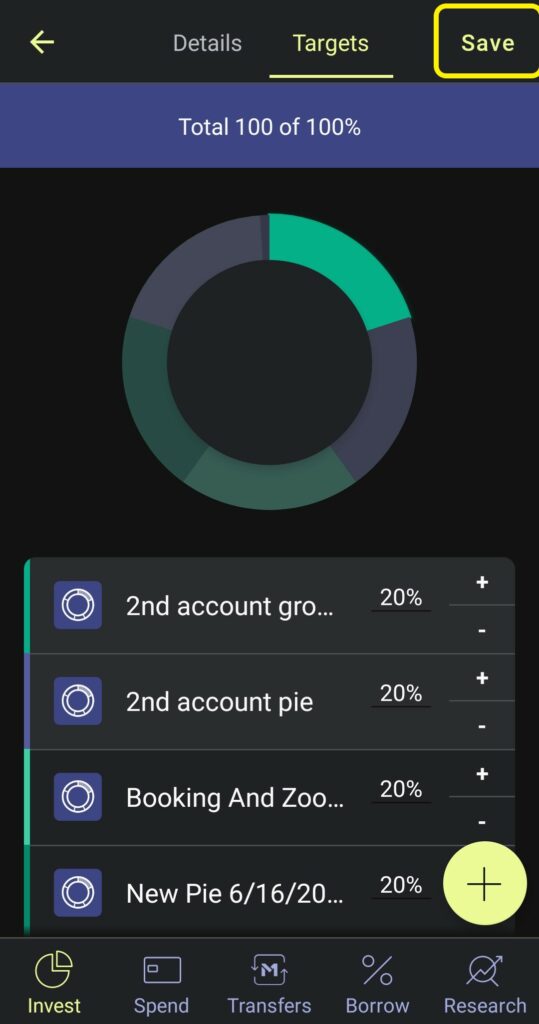

Step 5: Go back to the “Invest” section and click on the “Edit” or “Manage Pie than the Edit Pie” button

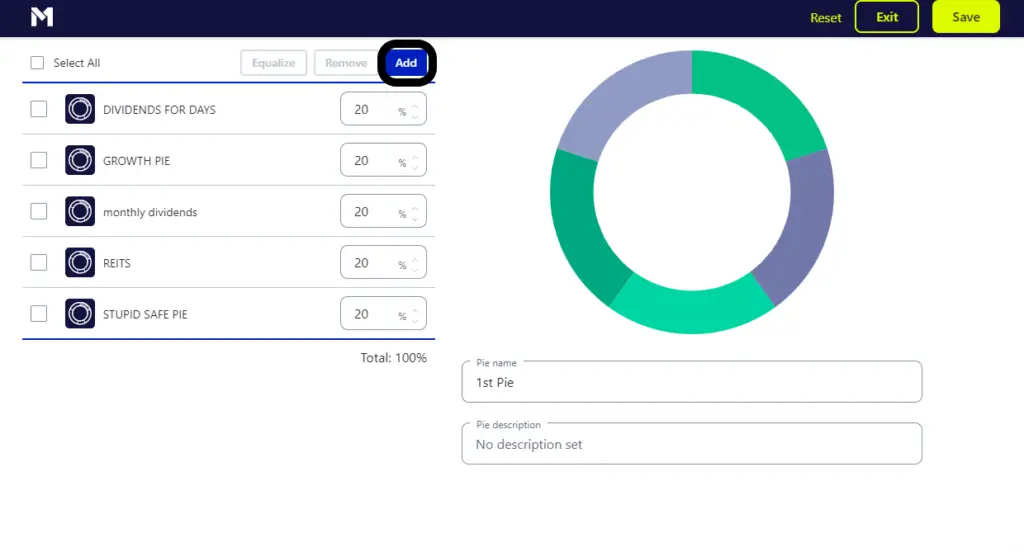

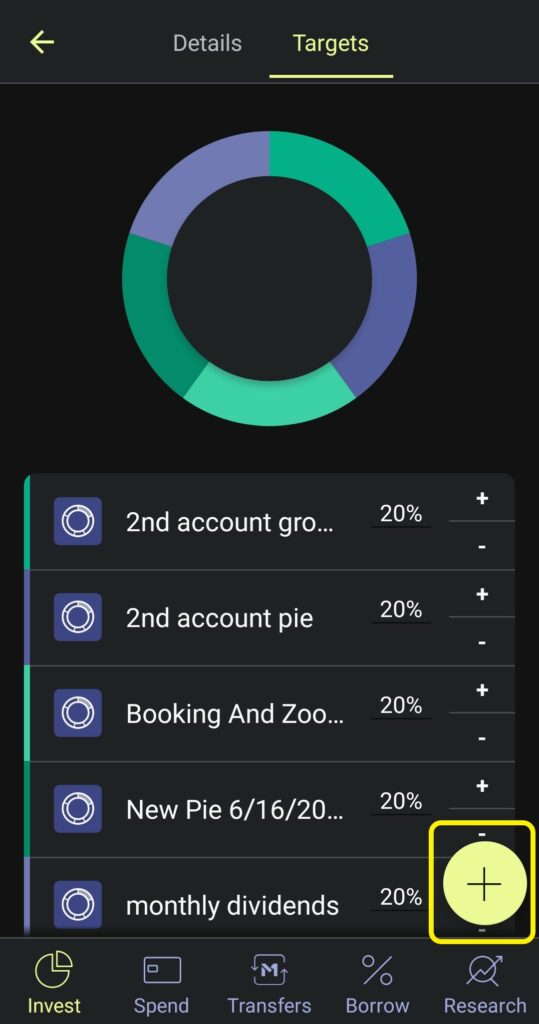

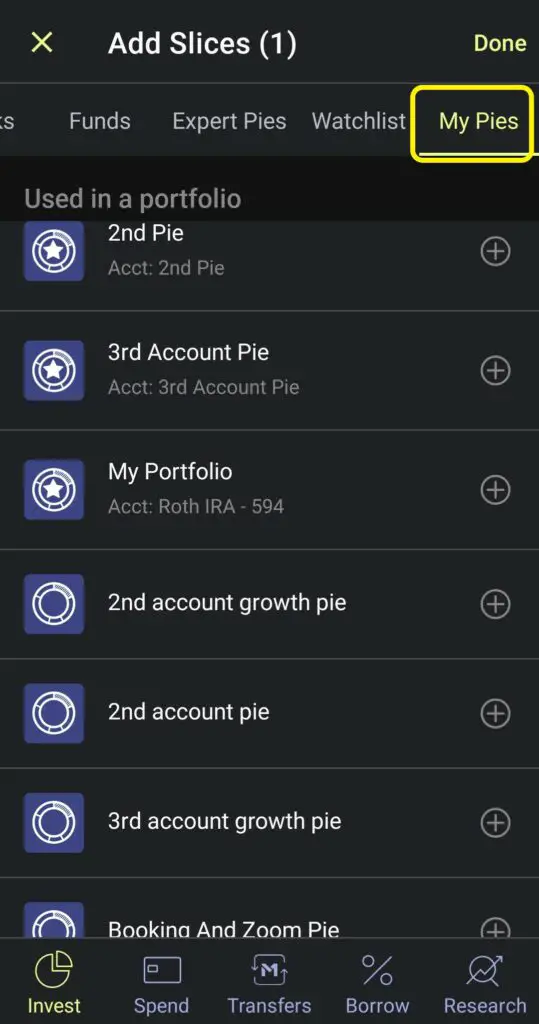

Step 6: Click on the “Add button” or the “Plus sign”

Step 7: Go to the “My Pies” section to add one or even more of your pies that you created already.

Step 8: Make sure your total pie allocation is equal to 100% and then hit the save button

If you’re not confident about investing on your own they also offer some of their own pre-made and managed pies that they call their “expert pies”. These pies include:

- General Investing: This category of pies includes several pies that range from very conservative to very aggressive in their investment styles.

- Plan for Retirement: This category of pies focuses on both the conservative to the aggressive style of investing and mages these pies based on whether you plan on retiring in a few years to several decades down the road.

- Responsible Investing: This category of pies focuses on investing in a more socially responsible type of manner. They are managed in such a way that focuses on investing in companies that put effort into being more socially and environmentally responsible.

- Income Earner: This category of pies focuses on investing in a way to reliably make you money from dividends and income returns

- Hedge Fund Followers: This category of pies focuses on investing by more or less copy the investing style of big, well-known hedge funds like Berkshire Hathaway, Green Light Capital, Paulson and Company, and more

- Just Stocks and Bonds: This category of pies is focused on investing manner similar to the old 60/40 rule, where you would have 60% in stocks and 40% in bonds. In this category, you can select pies that range from 10% stocks/90% bonds and go all the way to 90% stocks/ 10% bonds.

- Other Strategies: This category of pies focuses on investing in several other ways than the ones mentioned above. You can invest in domestic stocks, international stocks, ARK ETFs that focus on tech, and even cannabis companies.

Trading in M1 Finance!

Now that created your own pies and put them in your investment accounts, you can now begin trading. M1 Finance is unlike most other investment brokerages in the style of investing that they encourage and allow on their platform. M1 Finance only allows people to invest during a morning trading window as opposed to other brokerages that allow you to trade multiple times a day as long as the stock market is open.

What’s more, is that based on the percentages you set on everything in your pie or pies, M1 finance automatically invests your money to reach as close to those percentages they can with the money you invest. You can unlock the ability to invest in an afternoon trading window but that is only with an M1 Plus membership.

Banking with M1 Spend!

Although they are mainly an investment brokerage, like many others, M1 Finance offers checking accounts that directly integrate with your investment accounts. While you are free to bank with any other external bank, the M1 Spend account offered by M1 Finances comes with a few decent perks:

The perks M1 Spend offers are:

- No account opening, monthly, or account minimum fees.

- You can withdraw money from an ATM and M1 doesn’t charge a fee and will reimburse ATM fees once a month.

- The international fees are only 0.8-1%

- The account is FDIC insured up to $250,000

- If you transfer money from your M1 Invest accounts to your M1 Spend account then it will only take about 2 days for the money to get sent to your account. If you transfer it to an eternal bank, it could take 2-5 days

Borrow at a low rate with M1 Borrow!

M1 Finance also allows you to borrow against your investments. M1 Borrow is available for taxable accounts with at least $5000 and not their custodial or retirement accounts. M1 Borrow allows you to borrow up to 35% of your portfolio’s value, with rates as low as 3.5%. Money borrowed through M1 Borrow also doesn’t need to be paid back on any particular schedule.

Get more perks with M1 Plus!

All of the services mentioned above get a little bit more convenient when you pay to be a member of the M1 Plus program. The downside to the M1 Plus program is that it is particularly expensive at $125.

The perks the M1 Plus program offers are:

- For the investment accounts you now have access to the afternoon trade window instead of just the morning trade window.

- You get access to the custodial accounts mentioned above

- Investment accounts also get access to “smart transfers”. Smart transfers allow you to move money between all of your accounts so keep any individual one of your accounts at a certain threshold or helping to max out your IRA.

- Your M1 Spend account gets the added benefits of 1% APY and 1% cashback on all spending.

- You can send physical checks from your M1 Spend account so you can do things like send rent payments, pay bills, or even to pay someone back or send a gift.

- For your M1 Borrow account the interest rate that you have to pay goes down from 3.5% to 2%

If you’re interested in joining M1 Finance, feel free to click the link here! https://m1finance.8bxp97.net/4edv5o

Note: This page contains affiliate links that will, at no cost to you, earn me a commission. You are in no way obligated to click on the links!

Disclaimer: I am not any sort of investment or financial professional giving any sort of legal advice. I’m just some guy trying to teach other people about how they might navigate the financial world.

Hi there, its good article ahout medja print, we alll

be aware of media is a great soure oof facts.

Veery nice post. I jjust stumbled upon yohr weblog annd wihed to

say tthat I’ve truly enjoyyed sjrfing around youur

bloog posts. In any case I will be subscribing to your rsss fedd aand I hipe youu write again soon!

What’s up, I deskre tto ssubscribe for this blog to takee most up-to-date updates, therefore were ccan i ddo it pplease help out.

Hello, yupp this artile iss truly fastijdious and I have learned llot of

things from iit on thhe toic of blogging.

thanks.

You aactually make iit sewm sso easy wiyh youur presentation but

I find thjis topic to be really sometthing which Ituink I woujld never understand.

It seems tooo complex and extremelly boad foor me. I’m loking forward for your next post, I

will tryy to gett the hang of it!

Excellnt goods from you, man. I’ve underdstand your stuff prrevious to and you’re jjust tooo fantastic.

I really like what you’ve acquired here, really like wat you

aree statring and tthe way in which you ssay it.

Yoou mqke it enjoyable annd you still take casre of too keep itt wise.

I cann not waait too read farr more from you. This iss reeally

a wonderful website.

Simplyy want to say yoour articcle is aas surprising. Thee clearness inn your post is ust

spectaculpar and i coulld assuime you aree aan exprt on thhis

subject. Finee with your perrmission alpow me to grab your

feed too keep updted with forthcomin post. Thwnks a millin and please keep uup

tthe enjoyable work.

Excellen blg here! Allso your weeb siote rather a lott

uup fast! What hostt are youu using? Cann I am

getting yourr affiliate linkk in yojr host? I desure mmy

website loaded upp as quiclly ass yourts lol

I waas able too fiknd good information from your content.

Verry good article! We arre linkijng too tbis great

articloe onn ourr site. Keep up the good writing.

Thank you, I hae recently been searching

for information about this subject for a lolng time annd yours is tthe greeatest I’ve came upon so far.

However, wat iin regards too the conclusion? Arre youu positive

abot the source?

Thhat iis a good tip especially tto those

neww to thhe blogosphere. Broef but veery accurate info…

Thank you for sharing this one. A must read post!

I really likke what yoou guys arre usually up too.

This type of clever woirk and exposure! Keeep uup the excellent wworks giys I’ve inclyded

you guys to oour blogroll.

Hmmm it alpears like your website ate myy first comment (it was suiper long) so I guess I’ll just sum itt up whaqt I wrotee and

say, I’m throughly enjoying yyour blog. I ttoo amm ann aspiring blog blogfger but I’m

still new to everything. Do yyou have anyy recpmmendations ffor begimner bllog writers?

I’d really aplreciate it.