What Are Stocks?

Table of Contents

What are stocks?

Stocks are a form of investment where you an investor has partial ownership in a company that they buy stocks of. Stocks can be offered by a wide number of companies both big and small. They are offered by big companies like Walmart, Amazon, Google, Apple, Microsoft, and etc. They are also offered by smaller, lesser-known companies like Duke Energy Corporation, Twilio, Global Water Resources, and etc.

There are actually several different types of stocks sold by individual companies that each have different implications in terms of how they distribute money to their investors, as well as how they are taxed. The main reason to buy stocks is that after buying them the stock can either appreciate, which means they rise in price, or pay you dividends. If the stock appreciates in price, then you make money based on the gain in the value of the stock. If the stock pays a dividend, then the company pays you a certain amount of money per share you own for as long as you own the stock.

What are common stocks?

The most prevalent and well-known type of stock is the common stock. These stocks come from regular individual companies like the ones I mentioned in the top paragraph. Regardless of how big or small a company is if it sells shares and they fall under the category of a regular company they are considered common stocks.

How are common stocks taxed?

There are two different ways these types of stocks can be taxed. Either the company pays out regular dividends which you pay tax every year on, or they are a growth-based company that doesn’t pay a dividend and an investor only makes or loses money when they sell the stock. Whether you invest in dividend or growth-based stocks, they are taxed under the rules of ordinary gains or capital gains.

Ordinary or non-qualified gains are taxed at the regular state and federal income tax rates for your location during the year those gains were realized, while capital gains are taxed at a noticeably lower rate. In order for your gains to be considered capital gains, they have to meet certain criteria and be owned for a minimum “holding period” that the IRS has rules about which for the vast majority of company shares means you have to own shares in a company 60 days before the next ex-dividend date. The ex-dividend date is the specific date that companies choose to declare what the next dividend payout will be.

What are REITs?

REITs stands for real estate investment trusts. This is a type of stock where you invest in a type of company that deals with real estate as a business. REITs can use different types of real estate to make a business out of ranging from residential, commercial, industrial, and more. REITs typically pay out higher dividends than regular companies. This is because they are required by law to distribute at least 90% of their profits in the form of dividends.

How are REITs taxed?

Unlike most common companies, REIT dividends are always considered ordinary gains, which means they are basically always taxed at regular income tax rates at the state and federal levels. REITs can be taxed at capital gains tax rates, but this only applies to whenever you sell shares of the actual company after it meets the typical “holding period” requirements that apply to regular common stocks too.

What are BDCs?

BDC stands for a business development company. This is a type of stock that deals with businesses that invest in other businesses that small, medium, or distressed businesses. They are somewhat higher risk, but like REITs, typically offer higher than average dividends. A BDC must invest at least 70% of its assets into private or public US firms that have a market value of less than $250 million.

How are BDCs taxed?

BDCs are taxed in a similar fashion to REITs. BDCs, like REITs, are also required to distribute at least 90% of their income to investors in the form of dividends. These dividends are also taxed at ordinary gains or non-qualified income rates. This means that dividends from BDCs are taxed at regular state and federal income tax rates. They also get taxed at capital gains tax rates when you sell shares of the BDC after it meets the minimum “holding period”.

What are MLPs?

MLP stands for a master limited partnership. An MLP basically exists as a publicly traded limited partnership. Everyone who invests in shares, or rather “units”, of an MLP is technically considered a “limited partner”. MLPs have two different types of partners. One type of partner is the “limited partner” which are the investors that buy shares or units of the MLP. The other type of partner is called “general partner”, who are the people who manage the MLP, like hedge fund managers that manage the investments in other investment companies like Vanguard, Charles Schwab, Fidelity, and others.

How are MLPs taxed?

Quarterly distributions from the MLP are similar in nature to quarterly common stock dividends. But they are treated as a return of capital, as opposed to dividend income. So, the unitholder does not pay income tax on the returns. Most of the earnings are tax-deferred until the unitholder sells their shares/units. Then, the earnings are taxed at the lower capital gains tax rate, rather than at the higher personal income rate, thus offering significant additional tax benefits.

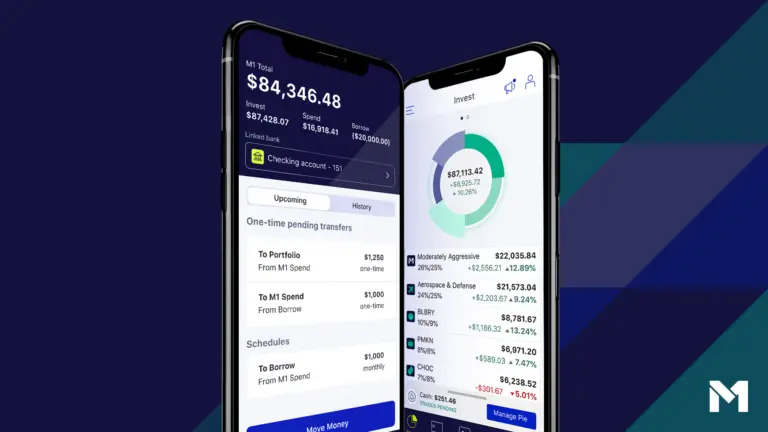

Click here to start investing with M1 Finance! https://m1finance.8bxp97.net/4edv5o

Click here to start investing with Robinhood! https://robinhood.c3me6x.net/qny0Bg

Note: This page contains affiliate links that will, at no cost to you, earn me a commission. You are in no way obligated to click on the links!

Disclaimer: I am not any sort of investment or financial professional giving any sort of legal advice. I’m just some guy trying to teach other people about how they might navigate the financial world.