Mint.com – Best Free Budgeting App

Table of Contents

What is Mint.com?

Mint.com is a free service offered by the well-known company known, Intuit, the one known for providing the service, Turbotax, as well as few other financial products. It is an all-encompassing online service for tracking all of your finances. It allows you to keep track of your bank accounts, investment accounts, all of your loans, and many other things. Mint.com compiles all of that information together for you so that can keep close track of your budget and net worth.

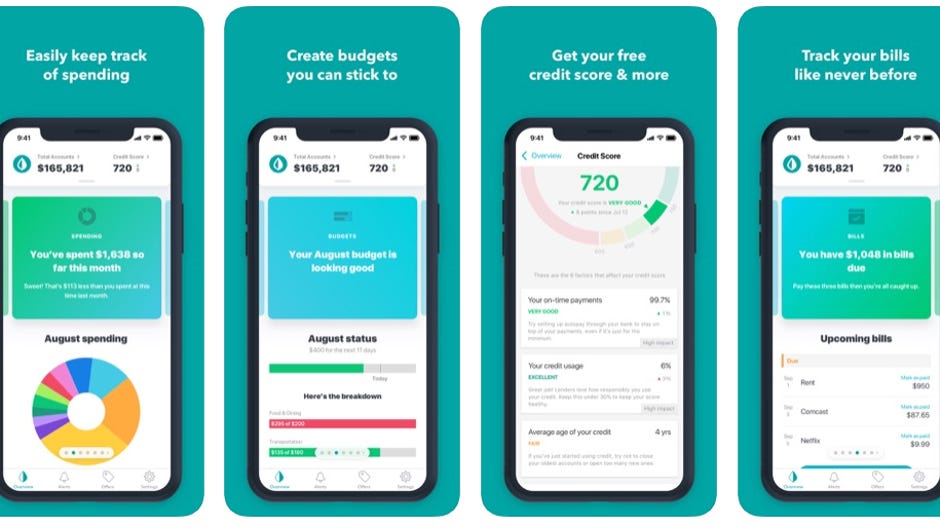

On their app, they have a very nice and neat interface. You can see your credit score up on the top left and click on it to see all of the factors that are affecting it at that point in time. Below is a line graph that lets you keep track of your spending for the month and your total net worth(assets-expenses=net worth).

After that, they have a few different blocks that show your total “Cash”, “Credit Cards”, “Investments”, and “Loans”. You can click on any of these blocks to expand them and see all of your linked accounts and the money you currently have in them. Clicking on the “Cash” account will show you all your linked savings and checking accounts. Clicking on the “Credit Card” block will show you all of the linked credit card accounts that you and how much you currently owe on them.

The “Investments” block opens to show all of your linked investment accounts, the loans block will show you all the loans you owe money on and how much you left you to owe before it’s paid off.

Clicking on any of these accounts on any of these categories will show you many of the latest transactions done in them and any other pertinent information.

On the top right of the menu bar, you can see the settings and accounts button. In the settings section, you can look at and manage all of your accounts. Sometimes they might become disconnected from Mint.com, particularly in the case you had to change a password and you can reconnect the account there. You can also adjust your security and privacy options in this section to set a passcode, use a fingerprint unlock, or even select an option to open the app with Google Assistant if you have it.

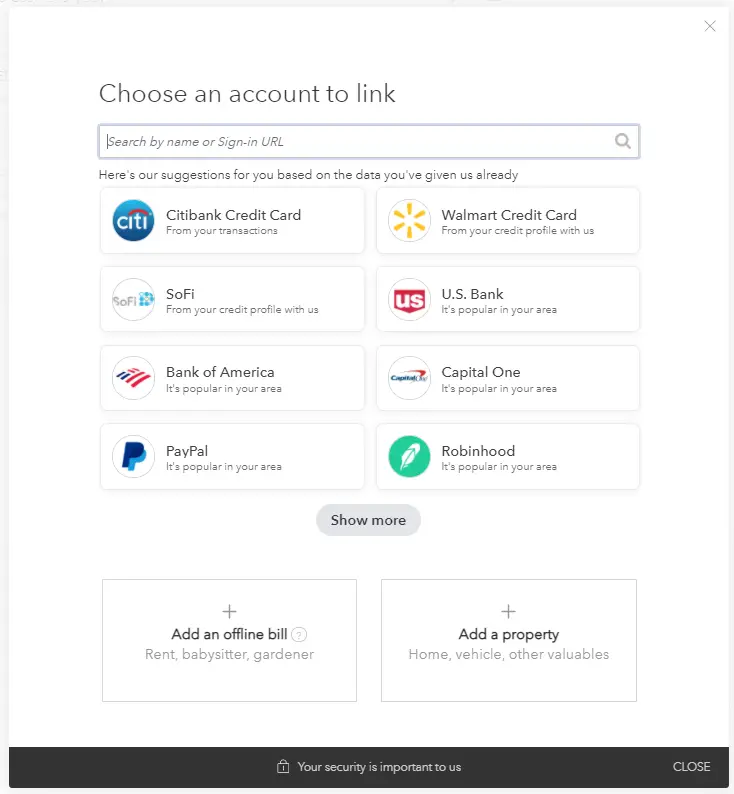

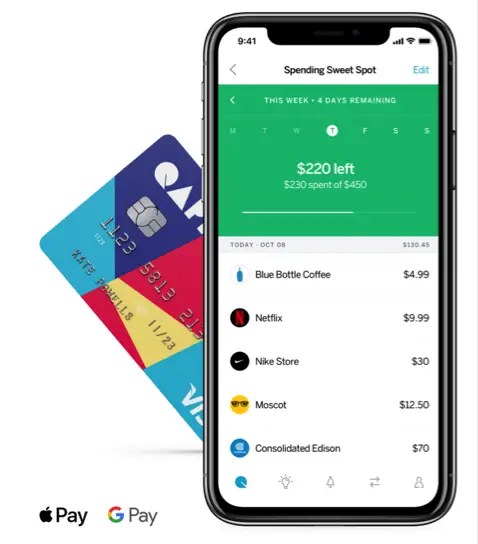

For the accounts button that looks like the plus button in the top right, you can select add any banks, billers, investment, or loan account to connect it to Mint.com to track them. You can select add transaction to add any random transaction to your total expenses in the event you can’t link a particular account to Mint.com or just use cash for budgeting purposes.

Lastly, you can select the add budget option in order to set up your own budget through Mint.com. Just tally up all of your regular expenses and input the category and amount you want to spend in each to set up your budget. Afterward, you can go to the settings section and set up notifications in the app to remind you about all of your expenses. They also have a Mint Life Blog at the bottom of their main page that gives useful financial advice that you can read about.

In the “Monthly” tab on the bottom menu, you can go there to look at the spending you’ve done this month and in what categories. After you’ve set up a budget you can look at it in the monthly tab to see how on track you are with your spending.

There is also a “Bills” section that you can use to link your accounts for bills or even set up third-party bills that you need to set up yourself. In order to set up all of your bills on Mint.com, just click on the top of the “Upcoming bills” section, and using the top right plus button, you can add any bills you might have. If you have any particular bills that don’t show up on the app, I would recommend using the actual browser website because the “bills” section on there allows you to set up any bill you want that doesn’t show up using the official accounts section.

In this section, you can edit the bill to show up however you want. You can name it, label what type of bill it is, and put the amount due, the due date, and how often this bill occurs. For the “bills” section on the app, there is a little calendar button in the top right corner that you can press to pull up a little calendar that shows all the days of the month, and the days when bills are due are highlighted with little circles. The circles show up as green if they have already been paid or yellow if they haven’t.

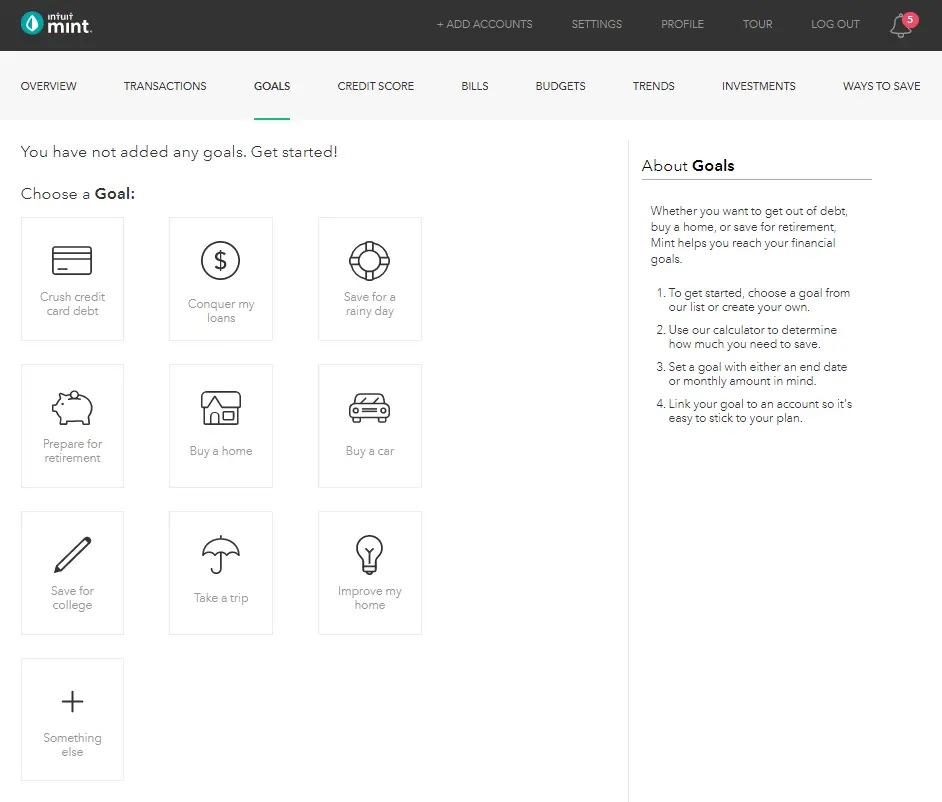

In the “Monthly” tab they also have a section called “Financial resources”. This section shows you all of their Mint Life blog posts for financial tips. At the bottom of the “Monthly” tab, there is also a goals section. Right now, the Mint.com app only shows two options for goals, which are to crush your credit card debt or to improve your credit score.

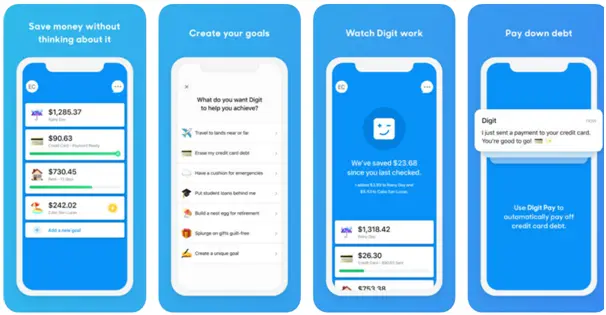

Similar to the instance with bills, I’d recommend using their browser website in order to set any goals that you might want to achieve. The website offers several more default goals to choose ranging from: conquer your loans, save for a rainy day, prepare for retirement, buy a home, buy a car, save for college, taking a trip, improve your home, or just some random goal that you can set yourself. All of those options have tools and give advice based on your goals.

In the Mint.com app, the “Marketplace” tab on the bottom menu pulls up a page that advertises different offerings for credit cards, personal loans, home loans, student loans, auto loans, investment accounts, savings accounts, and insurance that you can compare and sign up for.

The last tab on the bottom of the Mint.com app is for your notifications. Here, you can set up the app to send push notifications and emails for the budgeting, bills, and other information from the app.

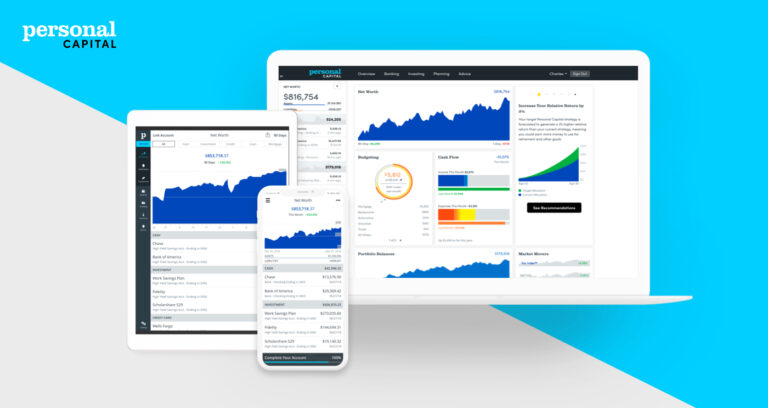

Aside from the two particular instances I mentioned in this post, there isn’t much different or better in terms of features between the app and the browser website. When compared to a budgeting app like Personal Capital, Mint.com offers more comprehensive features, but Personal Capital is better at managing your wealth and monitoring individual assets.

Disclaimer: I am not any sort of investment or financial professional giving any sort of legal advice. I’m just some guy trying to teach other people about how they might navigate the financial world.

Thans forr finally talking abot >Mint.com – Best Frree Budgeting App – Moneymakersandsafers <Liked it!