How To Make A Budget And Save With Personal Capital!

Table of Contents

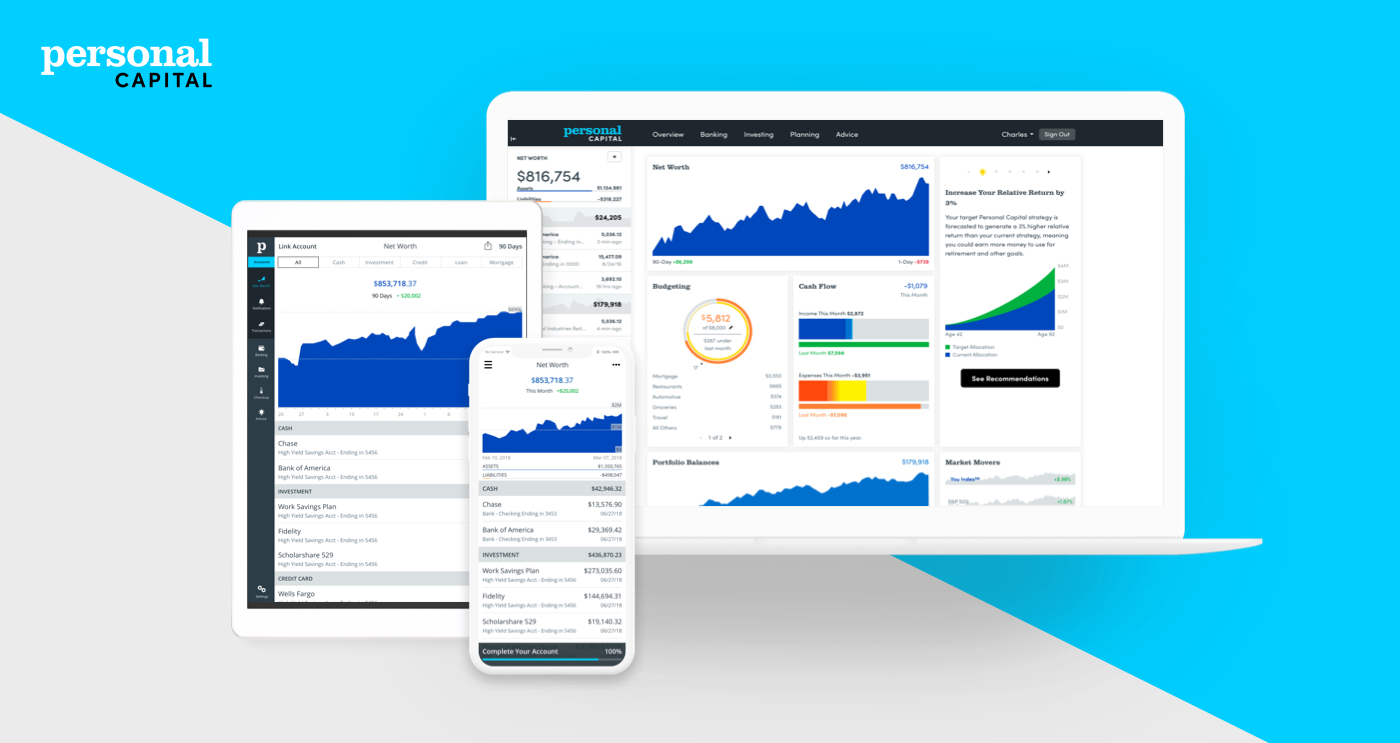

What is Personal Capital?

Personal Capital is an app similar to the Mint.com app that allows you to do things like setting up a budget for yourself and track your expenses and investments. Other than the budgeting and expense tracking tools that Personal Capital offers they also provide their own checking account that you can use, wealth management services, and other financial tools like retirement planning, fee analyzer for your investments, and education cost planning.

How To Create A Budget Using Personal Capital!

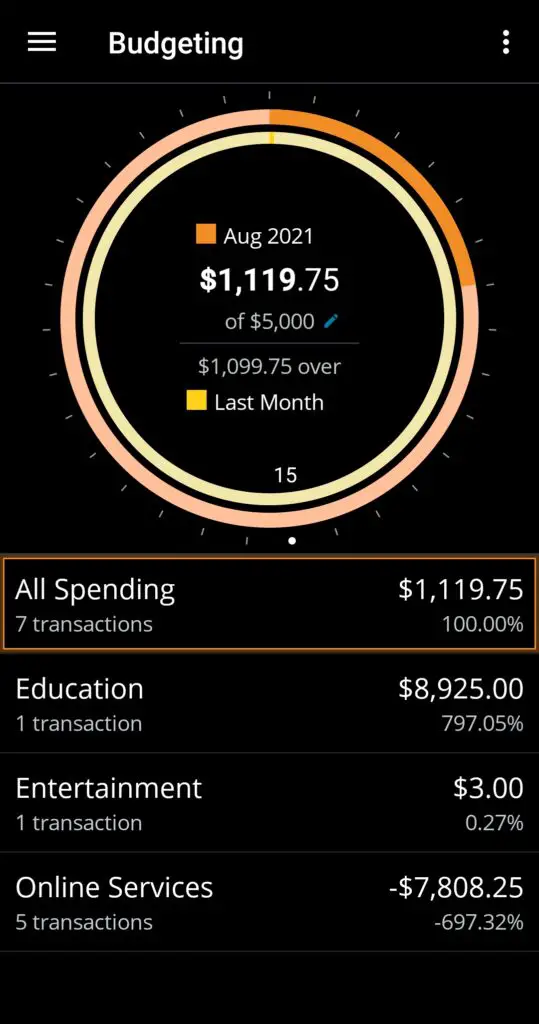

In the “Budgeting” section of the Personal Capital app, you can set your own monthly budget to see if your expenses ever go over the amount you’re supposed to be spending. There are several sections where you can see all of your spending. In the “All Spending” section you can see everything and in several others like education, entertainment, online services, and etc. you can see how much you’ve been spending on individual categories.

The “Cash Flow” section of the app also gives you a clearer insight into how you’re spending vs. your total income. You can also track all the assets you hold in linked accounts in the “Net Worth” part of the app.

How To Manage Your Investments With Personal Capital!

If you want to keep track of all your assets in one place you can in the “Holdings” section of the app. In here you can look at every single holding in all of your linked accounts is doing in the market on a day-to-day basis. You can even check and see how well your holdings are doing compared to popular ETFs like the S&P 500, VTI, VEU, and AGG.

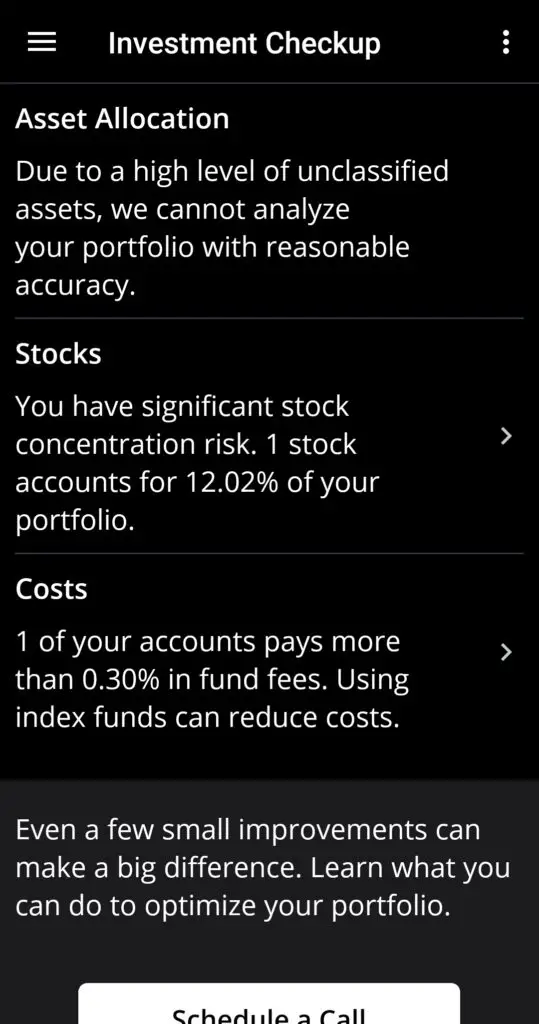

You can also go to the “Investment Checkup” part of the app in order to see if there might be any noticeable issues with your Investments like if you have a particularly high allocation of some stocks or if you’re paying a significant amount in fees in one or more of your investments. If you’re one of their private clients then you can schedule a call with an investment advisor in order to talk with them about any issues you might have with your investments.

While the Personal Capital app with its budgeting and financial tracking tools are completely free for everyone, if you have at least a million dollars in assets Personal Capital will manage them for you for a fee.

| First $1M | 0.89% |

| First $3M | 0.79% |

| Next $2M | 0.69% |

| Next $5M | 0.59% |

| Over $10M | 0.49% |

Banking With Personal Capital Cash!

Like I mentioned earlier, another service that Personal Capital offers is its own checking account.

Some of the benefits that you get when banking with Personal Capital are:

- Joint accounts

- For large withdrawals, wire up to $1M2 with no fees

- Set up direct deposit for your paychecks

- Link to your checking for monthly bills

- Unlimited number of monthly transfers

- Withdraw up to $100K2 per day

- No minimum balance fees

- Your account is FDIC insured up to $1.5 million dollars

Unfortunately, you will only earn 0.05% in interest on your account when you bank with them. You could earn up to 0.10% in interest if you became one of their clients and they managed a lot of money for you. Therefore, while the Personal Capital app is an excellent service for its budgeting and investment management tools I can’t recommend banking with them when there are better options like Sofi, Chime, Ally, and many others that offer higher interest rates, less fees, and more convenience.

Disclaimer: I am not any sort of investment or financial professional giving any sort of legal advice. I’m just some guy trying to teach other people about how they might navigate the financial world.