How To Get The Saver’s Tax Credit For Retirement Contributions!

Table of Contents

What is the Saver’s Tax Credit?

The Saver’s Tax Credit is also referred to as the retirement savings contributions credit. This is because it is a tax credit available to regular workers who contribute to retirement accounts. Single filers can receive a $1,000 non-refundable credit and joint filers can get $2,000.

Depending on income levels (see charts below), the credit is worth either 10%, 20%, or 50% of a person’s eligible contribution. In order to get the Saver’s Tax Credit, single filers must have an adjusted gross income of $33,000 or less. The income limit is $49,500 for a head of household and $66,000 for married couples filing jointly.

Claiming a saver’s credit when contributing to a retirement plan can reduce an individual’s income tax burden in two ways. First, the contribution to the plan itself qualifies as a tax deduction. Second, the saver’s credit reduces the actual taxes owed, dollar for dollar.

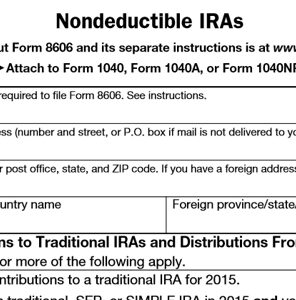

In order to claim this tax credit filers need to fill out IRS form 8880 to claim the credit on their tax return. You also have to be 18 years or older and not be claimed as a dependent on anyone else’s tax returns

Which retirement accounts count towards the Saver’s Tax Credit?

[slm_content_lock]

401ks, 403bs, 501c-18D plans, and traditional or Roth IRA retirement accounts qualify for the Saver’s Tax Credit, but, unfortunately, it doesn’t apply to rollover IRAs.

Government retirement accounts like 457bs, SARSEPs, or SIMPLE plans are also eligible for this tax credit.

Designated beneficiaries of contributions to an Achieving a Better Life Experience account to be eligible for the saver’s credit. These accounts are “tax-advantaged savings programs for eligible people with disabilities which helps designated beneficiaries pay for qualified disability expenses They are also tax-free if used for qualified disability expenses

[/slm_content_lock]

However, one thing to keep in mind about the Saver’s Tax Credit is that your credit amount may be reduced if you had any recent distributions from a retirement plan, IRA, or an Achieving a Better Life Experience account!

Want to file your taxes for 100% FREE, check out our article on “How to File Your Taxes For Free!”.

Disclaimer: I am not any sort of investment or financial professional giving any sort of legal advice. I’m just some guy trying to teach other people about how they might navigate the financial world.