How To File Your Taxes For 100% Free in 2022!

Table of Contents

How to file your taxes for free!

Every single year, there comes a time when it’s time to pay the piper, or in this case your government. Every year people have to file their taxes according to the law and either pay taxes or if you’re lucky get some money back from the government. There are several companies out there that exist to help people file their taxes, like TurboTax, H&R Block, Tax Act, and more. Some of these companies offer free options that are limited and end up making people pay anyways. However, did you know that several of these companies offer an entirely separate and more comprehensive option that allows you to completely file your taxes for free?

These separate and alternate versions of these programs are typically hidden and not talked about by the companies that offer them but exist as part of the IRS’s Free File Program. They offer noticeably more features that you would normally have to get for in their regular, “free” options they offer. However, not everyone can use this program as it does have some limitations.

What is the IRS Free File Program?

IRS Free File lets you prepare and file your federal income tax online using guided tax preparation, at an IRS partner site, or Free File Fillable Forms. It’s safe, easy, and at no cost to you for a federal return. Some of the options for free filing include free state returns, but not all of them.

To receive a free federal tax return, you must select an IRS Free File provider from the Browse All Offers page or your Online Lookup Tool results. Once you click your desired IRS Free File provider, you will leave the IRS.gov website and land on the IRS Free File provider’s website. Then, you must create an account at the IRS Free File provider’s website accessed via IRS.gov to prepare and file your return.

There are several options that you can use within the IRS Free File program that includes:

- Tax Slayer

- FileYourTaxes.com

- 1040now.net

- TaxAct.com

- OLT.com

- ezTaxReturn.com

- free1040taxreturn.com

- freetaxusa.com

Intuit’s TurboTax was part of this program until 2021 when they opted to stop offering their free version.

Who qualifies for the IRS Free File program?

As mentioned earlier though each of these individual programs has specific requirements that people have to meet before you can actually be allowed to use them like your “adjusted gross” or take-home income, your location, and more, which we will discuss in this post.

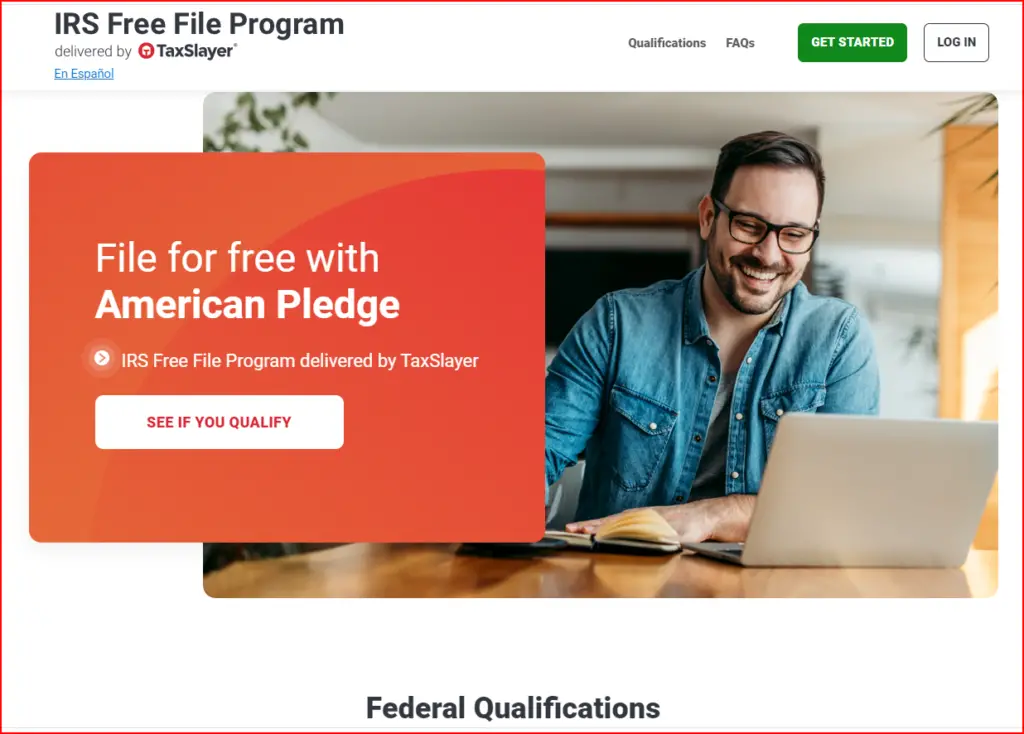

Tax Slayer Free File Requirements

In order to file your taxes for free with Tax Slayer, these are the requirement that you have to meet in 2022:

- Your Adjusted Gross Income (AGI) is $39,000 or less OR

- You are eligible for the Earned Income Tax Credit (EITC) OR

- You are an active duty military member with an AGI of $73,000 or less

- If you qualify for a free federal return, you can also file a free state return for the following states: AR, AZ, DC, GA, IA, ID, IN, KY, MA, MI, MN, MO, MS, MT, NC, ND, NY, OR, RI, SC, VA, VT and WV

According to their site, they also claim to include all tax forms, schedules, credits, and deductions are included — meaning all tax situations are covered. They also offer “unlimited” phone and email support.

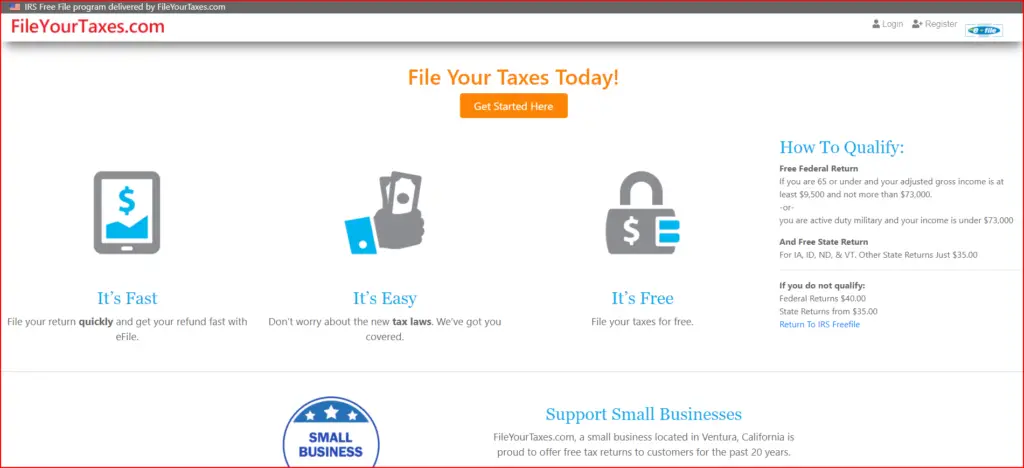

FileYourTaxes.com Free File Requirements

FileYourTaxes.com, a small business located in Ventura, California is proud to have offered free tax returns to customers for the past 20 years.

- If you are 65 or under and your adjusted gross income is at least $9,500 and not more than $73,000 OR

- you are active duty military and your income is under $73,000

- EITC included if age and AGI criterion are met

- If you qualify for a free federal return you can file for a free state return for IA, ID, ND, & VT. Other State Returns Just $35.00

1040now.net Free File Requirements (2nd Worst Option)

- Your Adjusted Gross Income (AGI) is $73,000 or less and you live in one of the following states: AL, AR, AZ, CA, CO, CT, DC, DE, GA, HI, IL, IA, ID, KS, KY, LA, MA, MD, ME, MI, MN, MO, MS, MT, NE, NC, ND, NJ, NM, NY, OH, OK, OR, PA, RI, SC, TN, UT, VA, VT, WI or WV.

- Active Military for AGI of $73,000 or less.

- EITC included if AGI criterion is met

This appears to be one of the worst options in the Free File program because unlike most of the other options, some states (AK, FL, IN, NH, NV, TX, WA or WY) are excluded from filing free federal tax returns. On top of that, THEY OFFER NO FREE STATE RETURNS AT ALL!

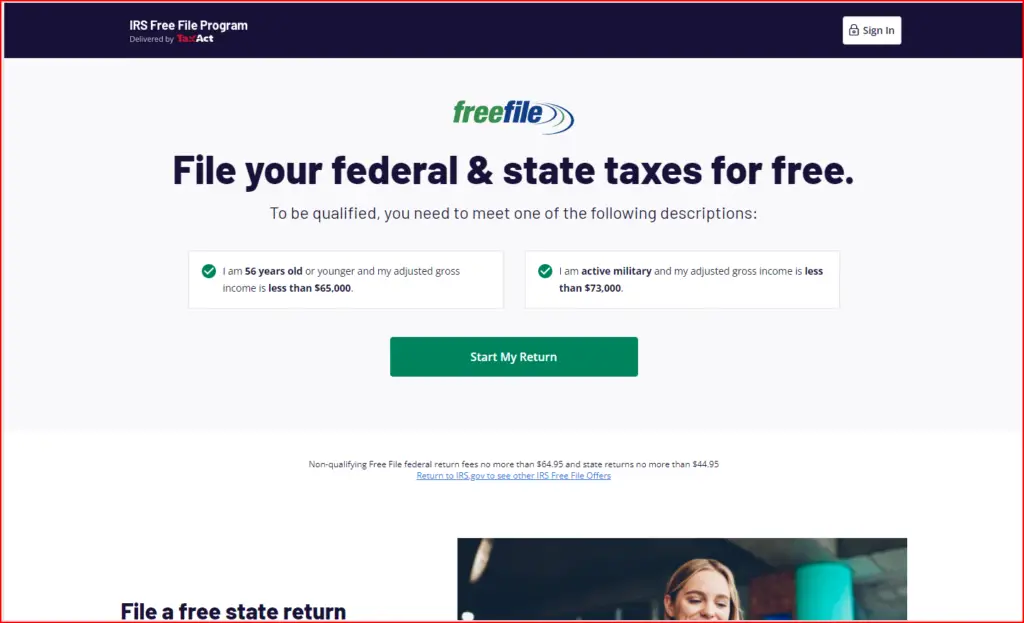

TaxAct Free File Requirements (2nd Best Option)

- 56 years old or younger and a adjusted gross income less than $65,000 OR

- Active military and adjusted gross income is less than $73,000.

- EITC included if age and AGI criterion are met

- If you qualify for a free federal return, you can also file a free state return for the following: AR, AZ, GA, IA, ID, IN, KY, MA, MI, MN, MO, MS, MT, NC, ND, NH, NY, OR, RI, SC, VA, VT, WV. Other state returns are $39.95.

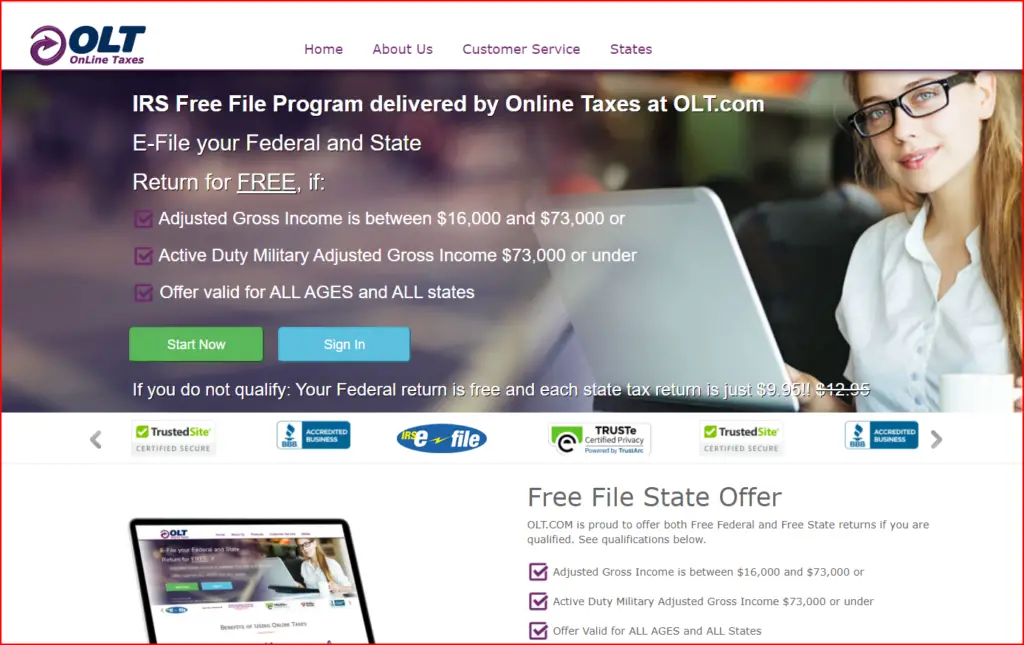

OLT Free File Requirements (Best Option)

- Adjusted Gross Income is between $16,000 and $73,000 OR

- Active Duty Military Adjusted Gross Income of $73,000 or under

- Free state tax returns if you qualify for the free federal return

- EITC included if AGI criterion is met

This one, while one of the relatively lesser-known options, is one of the best options to file your taxes for free. They have one of the higher limits for adjusted gross income requirements for regular citizens. They include both federal and ALL state tax returns for free if you qualify. They also appear to support/offer an extremely wide array of tax forms to cover a HUGE amount of tax situations people might need to file under. They also offer free amended returns and filing extensions.

The best part about OLT.com is that even if you DON’T qualify for the Free File program you’re federal tax returns are still 100% free. Although you will have to pay $9.95 per state for state tax returns.

ezTaxReturn.com Free File Requirements (Worst Option)

- If your adjusted gross income is $73,000 or less and you live in a qualifying state* which includes: AL, AR, AZ, CA, CO, GA, IL, LA, MA, MD, MI, MO, MS, NJ, NY, NC, OH, PA, SC, VA or WI

- Active Duty Military Adjusted Gross Income of $73,000 or under

- EITC included if AGI criterion is met

This is THE WORST OPTION in the entire Free File program. While they do have a higher adjusted gross income limit, they are very misleading with how they advertise themselves on their site. THEY OFFER THE FEWEST AMOUNT OF STATE OPTIONS WHEN IT COMES TO FREE “FEDERAL” RETURNS. THEY ALSO OFFER NO FREE STATE RETURNS AT ALL!

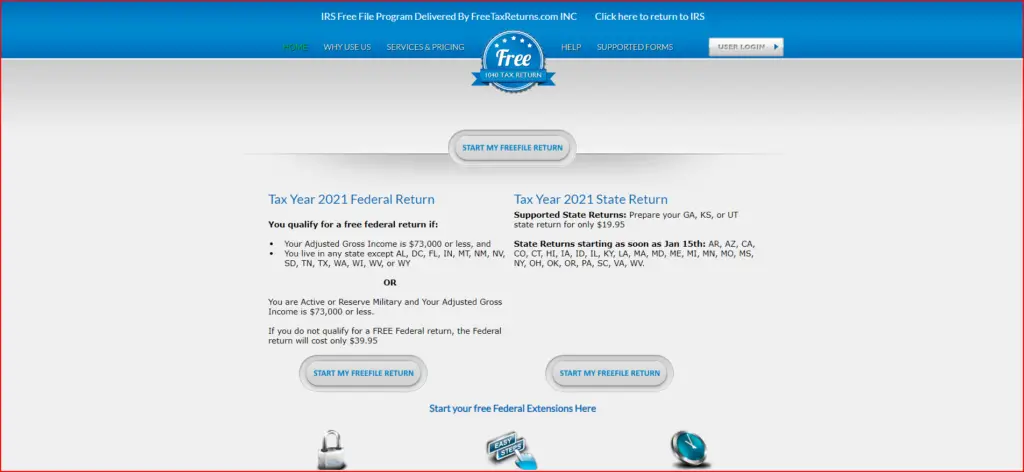

Free1040taxreturn.com Free File Requirements

- Your Adjusted Gross Income is $73,000 or less, AND

- You live in any state EXCEPT AL, DC, FL, IN, MT, NM, NV, SD, TN, TX, WA, WI, WV, or WY OR

- You are Active or Reserve Military and Your Adjusted Gross Income is $73,000 or less.

- EITC included if AGI criterion is met

Unfortunately, this is another one that does not support ANY free state tax returns.

FreeTaxUSA.com Free File Requirements

- Anyone with an AGI under $41,000 OR

- Active duty military during and your AGI was less than $73,000

- Free state return if you qualify for the federal return

- EITC included if AGI criterion is met

How to determine the best tax filing program for you!

While we here at moneymakersandsavers.com have combed through each of these programs and selected which are the best and worst options based on general criteria, sometimes people have specific filing needs that only certain programs cater to. Luckily the IRS’s Free File program also offers a free “Lookup Tool” to determine which program is the best for you personally to use.

All you need to do is enter your filing status (single, married, married filing separately, etc.), your adjusted gross income, and any Earned Income Tax Credits you might have received. This is still a pretty simple set of criteria, but for most people, this will work to find the best tax filing option for you.

For those of you interested in filing self-employment taxes, check out our post, What Are Some Deductions You Can Take If Self Employed?.

Disclaimer: I am not any sort of investment or financial professional giving any sort of legal advice. I’m just some guy trying to teach other people about how they might navigate the financial world.