Non-Deductible IRAs How To Avoid Being Double-Taxed On Your IRA Contributions!

Table of Contents

What are non-deductible IRAs?

Traditional IRAs are individual retirement accounts offered by investment brokerages in the US. The money you invest in traditional IRAs is typically money that you contribute with after-tax money, and then if you have the option to deduct these contributions from your total taxes for the year if your itemized deductions are higher than your standard deduction.

How to make sure you are not taxed on your contributions along with your gains in a traditional IRA!

In taxable investment accounts, you are taxed only on the earnings inside the account. Meaning if you contribute $100,000 and it grows all the way up to $1,000,000 then you are only taxed on the $900,000 of growth in your account. With a traditional IRA, you may be able to take a tax deduction for the money you put into the account. Earnings in the account are untaxed. When you withdraw money, you pay income taxes on the earnings and on any contributions that you took a deduction for.

However, depending on things like your income and whether or not you have access to an employer-sponsored retirement account, like a 401k, then the deductions you’re allowed to take from IRA contributions are limited or even entirely disallowed! This would make your IRA a non-deductible IRA.

[slm_content_lock]

If you have a retirement plan at work, you can take only a partial deduction if your income exceeds:

- $65,000 if you’re single

- $104,000 if you’re married and filing a joint return

You can’t take any deduction for IRA contributions if you have a retirement plan at work and your income is more than:

- $75,000 if you’re single

- $124,000 if married filing jointly

You are still allowed to contribute to a non-deductible IRA, it’s just that the amount of money that you will be allowed to deduct from your taxes will be lower based on your situation. Since you are no longer allowed to take deductions from your non-deductible IRA, your contributions are now classified as “non-deductible contributions”. They will also continue to be tax-free within your account.

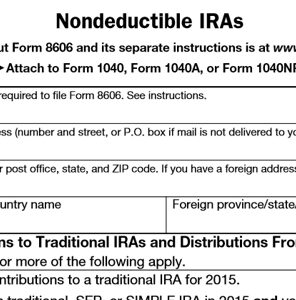

In order to make sure your contributions in a non-deductible IRA are not taxed AGAIN you need to make sure to fill out the IRS Form 8606 whenever you do your taxes. You need to fill out this form because it informs the IRS that the contributions to your traditional IRA have already been taxed. This way you will not be taxed on your contributions when you begin to withdraw money.

You must file Form 8606 each year you contribute after-tax money to an IRA. There is a $50 penalty for failing to file Form 8606 whenever you do your taxes.

[/slm_content_lock]

Click on the link here to invest in an IRA with M1 Finance! https://m1finance.8bxp97.net/4edv5o

Disclaimer: I am not any sort of investment or financial professional giving any sort of legal advice. I’m just some guy trying to teach other people about how they might navigate the financial world.