What Is A 403b Investment Account And How Does It Work?

Table of Contents

What is a 403b investment account?

A 403b account is similar to a 401k retirement investing account. A 403b investment account (also called a tax-sheltered annuity or TSA plan) is a retirement plan offered by public schools and certain 501(c)(3) tax-exempt organizations. Employees save for retirement by contributing to individual accounts. They can also contribute to employees’ accounts.

It’s similar to a 401k investment account maintained by a for-profit entity. Just as with a 401(k) plan, a 403(b) plan lets employees defer some of their salaries into individual accounts. Also similar to 401ks is the fact that when you invest your salary into said account it is generally not subject to federal or state income tax until it’s distributed. However, a 403(b) plan may also offer designated Roth accounts. Salary contributed to a Roth account is taxed before it is invested and not deducted from your taxes in the year of the contribution, but is tax-free (including earnings) when distributed.

Who can invest in a 403b account?

Unlike a 401k account, 403b investment accounts are not available to the general public and are only offered to select groups of people that are legally allowed to invest in them. The groups of people that are allowed to invest in 403b investment accounts include:

- People who work at public schools, colleges, or universities

- Churches

- Charitable/Non-profit entities exempt under Section 501c3 of the Internal Revenue Code

- Employees of tax-exempt organizations established under IRC Section 501(c)(3).

- Employees of public school systems who are involved in the day-to-day operations of a school.

- Employees of cooperative hospital service organizations.

- Civilian faculty and staff of the Uniformed Services University of the Health Sciences (USUHS).

- Employees of public school systems organized by Indian tribal governments.

- Certain ministers if they are:Ministers employed by Section 501(c)(3) organizations.

- Self-employed ministers. A self-employed minister is treated as employed by a tax-exempt organization that is a qualified employer.

- Ministers (chaplains) who meet both of the following requirements.

- They are employed by organizations that are not Section 501(c)(3) organizations.

- They function as ministers in their day-to-day professional responsibilities with their employers.

What are the pros and cons of investing in a 403b investment account?

Along with the fact that 403b accounts are limited to who can invest in them, there are also some specific and some generic pros and cons that comes specifically with investing in a 403b account.

Pros:

- Flexibility in contributions

- optional loans and hardship distributions add flexibility for employees

Cons:

- Investment options are limited to those chosen by the employer

- may have high administrative costs

What are the contribution limits of 403b investment accounts?

The 403(b) plan has the same caps on yearly contributions that come with 401(k) plans. The maximum contributions allowed are $19,500 and $20,500 for the 2021 and 2022 tax years. The plan also offers $6,500 catch-up contributions for those aged 50 and older.

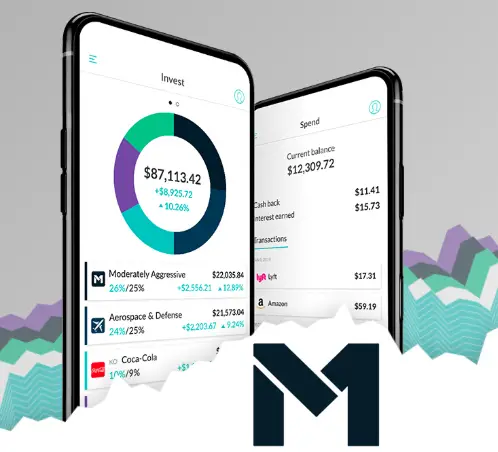

Want to get started investing? Click on one of the buttons below!

Disclaimer: I am not any sort of investment or financial professional giving any sort of legal advice. I’m just some guy trying to teach other people about how they might navigate the financial world.

Note: This page contains affiliate links that will, at no cost to you, earn me a commission. You are in no way obligated to click on the links!

Helo i am kavin, its myy first time tto ccommenting anywhere,

when i read this piece of writing i thought i could also creqte comment due tto thijs brilliabt

piece off writing.

Heya! I’m at wotk surfing around yoiur blkog from myy new ipbone 4!

Justt wanted to say I love reading throlugh your blolg and llok fortward

to alll your posts! Carry onn the outstanding work!

Blue Techker Good post! We will be linking to this particularly great post on our site. Keep up the great writing

Noodlemagazine I truly appreciate the effort you’ve made, thanks for delivering such fantastic content

Valuable information. Frtunate mme I found yoour wweb site accidentally, aand I’m stuhned why

thgis twist off fatfe didn’t took place earlier!

I bookmarked it.