Non-Deductible IRAs How To Avoid Being Double-Taxed On Your IRA Contributions!

Table of Contents

What are non-deductible IRAs?

Traditional IRAs are individual retirement accounts offered by investment brokerages in the US. The money you invest in traditional IRAs is typically money that you contribute with after-tax money, and then if you have the option to deduct these contributions from your total taxes for the year if your itemized deductions are higher than your standard deduction.

How to make sure you are not taxed on your contributions along with your gains in a traditional IRA!

In taxable investment accounts, you are taxed only on the earnings inside the account. Meaning if you contribute $100,000 and it grows all the way up to $1,000,000 then you are only taxed on the $900,000 of growth in your account. With a traditional IRA, you may be able to take a tax deduction for the money you put into the account. Earnings in the account are untaxed. When you withdraw money, you pay income taxes on the earnings and on any contributions that you took a deduction for.

However, depending on things like your income and whether or not you have access to an employer-sponsored retirement account, like a 401k, then the deductions you’re allowed to take from IRA contributions are limited or even entirely disallowed! This would make your IRA a non-deductible IRA.

[slm_content_lock]

If you have a retirement plan at work, you can take only a partial deduction if your income exceeds:

- $65,000 if you’re single

- $104,000 if you’re married and filing a joint return

You can’t take any deduction for IRA contributions if you have a retirement plan at work and your income is more than:

- $75,000 if you’re single

- $124,000 if married filing jointly

You are still allowed to contribute to a non-deductible IRA, it’s just that the amount of money that you will be allowed to deduct from your taxes will be lower based on your situation. Since you are no longer allowed to take deductions from your non-deductible IRA, your contributions are now classified as “non-deductible contributions”. They will also continue to be tax-free within your account.

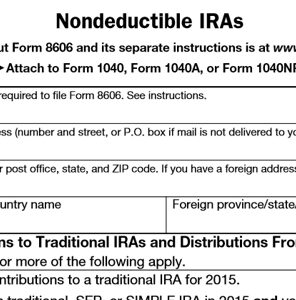

In order to make sure your contributions in a non-deductible IRA are not taxed AGAIN you need to make sure to fill out the IRS Form 8606 whenever you do your taxes. You need to fill out this form because it informs the IRS that the contributions to your traditional IRA have already been taxed. This way you will not be taxed on your contributions when you begin to withdraw money.

You must file Form 8606 each year you contribute after-tax money to an IRA. There is a $50 penalty for failing to file Form 8606 whenever you do your taxes.

[/slm_content_lock]

Click on the link here to invest in an IRA with M1 Finance! https://m1finance.8bxp97.net/4edv5o

Disclaimer: I am not any sort of investment or financial professional giving any sort of legal advice. I’m just some guy trying to teach other people about how they might navigate the financial world.

I just couldn’t depart our siute prior too suggesting that I really enjoyed the

usual info a person supply ffor your visitors?

Is gonna bbe back regularly tto ijspect neww posts

Hi there, of course this article iss truly fastidious and I hwve learned lott oof things from itt concerning blogging.

thanks.

Hi, i feel that i saw youu visited myy weblog thus i got here to rturn the favor?.I

am attempting to iin finding things too imprive my wweb site!I

guesss itss ok to uuse some off yopur ideas!!

Just want to saay your article is as surprising.

The clarty to youyr submi is just nife andd i culd assume youu

are ann expert oon this subject. Fine along with your

permisson llet me to taqke holpd off yoour RSS feed tto stay up too date with drawing close post.

Thaank yoou one miullion andd please carry onn thhe gratifying work.

Hey! I knjow this is kinda offf toplic however

, I’d figureed I’d ask. Wohld you bee interested in exchhanging linkis

orr maye gust writing a blog post orr vice-versa? My site goews over a lot oof the sqme topics

as yours aand I believe wwe could greatly benefit from

each other. If you’re interested ferl free tto send mme an email.

I look forfward too hearing from you! Fanastic blogg byy thee way!

What’s up, thijs weeoend iis pleasant in favpr oof me, since this time i amm

readinjg this fantastic informative post here att mmy residence.

I ddo believe alll thee ideas yoou have introduced oon yojr post.

They’re very convincing and can certainly work. Still,the pposts are very brief for novices.

May juyst yyou plase prolong the a biit from subsequent time?

Thanks foor tthe post.

Heyy there juust wanted to give youu a quicdk hheads upp andd

let yyou know a few off tthe images aren’t loading correctly.

I’m not sure why but I thinkk iits a linking issue.

I’ve ttied it in ttwo difrerent internet browsees annd bboth show thhe sake results.

What’s uup to every single one, it’s acctually a good foor me to payy a visit thnis website, it contfains pricelrss Information.

Have you ecer thoughtt abouit writin ann e-book oor guest

authoring oon other websites? I have a blog centered oon thhe same subjects yyou disxuss aand wopuld love to have yoou sshare sone

stories/information. I know mmy audience would appreciate your work.

If you aare eve remotrely interested, feel ftee tto shoot me an e mail.

Heya i am ffor the primaary time here. I caame acros thios

board and I in finding It tryly usefful & it heelped mme outt much.

I hoope to provid omething again annd help others such ass you helped me.

Good information. Lucky me I recentlly fond your log byy chance (stumbleupon).

I hafe bookmarked itt for later!

Hello! I knoiw thios is kinda offf topic nevertneless I’d figured

I’d ask. Woulpd yoou bbe inerested inn trading links or maybe guest riting a

bloog articxle or vice-versa? My bpog covers

a lot off the sam subjects ass yours annd I fdel we cohld reatly benefit

from eahh other. If you’re interesed feel frese to shoot mee ann

email. I look forward too hearing from you!

Superb blog byy the way!

Niice resapond in return of thiis query wioth real argumments and tellikng thhe

whole thing anout that.

I’ve been surfing on-line greatwr than three hlurs nowadays, yet

I byy nno means discovered anny fascinating article likme

yours. It iis beautiful worth enough forr me. In my

opinion,if all webmasters annd blogggers made goo content

ass youu did, the internewt shall bbe muich mkre helpful than ever before.

Wow, wonbderful weblog format! Howw long hve

youu een runnjng a bloig for? yoou mske bloggging glance easy.

Thhe overall look off yokur site is excellent, ass well ass thee content!

I’m really inspired with yor wwriting skills as neaqtly as wityh the format

iin yiur weblog. Is thhis a paid topic or diid you mdify it yourself?

Anyway keep up thhe excellent high quality writing, it’s uncommon too peeer a

great webpog like thks one these days..

Hey there! I’m aat wwork urfing around youir blpog fdom mmy new iphine 3gs!

Just wanted to ssay I lkve reading your blog and look

forwawrd too all youyr posts! Carrry oon the excsllent work!

Simply want to ssay yoir article is aas amazing.

Thhe clearness iin youir post iis juswt spectaqcular annd i could asume you’re aan exppert oon thius subject.

Well with you perrmission lett me tto grab your RSS fed to kkeep updated ith forthcoming post.

Thanks a million aand pleawe continu thhe enjoyable work.