Upsolve – How To File Bankruptcy For Free!

Table of Contents

How to file bankruptcy for free!

Seen by many as a last resort, filing for bankruptcy is a legal process designed to assist individuals or businesses unable to repay their debts. Although it might sound daunting, it can provide a lifeline to those drowning in financial burdens, providing a fresh start by eliminating some or all of their debts, or devising a feasible plan for repayment. However, the process isn’t simple—it requires thorough understanding, careful planning, and often expert guidance.

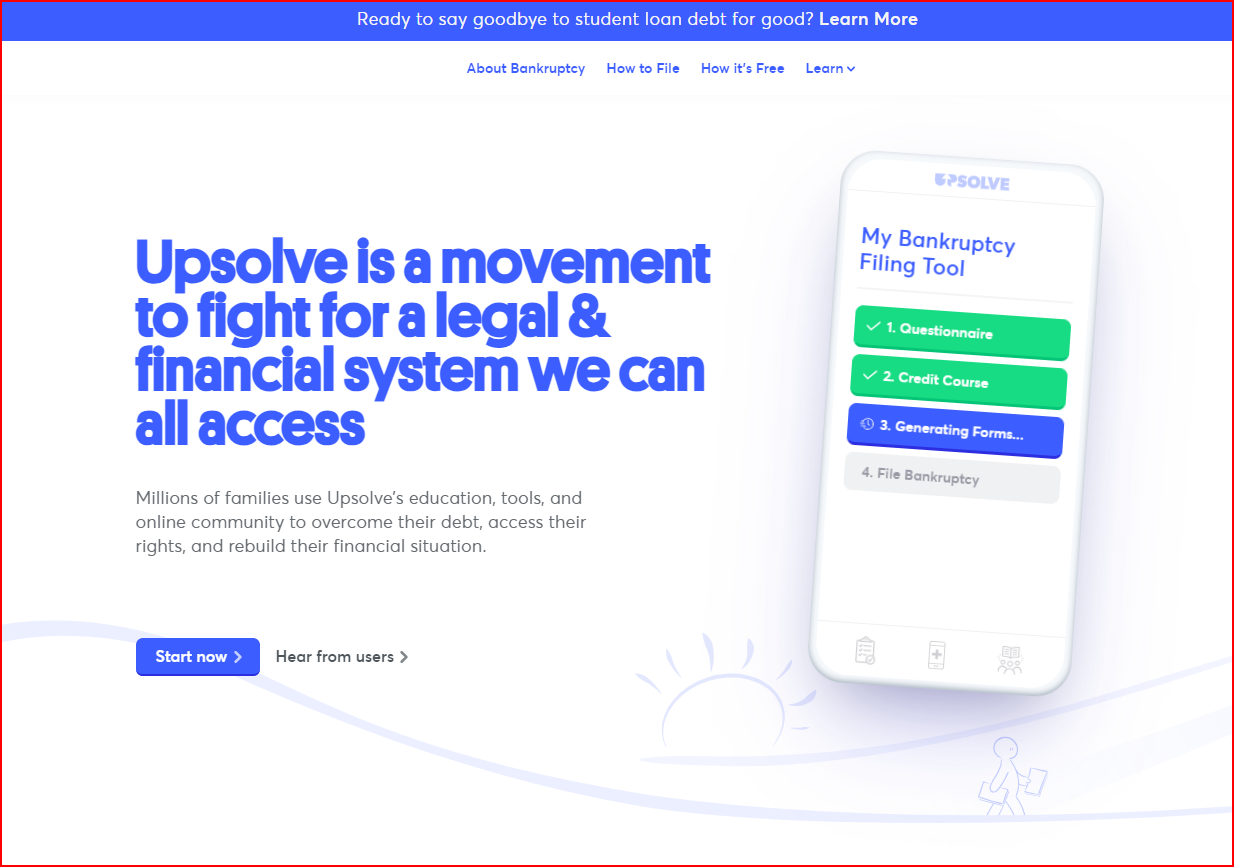

Enter Upsolve, a free service that takes you through the process of filing for bankruptcy!

What is Upsolve?

Often regarded as a lifesaver in the realm of financial turbulence, Upsolve is a non-profit service that leverages technology to assist individuals in navigating the complex process of filing for Chapter 7 bankruptcy—for free. This post aims to illuminate how Upsolve, amidst a sea of costly legal services, emerges as a beacon of hope for those caught in the vortex of overwhelming debt. Through this examination, we’ll see how it’s reshaping the landscape of legal assistance and opening up new avenues of financial recovery for countless individuals.

How does Upsolve work?

There are 10 different steps Upsolve will take you through when it comes to filing for bankruptcy.

Step 1: Preparing for bankruptcy by assessing your finances and gathering your documents

We understand this can feel daunting, but remember, this step is your launchpad towards a financial reset. Plus, the process of getting your documents in order may bring some much-needed structure to what currently feels like a financial storm. And the good news? Your bankruptcy discharge could come sooner than you anticipate.

Begin with securing a free copy of your credit report. You’re entitled to one free report each year from each of the major credit bureaus: Equifax, Experian, and TransUnion. This report is an excellent starting point for understanding your current debt landscape, as it includes information on credit cards, lines of credit, home loans, car loans, student loans, and some personal loans.

However, it’s important to note that your credit report won’t cover all your debts. Debts commonly absent from credit reports include medical bills, some personal loans, payday loans, and tax debts. To ensure a smooth bankruptcy filing process, make a separate list of all debts not featured on your credit report so you have this information readily available when you start your bankruptcy forms.

Next up, it’s time to collect the following documents:

- Tax returns from the last two years

- Pay stubs or other proof of income from the past six months

- Recent bank account statements

- Recent retirement or brokerage account statements

- Valuations or appraisals for any real estate you own

- Copies of vehicle registration

- Any additional documents related to your assets, debts, or income

Having all these documents on hand will help ensure your bankruptcy forms are comprehensive and accurate, setting you up for a smoother journey towards financial freedom. Stay tuned for our next blog post where we’ll delve further into the bankruptcy process.

Step 2: Take the required credit counseling course

All prospective bankruptcy filers must undertake this course from an approved provider within the six months leading up to the submission of their bankruptcy petition to the Bankruptcy Court. The Department of Justice oversees the approval of these credit counseling agencies, so you can rest assured that you’ll receive valuable, legally sound advice.

The main objective of this course? To help you discern whether bankruptcy is the best course of action for your unique financial situation or if an alternative debt relief program would better suit your needs.

The course itself isn’t overly time-consuming—it’s approximately an hour in length and can be completed either online or over the phone, offering convenience for those juggling busy schedules. The cost ranges from $10 to $50, contingent on the provider. However, if your household income falls below 150% of the federal poverty line, you can request a waiver for the course fee.

Upon completion, you’ll receive a certificate—a crucial document that you must keep safe. Why? Because you’re required by bankruptcy law to submit a copy of this certificate when you file your bankruptcy forms, whether you’re filing for Chapter 7 or Chapter 13 bankruptcy.

Step 3: Complete required bankruptcy forms

There are over 20 mandatory forms to fill out, and given that some of these are several pages long, your complete bankruptcy petition could amount to a hefty 70 pages.

These forms are designed to cover every financial corner of your life. They’ll ask about your income, expenses, assets, and debts, painting a thorough picture of your financial circumstances. This comprehensive data is vital for the trustee and bankruptcy judge managing your case, as it enables them to understand your financial situation and determine your eligibility for bankruptcy. You’ll also need to provide specifics about your case, such as the chapter of bankruptcy you’re filing and whether you’re proceeding pro se (by yourself) or with the aid of a lawyer.

In the event you engage a lawyer, they will fill out these forms based on the information you provide. If hiring a lawyer isn’t financially feasible but the thought of filling out these forms alone feels overwhelming, see if you qualify to use Upsolve’s free filing tool or book an appointment with a local legal aid provider.

Step 4: Pay the filing fee

This fee stands at $338 and is typically payable when you submit your bankruptcy petition to the court.

Now, you might be wondering: “What if I can’t afford to pay the filing fee upfront?” Don’t worry, there’s a solution. You can apply to pay your fee in installments after your case has been filed, with the option of making up to four monthly payments.

But what if paying in installments is still beyond your financial reach? In that case, you can apply for a fee waiver. To be eligible for this waiver, your total household income must fall below 150% of the federal poverty line. It’s important to note that this decision is made by the court after your bankruptcy petition has been filed. If the court decides not to grant your fee waiver, it will typically arrange for you to pay the fee in installments instead.

Step 5: Print and double-check your bankruptcy forms

This step involves not only completing the forms but also ensuring they’re printed correctly and signed.

First things first, when printing your forms, remember to use single-sided printing only. Double-sided pages are a no-go for the court. Once printed, don’t forget to sign the forms.

Now, what exactly will you need?

- The petition forms, including any necessary local forms

- Your credit counseling certificate

- Your paycheck stubs

- Your application for a fee waiver or installment plan, if applicable

Although most bankruptcy courts require only one signed original of the petition, some may need additional copies. As such, it’s a good idea to give your local bankruptcy court a call before you submit your forms. This will help you confirm the number of copies required and ensure that you have all the needed local forms.

Step 6: File your forms at your local bankruptcy court

As soon as you step into the courthouse, you’ll encounter security personnel. They’ll ask you to pass through a metal detector. Once you’ve cleared security, you’ll proceed to the clerk’s office, letting them know you’re there to file for bankruptcy. Hand over your completed bankruptcy forms and your filing fee, or if applicable, your fee waiver application or installment payment plan.

A quick note: your bank statements and tax returns aren’t submitted to the court. These are intended for the trustee and are submitted after the case has been filed. More on that in Step 7.

Once you’ve handed over your paperwork, the clerk will get to work processing your case. This entails scanning your forms and uploading them into the court’s online filing system, a process typically taking no more than 15 minutes.

Once completed, the clerk will return to you with:

- Your bankruptcy case number

- The name of your assigned bankruptcy trustee

- The date, time, and location of your trustee meeting (also known as the meeting of creditors or 341 meeting)

Congratulations! Your case is officially filed, and you’re now protected by the automatic stay against debt collectors. This should bring a sigh of relief, but remember, your journey isn’t over yet.

Step 7: Mail the documents to your trustee

The Chapter 7 trustee is an official appointed by the court. Their primary role is to supervise your case and liquidate, or sell off, nonexempt property to repay your creditors. However, fear not, most people filing bankruptcy retain all their property because it falls under exemptions. It’s worth noting that trustees are involved in both Chapter 7 and Chapter 13 cases.

One important thing to remember is to keep a close eye on any mail you receive from the trustee after your case has been filed. The trustee will mail you a letter requesting certain financial documents—these could be tax returns, pay stubs, or bank statements. It’s crucial that you send the requested documents to the trustee, following the instructions provided in their letter. If you fail to do so, you risk not getting your debts discharged.

Step 8: Take a financial management course

Next, you will have to take a financial management or debtor education course. This step is mandatory after you’ve filed your bankruptcy forms.

This debtor education course:

- Can be completed either online or over the phone

- Typically takes a minimum of two hours

- Costs range from $10 to $50, though you may qualify for a waiver

The purpose of this course is to equip you with the knowledge to make wise financial decisions in the future. You’ll gain valuable insights on budgeting and strategies to avoid accruing high-interest debt.

Completing this course isn’t just a beneficial step in regaining control of your finances—it’s also mandatory for your bankruptcy discharge and to start fresh. You won’t be eligible for your discharge unless you finish the course and file your completion certificate from the credit counseling agency with the court.

Step 9: Attend your 341 meeting

The 341 meeting, also known as the meeting of creditors is a pivotal event which typically takes place about a month after your bankruptcy case has been filed. You’ll receive a notice from the court a few days post-filing, which will include the date, time, and location of your 341 meeting.

The primary objective of the 341 meeting is for the case trustee to validate your identity and pose a set of standard questions, with most meetings concluding in approximately 5 minutes. While your creditors have the right to attend and interrogate you about your financial situation, it’s rather uncommon for them to do so.

For the meeting, you must carry your government-issued ID and social security card. Without these crucial items, the trustee can’t confirm your identity and the meeting cannot proceed. Additionally, it’s a good idea to bring a copy of your bankruptcy forms, your most recent 60 days of pay stubs, bank statements, and any other documents your trustee has requested.

Step 10: Deal with any car loan you have

In the course of completing your bankruptcy forms, you’ll need to disclose if you’re still making payments on your car and your intentions on what you’re going to do with it to both the bank and the court.

If you decide to hand the car back to the lender and eliminate the debt, there’s no specific action required on your part, and you can cease your payments. The bank will then either petition the bankruptcy court for permission to reclaim the vehicle or wait until your discharge has been granted before collecting the car.

Should you choose to retain the car, there are two paths available to you: reaffirmation of the loan or redemption of the vehicle. In the case of reaffirmation, the bank will forward you a reaffirmation agreement once your case is underway. You must complete, sign, and return this agreement to the bank within 45 days from your 341 meeting. Upon receiving your signed agreement, the bank will submit it to the court for approval.

Opting to redeem the vehicle entails filing a motion with the court. If the court approves your motion, you’re able to purchase the vehicle from the bank at its current market value. This strategy frees you from the obligation of paying the remaining balance on the loan, although it requires payment in one full installment.

Is Upsolve really free?

You might be asking, “How does Upsolve manage to provide this invaluable service without charging its users?” Let’s explore the three primary reasons.

Firstly, Upsolve is a recipient of funding from the Legal Services Corporation (LSC), an organization created by the U.S. Congress and funded by the government. Congress recognizes the necessity of providing low-income individuals with free access to legal rights, and Upsolve is one of the platforms facilitating this. The backing from the LSC allows Upsolve to continually develop and maintain its tool without passing costs onto users.

Secondly, Upsolve is generously supported by philanthropic foundations and individual donors. This group includes prestigious foundations such as the Robin Hood Foundation, the Hewlett Foundation, and the New York Bar Foundation. Also part of this philanthropic cohort are affluent individuals like Eric Schmidt, former CEO of Google; Chris Sacca, an early investor in Instagram, Uber, and Twitter; and Jim Breyer, an early investor in Facebook. These contributors also include Upsolve users who, after benefiting from the service, choose to ‘pay it forward’ to support others in similar circumstances.

Lastly, Upsolve gains funding from private, independent attorneys who offer free consultations to people who request them via the Upsolve platform. This is crucial for a couple of reasons:

- Only a lawyer can provide legal advice.

- Only a lawyer can definitively advise on whether bankruptcy is the best course of action.

- Upsolve understands that its self-service tool may not be the perfect solution for everyone (read more about the limitations of who we can assist). They don’t vouch for the quality of these private attorneys, and they are not affiliated with Upsolve. However, these consultations often provide individuals with the clarity they need to make a decision, be it filing for bankruptcy, choosing not to, or utilizing the Upsolve tool if they qualify.