Business EIN – How To Apply For A Business Ein!

Table of Contents

What’s the first thing you need when starting a business?

During the coronavirus pandemic of 2020-21, millions of people were laid off from their regular 9-5 type jobs in the USA and around the world. While some countries in the world were able to grant a fair amount of money in aid to those who were laid off we also saw a shift in the economy. Since so many people were laid off all at once one of the most noticeable things to happen in the US was the record number of applications for people to start their own businesses.

According to cbsnews.com, more than 4.5 million people applied to start their own businesses, like this very blog! This was an increase of 24% in business applications from the previous year. As a side note, one thing I thought was weird about this particular article was that it talks about how the increase in applications reflected optimism in the economy while the whole scenario just made me think of the saying “desperate times call for desperate measures”.

In any case, one of the first things you need when starting a business is an idea of what you want to do for a business. After you have an idea, then in order to make it an official US business you have to apply for a business EIN, which you can do for free and in a few minutes at the irs.gov website.

What is a business EIN?

Business EIN stands for the business employer identification number. This number is important for the formation of any US business because it allows the government to recognize a business as a legal and legitimate one. You also need it for the purpose of properly filing your business taxes, hiring employees, opening a business checking account, and etc.

How to apply for a business EIN!

[slm_content_lock]

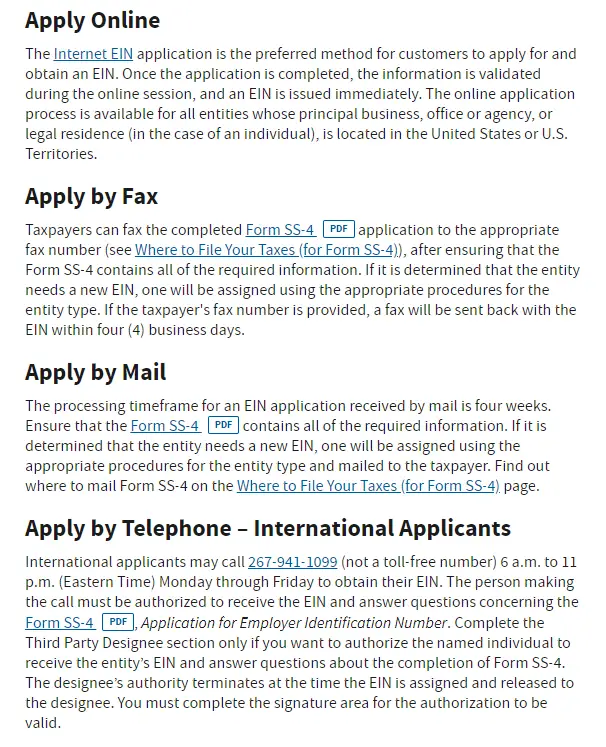

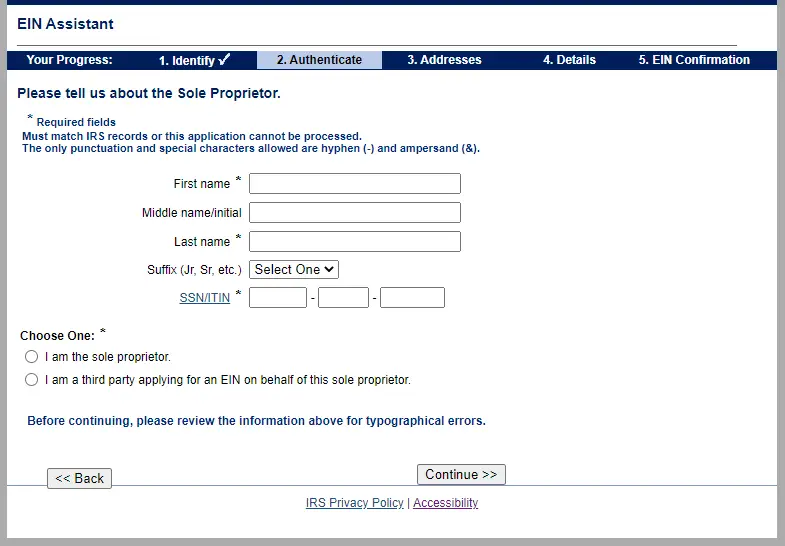

Like I mentioned earlier, it is free and only takes a few minutes to sign up for a business EIN at irs.gov. I will show you the step-by-step process of signing up for a business EIN. There are actually a few different methods that you can use to apply for a business EIN. The easiest one, which I will show you now, is to apply for it online which allows you to get your business EIN immediately.

International applicants must call 267-941-1099 (Not a toll-free number). If you prefer, you can fax a completed Form SS-4 to the service center for your state, and they will respond with a return fax in about one week. If you do not include a return fax number, it will take about two weeks. If you apply by mail, you need to send your completed Form SS-4 PDF at least four to five weeks before you need your EIN to file a return or make a deposit.

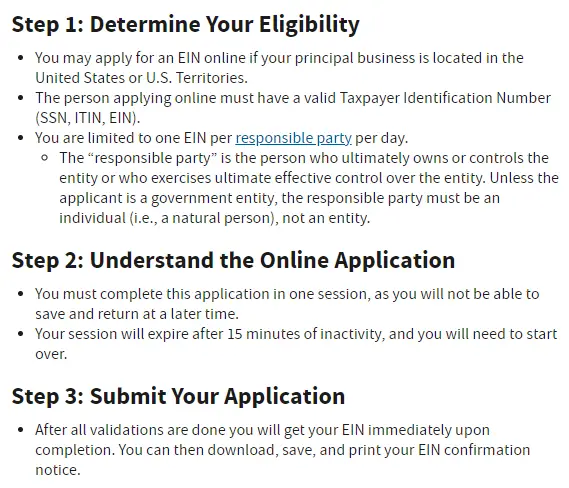

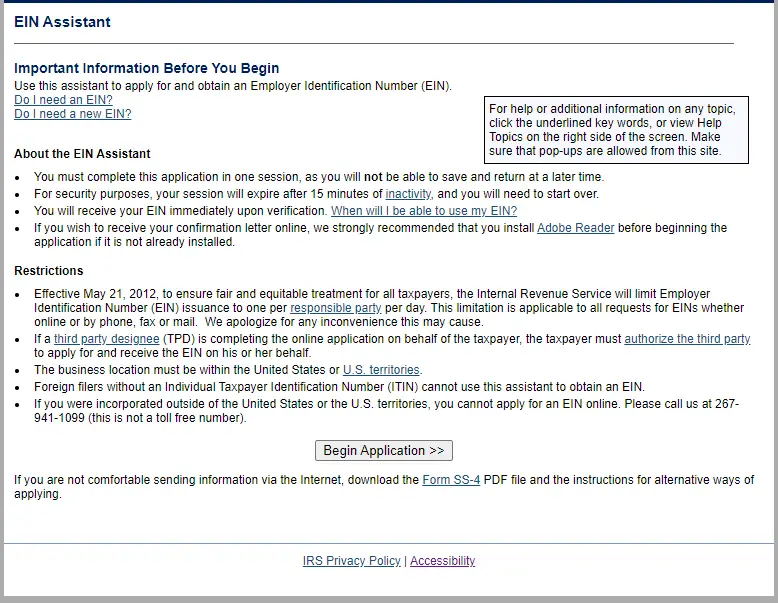

Step 1: Go to irs.gov to apply for your business EIN online and click the “Begin Application” shown in the picture below

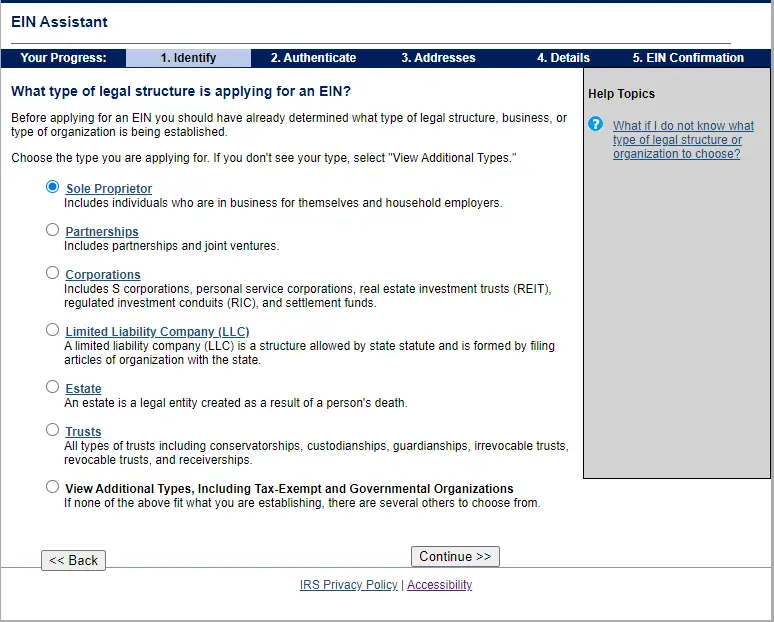

Step 2: Choose the specific type of business structure that your want for your business (as of the time I’m writing this post I’m just working on this blog by myself so I applied to be a sole proprietorship)

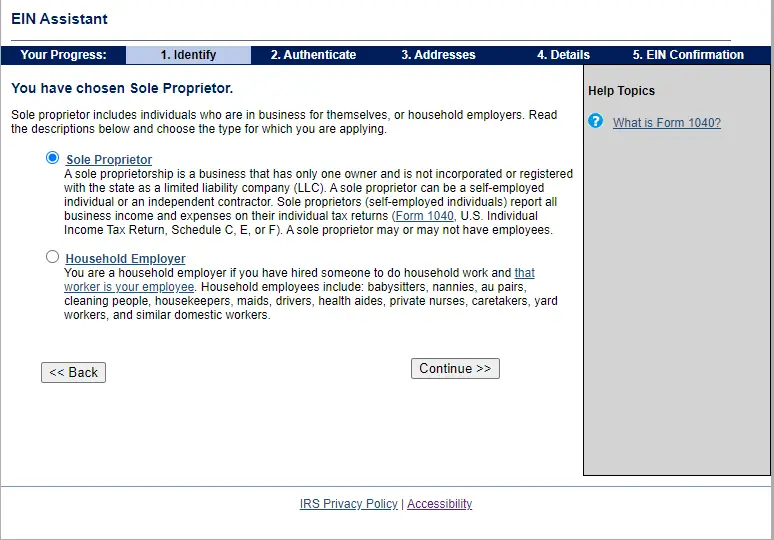

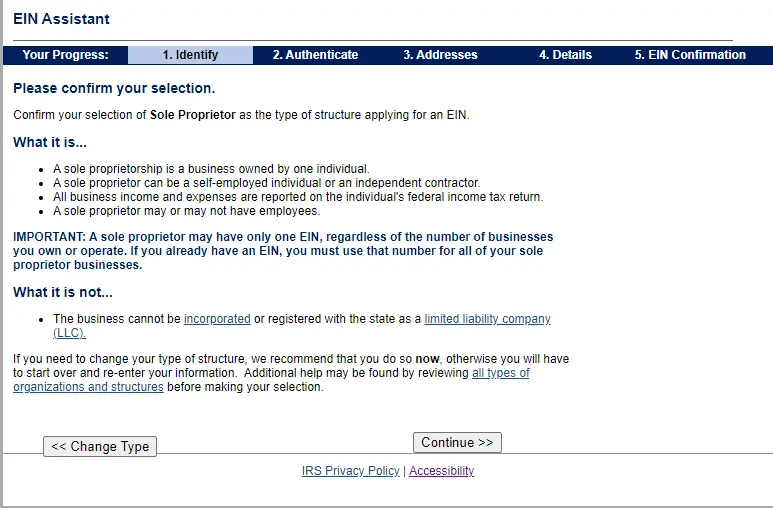

Step 3: If you choose to be a sole proprietorship then next you have to choose if you’re a “sole proprietor” or a “household employer”.

A sole proprietor is someone who runs a business with only one owner and is not incorporated or registered with the state as a limited liability company and can be self-employed or an individual contractor. A household employer is someone who hires someone else to do household chore-type work for them.

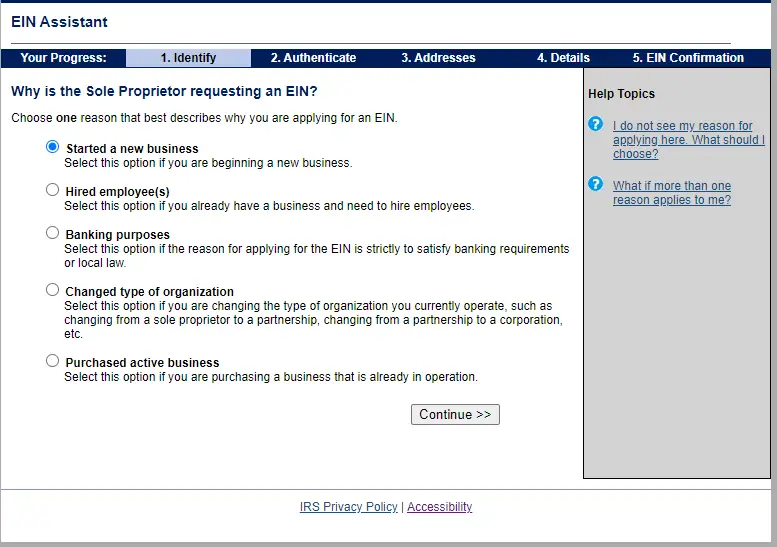

Step 4: Select the reason that you are applying for a business EIN.

The reasons could be that you are starting a new business, started hiring employees for an existing business, banking purposes, like applying for a business checking account, changing the organization type, or purchasing an already active business.

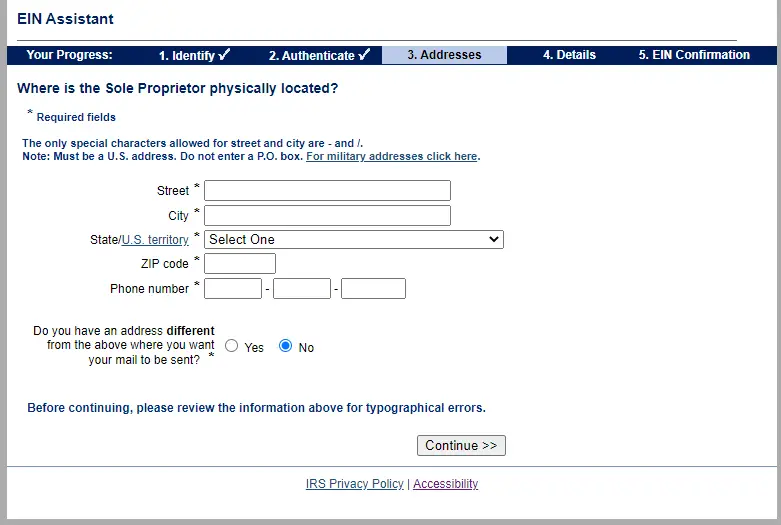

Step 5: Provide the information on the address where you plan on conducting your business.

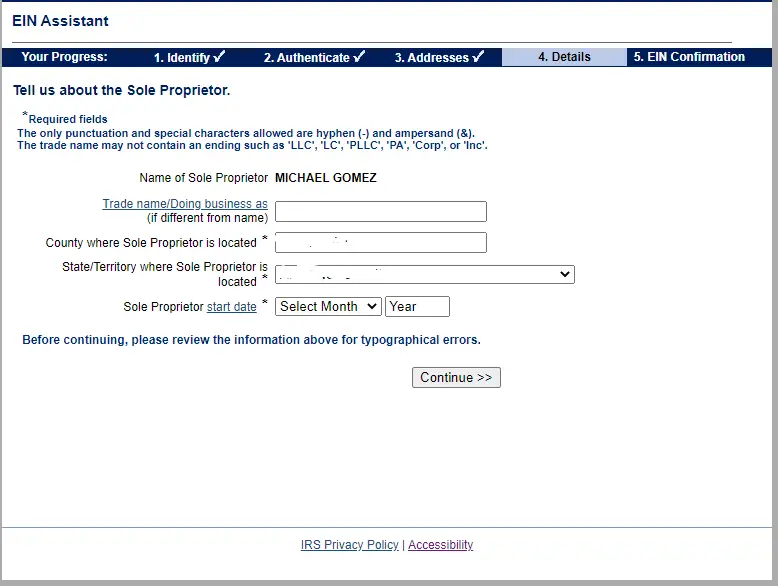

Step 6: Provide the business name, location, and start date

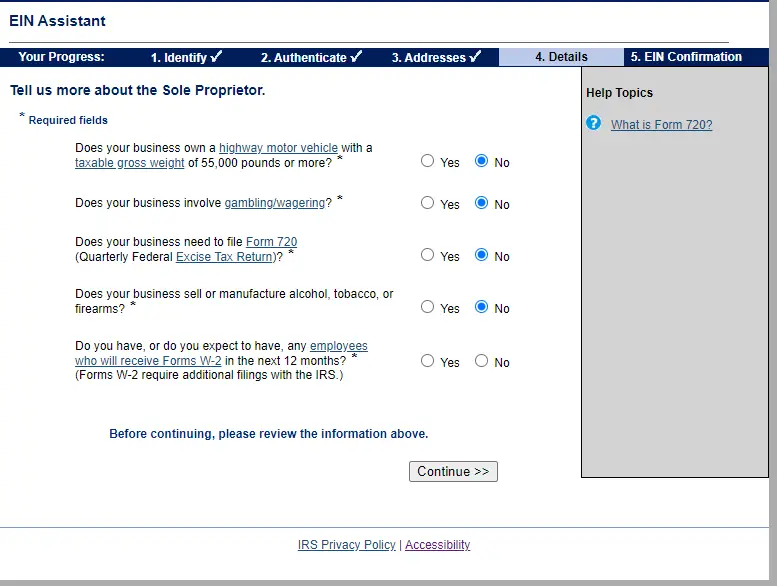

Step 7: Answer some extra questions about how you operate as a business.

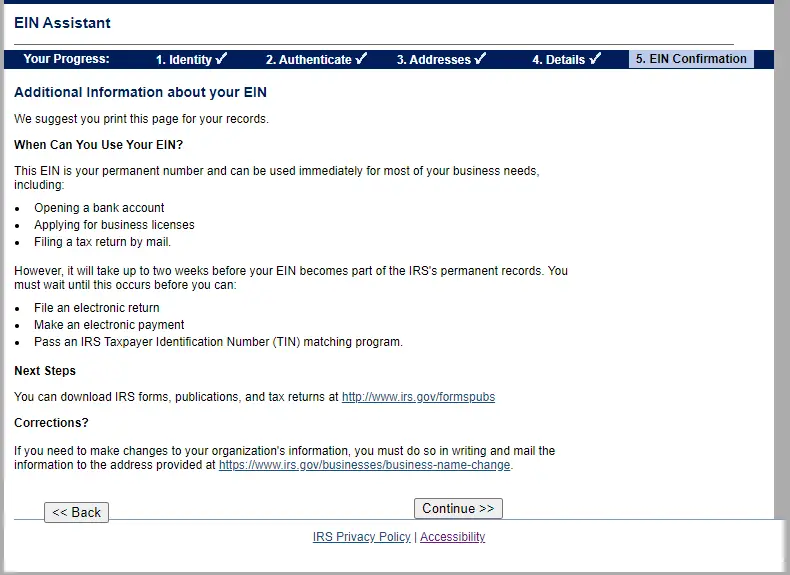

Step 8: Confirm your information. After doing this you should see your EIN on the next page, and receive an email from the IRS with your new business EIN.

[/slm_content_lock]

What to do if you’ve lost or forgotten your EIN?

In the event, you’ve lost and/or forgotten your business EIN after you applied for it there are a few things you can do in order to get it back.

- Find the computer-generated notice that was issued by the IRS when you applied for your EIN. This notice is a confirmation of your application for, and receipt of an EIN.

- If you used your EIN to open a bank account, or apply for any type of state or local license, you should contact the bank or agency to find out your EIN.

- Find a previously filed tax return for your business for which you have your lost or forgotten the EIN. Your previously filed return should include your EIN.

- Ask the IRS to search for your EIN by calling the Business & Specialty Tax line at 1-800-829-4933. The hours of operation are 7:00 a.m. – 7:00 p.m. local time, Monday through Friday. Someone will ask you for identifying information and provide the number to you over the telephone if you are a person who is authorized to receive it. Some examples of an authorized person include, but are not limited to, a sole proprietor, a partner in a partnership, a corporate officer, a trustee of a trust, or an executor of an estate.

Thinking of starting your own business??? Then check out Sidecar Health Insurance! It’s the best health insurance for the self-employed and even part time! You can sign up, close your account, or change your coverage whenever you want! One of the best part is that there are no networks. You can see any doctor you want!

Disclaimer: I am not any sort of investment or financial professional giving any sort of legal advice. I’m just some guy trying to teach other people about how they might navigate the financial world.