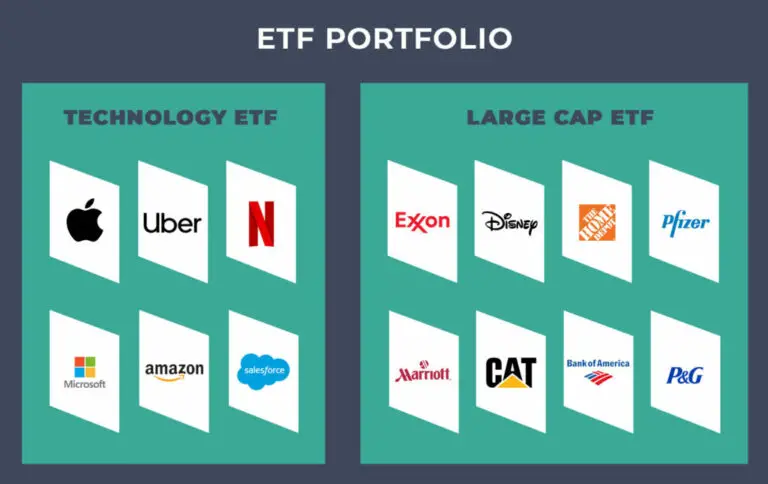

What Are ETFs?

What are ETFs? ETFs or exchange-traded funds are funds managed by investment companies and banks like Vanguard, Charles Schwab, Chase Bank, Bank of America, Sofi, and etc. These funds are comprised of the shares of many companies and are collected in one large investment pool. Some of the more famous and well-known ones are the…