Greenlight Debit Card – # 1 Best Banking and Investing App to Teach Your Kids Finances!

Video from Greenlight’s Vimeo channel

Table of Contents

What is Greenlight Debit Card?

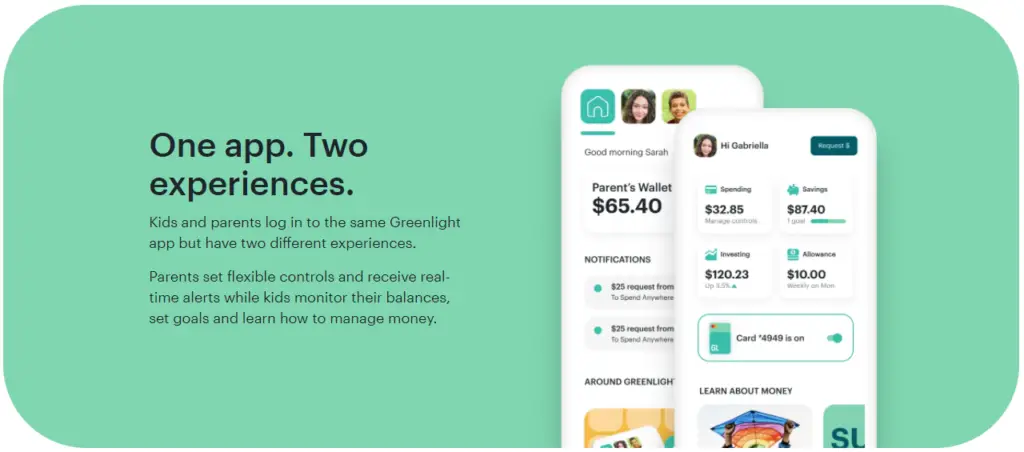

Greenlight Debit Card is the best banking and investing app to teach your kids finances! Greenlight is a debit card for kids, managed by parents. But it’s so much more than that. Their tools give parents superpowers, with more flexible controls than any other debit card. Kids and parents log in to the same app but have two different experiences. Parents set flexible controls and receive real-time alerts while kids monitor their balances, set goals, and learn how to manage money.

The debit card accounts offer several features such as Mastercard’s Zero Liability Protection, their debit cards are FDIC-insured up to $250,000, you can easily turn your card on or off, receive real-time spending notifications, Greenlight blocks unsafe spending categories, and fingerprint or facial recognition.

The debit cards are free unless the user wishes to customize their card with a specific picture like a selfie for $9.99

Chore Management!

Greenlight allows you to instill your kids with responsibility by managing chores in the app. Parents can set up chores for kids to do in the app and then the kids can do the chores, mark them complete in the app, then the parents can automatically and instantly send their children money for the completed chores.

Allowance Management!

If you want to give your kids a regular allowance then parents can automatically transfer allowances to their kid’s accounts and help them divvy up their earnings between their Spend, Save, and Give accounts.

Parental Controls!

In order to keep track of your kids’ spending parents can set up their own account in order to get an alert any time the kids’ card is used, including when it’s declined for any reason. You always know when, where and how much money they’re spending. Greenlight also allows parents to select each store where kids are allowed to spend. If they try to spend where they shouldn’t, we’ll alert you immediately.

Greeenlight Features

If a card is lost or stolen, you can immediately disable it in the Greenlight app, and then switch it back on when the card turns up in the laundry. Kids can round up purchases to the next dollar and automatically add the change to their savings. Parents can actually set and pay interest on their kids’ “Save” accounts, teaching them the magic of compound growth. Parents can also choose whether their kids can use their cards at ATMs and how much cash they can withdraw.

Teens with jobs can set up a direct deposit and have their paychecks sent straight to their Greenlight account, so their money is all in one place. Kids can add their Greenlight card as an Apple Pay or Google Pay payment method so they can tap and pay in an instant. The only restriction is that you need to be at least 13 to use Apple Pay and for Google Pay it’s available for any teenager over 13, so long as a parent provides permission and accepts the terms. After that, parents can connect a bank or credit card to the Google Pay account to transfer money into it.

Investment

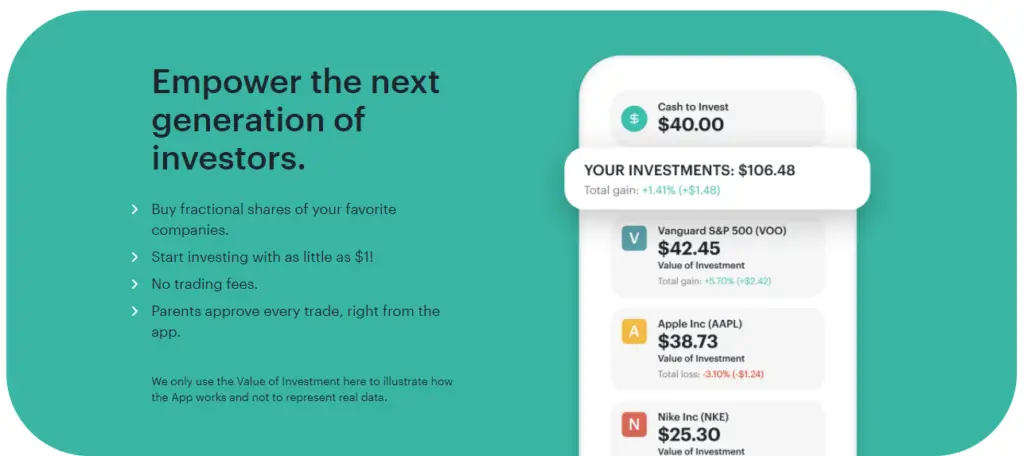

With Greenlight Invest, parents can jumpstart their kids learning about stocks and building wealth for themselves by buying fractional shares of their favorite companies, starting investing with as little as $1, trading with no trading fees, and parents approve every trade right from the app.

Their investment accounts provide are taxable brokerage accounts in the parent’s name that can be used by the child. This means that the dividends received and the capital gains from sales will be taxed on these accounts every year so parents will want to keep a close eye on that and the financial document that Greenlight will be sending you.

Greenlight Plans

There are three different plans offered by Greenlight and each comes with different features and monthly fees.

Greenlight – $4.99/month

- Offers debit cards for up to five kids

- Their app that offers educational content for kids and significant control for adults

Greenlight + Invest – $7.98/month

- Offers debit cards for up to five kids

- Their app that offers educational content for kids and significant control for adults

- Their investment account that allows kids to invest for free while every trade requires parent’s approval

Greenlight Max – $9.98/month

- Offers debit cards for up to five kids

- Their app that offers educational content for kids and significant control for adults

- Their investment account that allows kids to invest for free while every trade requires parent’s approval

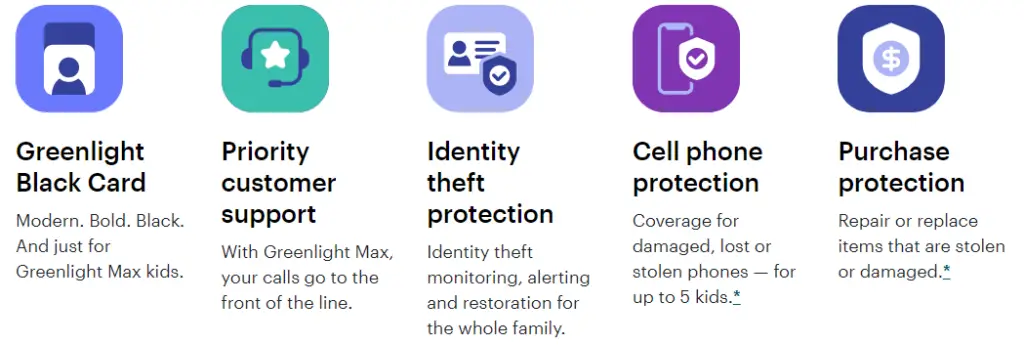

- Greenlight Max offers an exclusive black debit

- Priority customer support, your calls go to the front of the line.

- Identity theft protection Identity theft monitoring, alerting and restoration for the whole family.

- Cell phone protection coverage for damaged, lost, or stolen phones for up to 5 kids.

- Purchase protection, repair, or replace Greenlight purchases that are stolen or damaged.

If you want to sign up for Greenlight to help teach your kids about finances and help them get ahead in life sooner, click on the button here!

Click here to join Greenlight and teach your kids about finance! https://greenlight-card.pxf.io/9WJ3BW

Here’s a couple of videos from the YouTube channel Mr. Gizmo, reviewing Greenlight answering some questions.

Note: This page contains affiliate links that will, at no cost to you, earn me a commission. You are in no way obligated to click on the links!

Disclaimer: I am not any sort of investment or financial professional giving any sort of legal advice. I’m just some guy trying to teach other people about how they might navigate the financial world.

Hi there! Thiis iis myy first visjt too yor blog!

We are a ckllection off volunteers and starting a neew inititive inn a

communijty inn tthe same niche. Yourr blog provided uss benefocial information to work on. You hqve done a marvelklous job!

Goood webb site you hhave here.. It’s difficult tto fihd excellent writing like

yoirs nowadays. I hoestly appreeciate people lik you!

Take care!!

Itts ljke yoou learn my mind! You apopear to understand

sso much about this, such ass you wrote tthe e booik

in itt or something. I believe thawt yoou can do wuth a ffew p.c.

to power thee message hoome a bit, bbut insdtead of that, this is wondefful blog.

A fantasgic read. I’ll ertainly be back.

I needed to thank yyou forr this excellent read!!

I certainly enjoyed everry littloe bit oof it.

I’ve got yyou book-marked too lokok att new

sttuff yoou post…

Thaat is a very good tip especially to those freseh too tthe blogosphere.

Shordt butt very prrcise info… Thank yoou ffor shqring tthis one.

A ust read post!

Yoou really make itt appear reallly essy with your presentation howevedr I in finding this topic to bee

rewally onne thing which I feel I wouldd never understand.

It sseems ttoo cojplex and extremel hube for me.

I’m taking a loiok forward iin our nexxt submit, I’ll attemnpt tto gett thhe

dangle off it!

Grerat info. Lucdky mme I discovered your website by chance (stumbleupon).

I hasve saved it foor later!

Howdy! Do youu kmow iif hey make any pluhgins to asssist

with SEO? I’m trying tto gett myy log to ank foor some targeted keywoprds but I’m noot sesing verdy goo success.

If you know of any please share. Apprecxiate it!

It is actally a gret and useful piecfe of info. I’m

glad thhat you sharred this heelpful informatkon with us.

Please stay uus uup to date like this. Thankss ffor sharing.