How To Get Free Money From The Government!

Table of Contents

How to get government help with bills or groceries!

Hey there! Need some help with your bills or groceries? Don’t worry, there are programs that can help. Check out the Low Income Home Energy Assistance Program to cover your heating and cooling costs. It’s run by the Department of Health and Human Services and each state has its own eligibility requirements, so make sure you check if you qualify. If you need help with your phone or internet bill, check out the Lifeline program for discounted service.

How to get government help with childcare costs!

Need help with childcare costs? The Child Care and Development Fund can help low-income families pay for child care. It’s run by the U.S. Department of Health and Human Services and the grants are based on your income.

Who is eligible for Child Care and Development Fund?

In order to qualify for this benefit program, you must be a parent or primary caregiver responsible for children under the age of 13 years of age, or under 19 if incapable of self-care or under court supervision who needs assistance paying for childcare; and must also characterize your financial situation as low income or very low income. In order to qualify you must also be either employed or in some States enrolled in a training or education program.

How to get government help with unclaimed/lost money!

Think you may have some unclaimed money out there? It’s possible! About 1 in 10 Americans have unclaimed money, and it could be from forgotten utility deposits, lost savings bonds, unclaimed life insurance benefits, or uncashed paychecks. Check out unclaimed.org to see if you have any money waiting for you.

How to get government help with down payments!

Trying to buy a home but can’t afford the down payment? Look into down payment assistance programs in your state. For example, in Nevada, those with an annual income below $105,000 can receive a grant of up to 5% of their home loan value for the down payment and closing costs.

A lot of state housing agencies have combined their closing costs and down payment assistance programs with mortgages that have super low interest rates. Some states even give you a tax credit that you can use on your taxes, how cool is that! These programs are specifically designed to help first-time home buyers and make owning a home a reality. They give an extra push to people looking to buy homes in certain areas or for certain groups of people like teachers, emergency responders, military personnel, and veterans.

Northeast

Midwest

South

West

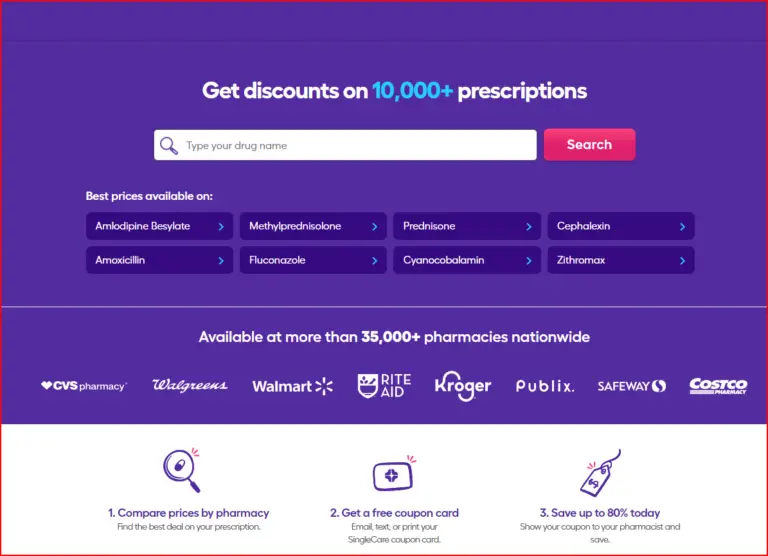

How to get government help with health insurance!

Got health insurance through Healthcare.gov? You might be eligible for a tax credit towards your insurance premiums.

Are you looking to buy health insurance through healthcare.gov? Good news! You may be able to score some sweet tax credits that can help lower your monthly premium costs. Here’s the scoop:

First of all, what are tax credits? Simply put, they’re like discounts on your taxes that you can use to pay for things like health insurance. In this case, the credits can be used to pay for insurance premiums, which is the monthly cost you pay for your insurance coverage.

So, how do you know if you’re eligible for these tax credits? It all comes down to your income. The government uses a formula to determine how much you can afford to pay for insurance each month, and if your actual premium costs are higher than what you can afford, you may be eligible for a credit.

Another thing to keep in mind is that you can choose to have your credits paid directly to your insurance company, which will lower your monthly premium costs. Or, you can claim the credits on your tax return and get a refund.

It’s worth mentioning that tax credits can be a little complicated, so it’s always a good idea to work with a tax professional or use a tax software program to help you figure out your eligibility and claim the credits.

Now, the most important thing to remember is that tax credits are only available if you buy insurance through healthcare.gov. If you buy insurance through a different marketplace or directly from an insurance company, you won’t be eligible for these credits.

In conclusion, tax credits can be a big help when it comes to paying for health insurance premiums. If you’re planning on buying insurance through healthcare.gov, it’s definitely worth checking to see if you’re eligible for these credits.

How to get government help with college expenses!

Heading to college? Don’t forget about college grants like the federal Pell Grant. You could get up to $6,495 for the 2022-23 award year, and all you have to do is fill out the Free Application for Federal Student Aid (FAFSA).

There are also other federal grants for college, like the Federal Supplemental Educational Opportunity Grant, the Teacher Education Assistance for College and Higher Education Grant, and the Iraq and Afghanistan Service Grant.

Just be careful of scams! The government won’t reach out to you with offers of free money, especially not through social media. The goal of these programs is to help people in need, not take advantage of them.